http://www.freepressjournal.in/analysis/maharashtra-continues-to-slip-badly-r-n-bhaskar/1318763

Maharashtra’s finances are in a precarious condition

— By | Jul 19, 2018

Maharashtra continues to stumble along. Vision has evidently given way to expedience. Basic accounting and book-keeping norms are being flouted. And the yardstick of what constitutes corruption is sought to be redefined.

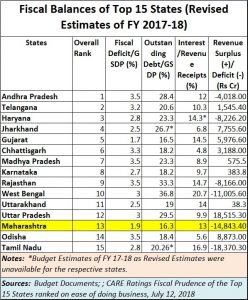

Nowhere does this become as apparent as in the ranking of states in CARE Ratings paper of 12 July 2018 on “Fiscal Prudence of the Top 15 States ranked on ease of doing business”. As the chart alongside shows, Maharashtra ranks way below other states.

Nowhere does this become as apparent as in the ranking of states in CARE Ratings paper of 12 July 2018 on “Fiscal Prudence of the Top 15 States ranked on ease of doing business”. As the chart alongside shows, Maharashtra ranks way below other states.

No, Maharashtra is not a lost cause as yet. As the report points out, “Maharashtra has interest payments as a slight concern, yet it continues on its position as the state that attracts the highest FDI and private investment. The state has to work on the aspect of reform access, as it scores far too low compared with others on the feedback front. Given persistent revenue deficits there would always be pressure to compensate for this imbalance which can affect capex. “

Yes, the state’s revenue deficit is quite large, dwarfed only by Tamil Nadu. Surely Maharashtra does not want to go that way!

Look closer. You will find some of the state’s best projects being abandoned. Take the dedicated freight corridor (DFC) linking Rewari (Haryana) to Mumbai as an instance. This project could have brought volumes of business to JNPT. The economic potential of having this port as the proverbial gateway to India would have been mind-boggling. It would have reduced freight time from a week or more to under 18 hours. And it would have brought in more projects (and FDI) to the state.

But the government has allowed the real estate mafia to clutch on to lands it controls thus making the acquisition and development of land in this state a very difficult exercise. As a result, even the Japanese have stopped talking about this brilliant project. Instead, the state has been touting the high-speed railway project. This might be a good project, but certainly not as economically relevant as the DFC. Some bureaucrats and legislators clearly prefer the short-term to the long term.

Take instance two. As a corollary to the DFC, the Japanese had identified 24 smart cities. At least two of them were to be in Maharashtra (http://www.asiaconverge.com/2011/02/dmic-delhi-mumbai-corridor-will-create-new-best-class-cities/) . But the state administration isn’t keen on those smart cities, because it wants to keep its control over both politics and lucre involving land deals. The smart cities planned were to be built under the protection of Article 243-Q of the Indian Constitution which provides for independent (non-political) administration of cities identified as “industrial” cities. It was this provision that made Jamshedpur an oasis of tranquility even during the most turbulent times in Bihar.

Instead, the state has a record of abrogating the rights it had assured its own industrial townships under MIDC’s charter (http://www.asiaconverge.com/2016/07/extortion-land-grab-navi-mumbais-midc-part-ii/) and http://www.asiaconverge.com/2016/07/midc-hurts-industrialisation-employment/). The money (both legal and illegal) that can be made through granting of development rights is far too tempting for the state to honour its commitments to industrialists.

Take just one more example. Let’s begin with a hypothetical question. If a customer went to a restaurant, had his meals, was given a bill for Rs.100 but was compelled to pay Rs.102 instead, would the person keep quiet? No, he would protest. If the restaurant owner said that this additional amount was paid to his accountant who had been appointed on contract, and was not his employee, would that argument wash? Obviously no. Yet that is precisely what the country’s richest municipal corporation has been doing.

The Municipal Corporation of Greater Mumbai (MCGM) accepts epayments from customers desirous of paying their water bills, or property taxes online. The billed amount and the receipt reflect one figure. But the amount debited to the bank account (or the credit card) is a higher amount. No receipt is issued for that amount. Ask the MCGM, and it will tell you that this amount is charged by the service provider.

But who appointed the service provider? Whose agent is the service provider? By collecting money as service charges without issuing receipts, the government wants some private party to benefit, but without being scrutinised by the state auditor or the CAG. The amounts involved could be staggering.

Ironically, when the CVC (Central Vigilance Commission) was alerted about the potential ramifications of this accounting sleight of hand, it merely stated that such acts do not come under its purview. So much for the state’s financial integrity, and the claimed willingness of the CVC to make India corruption free!

Obviously, a state cannot live merely on the legends of its great emperor and visionary Chhatrapati Shivaji Maharaj. Its present government too must also learn to aspire to such values and vision.

COMMENTS