You cannot become a superpower with a weak currency

By RN Bhaskar

India analysts have watched with amazement as they see the rupee continue to slip. It has lately been hovering around Rs.82 for each US Dollar, and is threatening to breach Rs.83.

People recall how, in December 2014, the INR was worth Rs.63.33 per USD. At that times, people were led to believe that it would soon bounce back to Rs.40/USD. All indications pointed to a resurgent India. Today those hopes look feeble. Should one pronounce them dead?

People recall how, in December 2014, the INR was worth Rs.63.33 per USD. At that times, people were led to believe that it would soon bounce back to Rs.40/USD. All indications pointed to a resurgent India. Today those hopes look feeble. Should one pronounce them dead?

Urgent remedial action

It is difficult to give a reply to such questions, because there is always the element of hope. But for such hopes to be revived, some urgent reforms are required first – and on a war footing.

- The first, is a renewed focus on education with an eye on outcomes (free substack subscription https://bhaskarr.substack.com/p/the-state-of-education-in-india and https://bhaskarr.substack.com/p/the-state-of-higher-education-in?sd=pf). Educational standards are collapsing quite rapidly in India. This is worsened by the recent attempts to fiddle with the syllabi of school textbooks through the government funded National Council for Educational Research and Training or NCERT (https://www.indiatoday.in/education-today/news/story/ncert-advisors-demand-their-names-to-be-dropped-from-mutiliated-political-science-textbooks-2391049-2023-06-09). India may talk about being a vishwa-guru (or a teacher to the entire world), but that becomes a joke if education at home remains in shambles. Without good basic education, a nation cannot become a global superpower. It will remain a has-been with claims and visions of being bigger than it really is.

- Linked to this is the abysmal state of healthcare (free substack subscription https://bhaskarr.substack.com/p/india-population-and-economic-growth). You cannot claim to be the beneficiary of a demographic dividend without providing good healthcare services first.

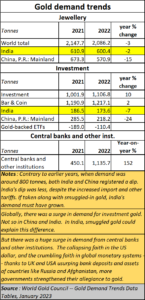

- The third is the way the government looks at gold. Its policies suggest that there is little understanding of how money markets and currency values work. Just look at how different governments in India have pushed up the import levies on gold from 7.5% to 12.5 % in July 2022 (https://www.reuters.com/world/india/india-raises-import-tax-gold-125-75-2022-07-01/). It used to be 5% earlier.

Today, the effective duty on gold is 18.45%, which includes 12.5% import duty, 2.5% agriculture infrastructure development cess and other taxes (https://www.business-standard.com/article/economy-policy/india-plans-to-cut-gold-import-duty-to-arrest-smuggling-govt-officials-123012300677_1.html). Pious thoughts about reducing this huge burden on gold have been thrown to the winds.

Do bear in mind that the annual gold demand in India is normally around 800 tonnes (China and India are the biggest consumers of gold). Of this, around 100-150 tonnes get smuggled in, especially when import duty rates hover at levels above 5%.

The costs of smuggling in gold are around 5%, thus any import duty rate above this level makes the smuggling activity attractive – the higher the import duty rates, the more attractive this illegal trade becomes.

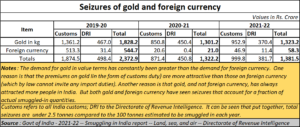

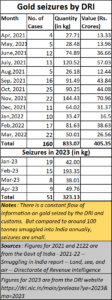

Media has often referred to the findings of the Smuggling in India Report 2021-22 by the Directorate of Revenue Intelligence (DRI) (this can be downloaded from https://dri.nic.in/writereaddata/2021_2022%20REPORT%20FINAL_14.pdf). Such reportage points out that “about one-sixth of the total amount of gold entering India is done through illicit trade” (https://economictimes.indiatimes.com/industry/cons-products/fashion-/-cosmetics-/-jewellery/high-import-tariff-adding-fillip-to-illicit-gold-trade/articleshow/97318446.cms?from=mdr).

It also means that even though the total volume of gold imported into India appeared to drop in 2022, it is probable that the volume of smuggled gold increased, because this activity became immensely profitable thanks to the higher rates of government levies. At 18.5%, gold has become the smugglers’ favourite item for trade.

And even though the finance minister may claim that smugglers cannot be smarter than the authorities (https://www.moneycontrol.com/news/india/smuggler-cannot-be-smarter-than-the-authorities-fm-nirmala-sitharaman-on-dri-65th-foundation-day-9651061.html), the volumes of gold seized as a percentage of estimate volumes smuggled in shows that smugglers can indeed be quite savvy.

What is worse is that when gold import duties go high, they help the smugglers create a pipeline – right from the suppliers of gold, to the loading and the landing agents, and even the authorities who can be compliant – to create a pipeline which can be used to carry other items. The other items most often smuggled into India are narcotics and arms.

