Nothing like the sun

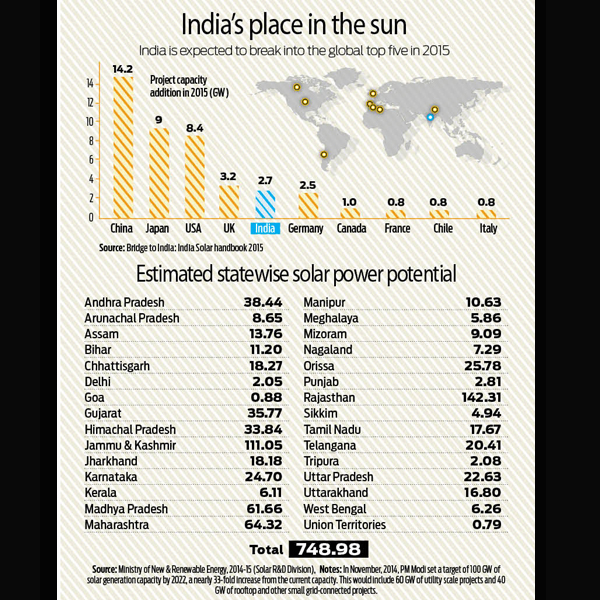

India has finally begun to make its mark in solar energy (see chart).

Significantly, as was the case with Germany, solar power costs have been falling year on year. It is worth recalling that it was Germany(http://dnai.in/bj4W) which catalysed this industry worldwide. It began setting up solar facilities in 2001, when installation costs were well above $8 per Watt. Today they are under $1, thanks to the demand volume that Germany helped generate, which in turn saw large-scale production of solar cells. China was quick to grab this opportunity and has emerged as the world’s largest producer of solar panels.

In India, solar power bids invited under the National Solar Mission Phase I offered tariffs of Rs7.49 to Rs9.44 per kWh. But, as each state went in for reverse auctions for setting up solar facilities, costs kept dropping. The solar bids conducted by Madhya Pradesh Power Management Company Limited recently arrived at prices of Rs5.05/kWh. Prices could fall further. In a recent bid in the US, NV Energy, a Nevada utility, agreed to purchase 100MW solar power under a fixed-price 20-year power purchase agreement at 3.87cents/kWh (Rs2.52/kWh).

Rajasthan could push down solar costs even further. After all, this state has the largest potential for solar power in India (see chart). Already, according to BK Dosi, managing director, Rajasthan Renewable Energy Corporation Ltd (RREC), “The state has secured the leading position in solar power with a total generation capacity of 1,167 MW, as of May 31, 2015. Similar trends can be observed in Wind Energy production with a total installed capacity of over 3324 MW.”

As an India Ratings report points out, “Solar power is likely to become cheaper than, or equivalent to, conventional thermal energy prices over the next two to three years.” Solar power costs could reach anywhere between Rs4 and Rs4.5 per kWh by March 2018. This decline in costs, explains India Ratings, will be driven by several factors: (i) a decline in capital costs (solar modules and other balance of plant), (ii) an increase in efficiency, (iii) a shift towards large solar photovoltaic projects leading to the economies of scale and (iv) lower return expectations by developers.

According to the International Renewable Energy Agency, solar photovoltaic prices have fallen nearly 80% since 2008. Additionally, solar module efficiency has witnessed an annual increase of 3.5%-4.5%.

This may be welcome news, but there are dark clouds that have begun looming large.

Last fortnight, SoftBank founder, Masayoshi Son, decided to demand a change in India’s solar power policies. He plans to produce 20 gigawatts (GW) of solar energy in India!

But aware of how state government power distribution companies (discoms) — which are mandated to purchase solar power — do not pay on time, he has asked the central government to counter-guarantee payments that state discoms have committed themselves to. The last time a sovereign guarantee was granted to anyone was Enron. Obviously, the current government would not want to do something that has become repugnant to policymakers by now.

Clearly, some kind of escrow arrangement which allows power producers — who have power purchase agreements (PPAs) with state discoms — the first right to draw such funds needs to be put into place. No investor would like to commit himself to investment worth several billion dollars, where the biggest (at times only) purchasers are state discoms. After all, many such discoms have terrible balance sheets, and do not enjoy a good reputation when it comes to meeting their payment obligations.

The other dark cloud is the poor focus the government has given to rooftop generation of solar power (http://dnai.in/cyyp). The concept isn’t new. Israel began doing so since the 1970s — it is mandatory for each newly constructed house to have rooftop solar facilities.

India, with its huge population, has more rooftops than most countries. Obviously, using rooftops in India would make immense sense, because it would benefit many. Its citizens, who allow such facilities on the top of their hoses, would earn some money. It would also reduce the pressure on land acquisition. Most importantly, rooftop solar would also help create huge employment opportunities. Remember, Germany currently employs more people in the solar industry than in the automobile sector.

But then the Indian government has not yet come up with attractive policies to encourage rooftop solar power generation. It needs to announce better financing (priority sector lending, interest rate subvention), improve availability and cost of debt financing, and offer a wide range of net-metering policies.

True, Maharashtra, Tamil Nadu and Gujarat are the leading states with close to 30% share (>100 MW) of total rooftop capacity. But it is nothing compared to the 2.7 GW of solar power facilities already installed, or the 40 GW of power being planned. Today, more rooftop solar power is being planned in countries that have fewer houses — Australiawhere, in 2014, a rooftop solar system got added every 2.8 minutes; Germany which already had 8.5 GW mark in 2015 and has almost achieved grid parity; and Israel.

Unless these issues are addressed, the progress of solar power will be patchy. More worrying, the long-term consequences of ignoring these issues could be very, very painful.

COMMENTS