US dollar: rumble stumble

By RN Bhaskar and Sakeena Bari Sayyed

Image: Gemini AI

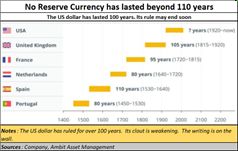

The rumbling is now perceptible. The solid ground on which the US stood is now shaking under the feet. When Nixon nixed the gold standard by ending the Bretton Woods in 1973, it was advantage USA. The old system worked when the US had surplus production. The new system would allow it to use finance to create demand from other countries. That in turn allowed it to spend more than it earned. Thus, the dollar could remain the global hegemon like its master and printer, the US.

The petrodollar agreement with Saudi Arabia initiated on June 8, 1974, further consolidated the hegemon status of both the US and the dollar. It allowed the US to spend a lot more than it earned. President after president added to this debt, confident that good times will never end.

Power blinds people and countries into believing that their rule will never end. It leads to imperiousness and that becomes hubris. It leads to the first stirrings of revolt, and it makes the imperious even more blood thirsty, disregardful of the value of human lives, especially when it comes to the weak who seek to rebel. This happened with France, with Spain, with Belgium, with the British and now it is a turn of the US. Each great power has learnt to massacre thousands and more in the pursuit of more power.

The first dark clouds on the horizon were visible when Saddam Hussain impetuously decided to sell oil in currencies other than the Dollar. It was a death wish. Libya’s strongman, Muammar Gaddafi, also entertained the same death wish. Both had to be eliminated. To justify the elimination of Saddam and Gaddafi, stories had to be invented. Lies had to be concocted. And the wrath of the global hegemon had to be visible to everybody. Eventually, the invasion of Iraq saw the death of 650,000 people (https://www.aljazeera.com/news/2006/3/20/timeline-conflict-in-iraq). Both rebel leaders – Saddam and Gaddafi – had to be killed.

But now, the number of rebels has grown larger – through BRICS. The headache has become a migraine. And the hegemon is trying to curb the growth of BRICS through tariffs, sanctions, and other means. But this is becoming exceedingly difficult.

In the meantime, the display of power through more killings continues. The imperiousness led to the bombing of Afghanistan, the assassination of Osama Bin Laden and the dispersal of his body in a manner that no shrine or memorial could be built for him. Later, in January 2020, even non-criminal leaders were assassinated — like Qasem Soleiman, commander of the IRGC. In retrospect, the world’s reluctance to call Bush Jr. a war criminal would eventually pave the path for Trump’s war crimes (https://bhaskarr.substack.com/p/is-venezuela-the-path-to-trumps-third).

To terrorise the oil lobby into submission, Israel was given the greatest sway. It was allowed to pillage, destroy, dehumanize, and even terminate people and populations. It was allowed to remain a nuclear state, without submitting itself for inspection to the International Atomic Energy Agency (IAEA). It was allowed to wage a war against Iran, without UN approvals, even when it did not have nuclear facilities. It assassinated intermediaries, scientists, and many others through stealth – even before a war was declared.

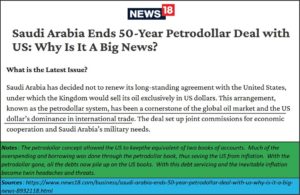

All this mayhem was abetted, supported, and financed by the US. The reaction against this was inevitable. It wasn’t long before Saudi Arabia formally spurned the petro dollar. Effectively, the US encouraged Iran to develop its military and even have Russia and China as its partners.

New centres of gravity

Even while this was underway, the position of the US as the sole hegemon from 1990 to around 2005 was being challenged. It began in December 1999, when Vladimir Putin came to power. Between 1990 and 2020, Russia was financially weakened by the Western collective. The cold war and US machinations had pushed Russia to its knees.

Putin reversed the downslide, even while coping with the sanctions. It built up its foreign exchange reserves, which have today been confiscated by the US and the EU. The West which was hopeful of picking up fragments of a broken Russia, now had to contend with an emboldened nuclear armed Russia.

The other challenge came from China – itself a nuclear power. It had learnt from the mistakes Russia had made. It focussed on education, healthcare, and poverty alleviation, without losing sight of its goal of becoming the industrial powerhouse for the entire world. It notched up productivity gains which left the world spellbound.