Both are detrimental to the security of any country. But what India has done is that to make official figures of gold import appear smaller, it has abetted illegal trade in many more items that are injurious to the very security and health of the nation. They help strengthen the mafia (https://theprint.in/economy/gold-smuggling-leads-to-growth-of-mafia-groups-is-a-heavy-drain-on-indias-forex-dri-report/1249963/). While this data has not been provided by the DRI in a manner that allows for closer comparison, market sources point to the increase in the volume of arms and drugs being brought into India through such pipelines.

These drugs, arms, and gold are paid in foreign exchange, which also must be purchased on the black market. Any black-market purchase of forex only corrodes the value of the Indian rupee. Effectively, the government has created the very mechanisms for eroding the value of the Indian rupee as well.

Worse, India has not yet devised a way to store all gold in a central vault, managed by the central bank. Even now, there are reports of gold being stolen from the very vaults of the government (https://asiaconverge.com/2022/11/when-the-cad-swells-it-is-easy-to-blame-gold/).

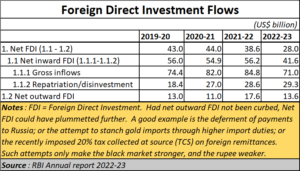

Diminishing FDI

This might not have mattered much if the country was an attractive destination for foreign investment. On the contrary, mismanaged exim policies (https://asiaconverge.com/2023/04/indias-confused-exim-strategy/) and myopic raids and seizures on businesses have rightened money away. They have left India a bit hollowed out (free substack subscription https://bhaskarr.substack.com/p/indias-economy-is-being-hollowed?sd=pf). Foreign direct investment (FDI) is diminishing.

These columns had predicted a further weakening of the rupee even in July 2022 (https://asiaconverge.com/2022/07/major-financial-turbulence-ahead-inr-may-weaken-further/). We believe that the rupee will continue to weaken, unless the above policies are remedied.

- What is galling is the way the government has sought to stanch forex outflow by taxing such remittances.

When the country was upbeat about its export and import policies, and when the country was becoming attractive as an investment destination, the government introduced the liberalised remittance scheme under which USD 250,000 could be spent by individuals overseas each year (https://m.rbi.org.in/scripts/FAQView.aspx?Id=115). Now with the first signs of weakening inflows, the government seeks to make the LRS more illiberal by imposing a 20% tax collection at source (TCS) (https://www.livemint.com/news/india/20-tcs-on-foreign-remittances-under-lrs-to-roll-out-from-july-1-11686306894538.html).

When the country was upbeat about its export and import policies, and when the country was becoming attractive as an investment destination, the government introduced the liberalised remittance scheme under which USD 250,000 could be spent by individuals overseas each year (https://m.rbi.org.in/scripts/FAQView.aspx?Id=115). Now with the first signs of weakening inflows, the government seeks to make the LRS more illiberal by imposing a 20% tax collection at source (TCS) (https://www.livemint.com/news/india/20-tcs-on-foreign-remittances-under-lrs-to-roll-out-from-july-1-11686306894538.html).

The deleterious consequences of such a tax cannot be underestimated. It will make more Indians enter into private arrangements for financing their expenses overseas through informal and/or illegal arrangements. The trade is smart. You don’t even have to carry Indian currency with you when you travel overseas. Someone will supply you with the cash you require, wherever you are. And someone collects the equivalent Indian currency from your Indian relatives in cash or cheque, as desired by you. That will make the Indian rupee even weaker.

And there are good reasons why this will be done.

Imagine a a student going abroad, taking a loan, submitting tax returns, mortgaging the family home. Finally, he will be at the mercy of a junior bank employee to discern what are qualifying education expenses. Fees OK but books, clothing, rentals may not be. And the officer may slap the 20% TCS upfront.

Or visualise someone (without the means) having to travel abroad for some emergency medical treatment. Loans from family and friends are always forthcoming but, in haste, does one have time to wrangle with junior staff at banks / credit card companies to avoid having to add 20% to the cost of the medical treatment.

Or take the situation banks are confronted with. Not sure if a person has more than one credit card, and hence not knowing if the Rs7 lakh limit for exemption from TCS has been breached, the banks will charge 20% TCS on every forex transaction through credit card, debit card or even bank transfer. Let the individual file for a refund in case the tax has been unfairly deducted.

Overnight, the government has made India a messier place to be in and to do business with.

Unless the government modifies its tax rules and its policies, yes, the rupee will continue to become weaker.

Keywords:

LRS, TCS, Tax collected at source, liberalised remittance scheme, gold, DRI, customs, INR, USD, education, healthcare, NCERT, China, India, seizures, drugs, narcotics, arms, smuggling, import duty, pipeline, forex foreign currency, exim policy, FDI

COMMENTS