Initially, both Russia and China did not trust each other. But when the imperious West – with its pathological hatred for Russia – chose to spurn its own promise of not allowing NATO ‘an inch eastward’ (https://asiaconverge.com/2022/03/the-ukraine-crisis-this-is-the-way-the-world-ends/), the situation changed.

The West again tried to weaken Russia by impounding its foreign exchange reserves of over $300 billion (https://www.bignewsnetwork.com/news/278822256/russian-gold-gains-offset-frozen-asset-value-bloomberg). It even sanctioned Russian oil and gas. The West thought that it could break Russia. Instead, Russia sought a market in China which is always thirsty for more and more oil. Thus, the West, blinded by imperialism, actually solemnised the union of Russia and China. In the meantime, Europe, which had become prosperous by using cheap energy from Russia, now found that it had to pay higher prices for this energy. Today, the UK, France and Germany are weakened.

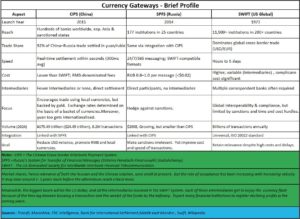

The would-be hegemon also decided to weaponize the US dominated SWIFT system. It had already used financial coercion against Iran. It formalized this strategy with Russia and threw it out of the SWIFT system, preventing it from conducting any forex transactions. That propelled both Russia and China to develop alternative monetary systems that could bypass SWIFT.

The pace quickens

There comes a time when every carefully planned strategy begins to boomerang against the hegemon.

This is what happened in Ukraine. This is what is happening in Israel. In both territories the bloodbath is nauseating. The massacres in both territories were abetted, even instigated, by the US. The punishing sanctions created a new alliance of Russia, Iran, and China – each of them formidable in military prowess. Israel felt the first taste of this military prowess when Nevatim was destroyed in April 2024. It got a second taste of this a year later when Iran’s missiles pounded Tel Aviv as well. All this in just twelve days.

But wars cost money — huge sums of money – especially when they cannot be concluded quickly and when defeat stares hegemons in the face.

US debt was a result of several factors:

The cost of war

- Costs involved in dousing the fires of the 2008 financial meltdown,

- Death of the petrodollar

- Other ill-advised extravaganzas.

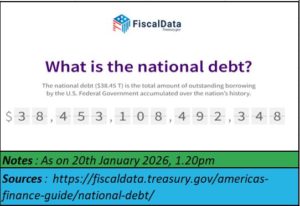

Today, US debt totals over $38 trillion, more than a third of global debt. Almost $9 trillion must be repaid or rolled over by mid-2026. Earlier fund managers would jostle for a share of US debt. Now with the dollar weakening and the US economy shaky, fund managers are shying away. Expect the cost of rolling over this $9 trillion to push up bond coupon rates.

That will push up inflation. So, the US is going to suffer a triple whammy:

- Inflation through higher coupon rate for the debt rollover.

- Inflation caused by higher tariffs

- Inflation through higher labour cost because of ill advised immigration policies.

The worst is yet to play out.

At the time of uploading this article, the US stock market indices are also slipping; the economy remains shaky; and the dollar continues to weaken. The pace of dedollarisation is accelerating.

As Jamal Mecklai, astute forex advisor, explains, the dollar has already declined in 2025 by 12% against Euro and other currencies. It could decline further.

As Jamal Mecklai, astute forex advisor, explains, the dollar has already declined in 2025 by 12% against Euro and other currencies. It could decline further.

Sadly, the Indian Rupee is weakening even more rapidly than a weakening dollar.

Sadly, the Indian Rupee is weakening even more rapidly than a weakening dollar.

Not surprisingly, the share of the dollar in global trade has slipped way below the 50% mark that it enjoyed earlier. The Euro too is declining. Although the share of the RMB is very small now, do remember that the process of pushing the RMB started just a few years ago. And the pace of switchover from the dollar to the RMB is gaining momentum.

Not surprisingly, the share of the dollar in global trade has slipped way below the 50% mark that it enjoyed earlier. The Euro too is declining. Although the share of the RMB is very small now, do remember that the process of pushing the RMB started just a few years ago. And the pace of switchover from the dollar to the RMB is gaining momentum.

The best way to look at currencies is to consider its exchange value against gold. Over a five-year period, the dollar has weakened by over 30%. The only currencies that have a worse performance are the Indian Rupee and the Japanese Yen. The stride of the hegemon is becoming unsteady.

The best way to look at currencies is to consider its exchange value against gold. Over a five-year period, the dollar has weakened by over 30%. The only currencies that have a worse performance are the Indian Rupee and the Japanese Yen. The stride of the hegemon is becoming unsteady.

In the meantime, to lend greater credibility to the new global trade financing system (CIPS), China is setting up two gold vaults. One is to be located in Hong Kong and the other in Saudi Arabia. In a way, China is reviving, at least partially, the old Bretton Woods gold backed monetary system. Expect more action on this front.

In the meantime, to lend greater credibility to the new global trade financing system (CIPS), China is setting up two gold vaults. One is to be located in Hong Kong and the other in Saudi Arabia. In a way, China is reviving, at least partially, the old Bretton Woods gold backed monetary system. Expect more action on this front.

A global pirate

In its quest of Making America Great Again (MAGA), Trump has adopted the strategy of land acquisition. He almost occupied Venezuela (https://bhaskarr.substack.com/p/is-venezuela-the-path-to-trumps-third). Unfortunately, the regime didn’t fall. Only another head of state took charge. Trump, meanwhile, has threatened both Colombia and Cuba of a similar invasion. He is disdainful of the fact that any invasion of a sovereign state is against international law.

However, he has clearly learnt the wrong lessons from Israel which has sought to capture territories in defiance of UN and international law. He now wants to acquire Greenland. Once again, caught unawares by the tremendous show of unity by the EU against such moves. Trump backtracked at the Davos meet. He changed his stance and said that he will not occupy Greenland by force. He said he will now try discussing the issue with the EU.

Tragically, the EU has been myopic in dealing with the US. It has been servile and obsequious. It said nothing when Trump invaded Venezuela and kidnapped its President. It (especially Emmanuel Macron) approved moves by the US to attack Iran. The EU has abetted the invasion of Iraq, Syria, and Libya without UN sanction. It woke up to the unfairness of such moves only when Greenland was threatened. It has begun crying foul.

The actions of the US are further compounded by an insatiable greed to grab a lot more of other people’s money. Tariffs was one way. Impounding the money of Iran and Russia was another. It has impounded over $300 billion of Russian money ($100 billion lying with USA and the rest as gold deposits with Belgium).

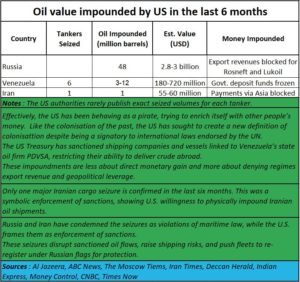

It has now begun grabbing oil. It has done this with Venezuelan and Russian oil. The US has not released any comprehensive statement of the oil it has seized and its approximate value. But our computation suggests it could easily be worth over $200 billion dollars (assuming the market price of $60 a barrel).

Trump also believes that he could make America extremely wealthy by pumping out more oil from Venezuela. That may be a mirage.

Trump has gone on record saying that he could offer cheaper oil to America. That could be at best a political statement. The oil in Venezuela is not easy to pump out. Any new well can produce incremental oil at $90 per barrel. Considering global prices at #90 no additional oil may get pumped out.

Moreover, contrary to his claims, Trump cannot lower prices in America. On the contrary he needs higher prices. That explains why he wants to reduce the flow of oil from Venezuela, Nigeria, and Iran.

Moreover, America is itself one of the highest cost producers of oil (https://bhaskarr.substack.com/p/india-slips-on-oil). If global oil prices fall to $50 a barrel, estimates show that at least 25-30% of US oil wells will have to shut shop. But an increase in oil prices is possible, especially if he or Israel’s Netanyahu try provoking a war with Iran, Rusia or even China. Ironically, one of the biggest casualties will be America itself because it has equity stakes in most oil wells in the Middle East.

Conclusion

Trump’s dreams of continuing to be a global hegemon may not come true. The dollar is likely to continue its downward move. That will be mirrored by a similar decline in US fortunes as well. Trump has only accelerated the process.

===========

My latest podcast is on the increased volatility in the stock market prices. You can find it at https://youtu.be/w-nM07ISHCQ

============================

And do watch our weekly “News Behind the News” podcasts, streamed ‘live’ every Saturday morning, at 8:15 am IST. The latest can be found https://www.youtube.com/live/-kH7fkmcXAw?si=vaHy9Usj1f0SAM3f

============================

COMMENTS