https://www.freepressjournal.in/analysis/heres-why-the-make-in-india-and-atma-nirbhar-bharat-ruse-can-cause-more-harm-than-good

The cobra effect the govt is blind to — in IT, telecom, finance, and elsewhere

RN Bhaskar — June 5, 2020

Management gurus call it the Cobra effect. That’s when a decision is taken that you think is brilliant. But it turns out to be a disaster.

The origins of this phrase lie in an apocryphal tale from colonial India. As there were too many cobras around Delhi, and as too many people were dying from cobra bites, and as the British wanted to be safe as well, they passed a decree to kill cobras wherever found. To incentivise this, they offered a cash prize for each cobra killed.

The strategy worked. Many cobras got killed. The numbers declined. Then they started swelling again. And the reason was simple. In poverty afflicted India, the money got from killing cobras was so attractive that people began breeding cobras, then killing them, and then taking the prize money.

The unintended consequence led to making the problem worse. The order had to be rescinded. What happened thereafter is not known. But the phrase stuck.

The unintended consequence led to making the problem worse. The order had to be rescinded. What happened thereafter is not known. But the phrase stuck.

And today one can say that the government of India allows itself to become the victim of the Cobra effect, again and again. An error once is a lapse of judgement. But repeated repetitions point to a tragic flaw. Even a death wish.

Take the latest example.

On June 2, Google Play Store removed the “Mitron” and “Remove China Apps” from its Google Play Store for policy violations (https://www.thehindu.com/sci-tech/technology/google-scraps-mitron-and-remove-china-apps-from-play-store/article31741654.ece). Both apps were by-products of India trying to demonise China.

The “Mitron” app violated its ‘spam and minimum functionality policy’, say sources.

The “Remove China Apps” went live on Google Play Store on May 17 and was downloaded over 10 Lakh times since then. “Mitron” (which functioned just like TikTok) gained popularity amid negative reports about TikTok. Finally, Google Store had to remove around over 8 million negative reviews about TikTok and its ratings went back to 4.8 (https://www.indiatoday.in/technology/news/story/remove-china-apps-garners-1-million-downloads-in-india-gets-4-8-stars-on-google-play-store-1684319-2020-06-01),

Mitron was removed after it was found that it was not an Indian app at all, but had been developed by a a Pakistani software development firm.

Moral: it is easy to say that a software is Indian, when actually it has been developed overseas. All that is needed is a backroom financial arrangement to let the Indian developer claim that it has been developed in India. The Made in India ruse can cause more harm than good.

The irony is lost on many. Once competitors (from China or elsewhere) are driven away, by disinformation or clandestine government support, the cost to be paid by customers eventually begins to rise. That is why bans of any technology from anywhere are dangerous games that the unscrupulous can exploit, much to the disadvantage of India and the Indian customer. It could be the Cobra effect all over again.

Encouraging funny money

This effect can be seen in some of the ridiculous decisions taken in the realm of finance as well.

Consider for instance, the decision to give MSMEs collateral free loans (http://www.asiaconverge.com/2020/05/arma-nirbhar-for-msmes-does-not-promote-self-reliance/). As any economy watcher will tell you, this is an incentive to any unscrupulous promoter to take funds from the banks and not repay the loans. This is precisely what happened when Indira Gandhi gave our collateral free loans to farmers in the name of Loan Melas. Expect the sting of the cobra soon.

Ditto with the decision to restrain investments from China in any Indian venture (http://www.asiaconverge.com/2020/04/india-needs-investments-china-has-the-money/). That is absurd. The least the government could have done is to get all investments approved by a select committee. You do not single out a single country — neither diplomatically, or commercially — especially when that country is the largest investor in the world, and when India is in dire need of investments. It may make good headlines. It may help distract attention from the economic crisis confronting India. It may also help provoke a border clash, which is make to look bigger by roping in other global players. Yes, it does take away attention from the huge migraine of the economy slump (http://www.asiaconverge.com/2020/05/5-reasons-that-leave-many-unenthused-about-the-atma-nirbhar-schemes/). But it is the cobra effect once again.

India needs to focus on peace, on not allowing things to flare up anywhere. The economy needs attention. Industry is in tears – And as Rajiv Bajaj of Bajaj Auto stated publicly, India flattened the wrong curve – the GDP curve (https://www.freepressjournal.in/business/instead-of-covid-curve-india-flatten-gdp-curve-rajiv-bajaj). Agriculture too needs help. Policies for procurement and subsidies need to be changed (http://www.asiaconverge.com/2020/05/what-aatma-nirbhar-bharat-could-learn-from-the-usda/). And the government itself needs more transparency. Just look up Mospi’s website. See how outdated and incomplete some data is. Ditto with the Warehousing Development Regulattory Authority WDRA (http://www.asiaconverge.com/2020/05/atma-nirbhar-and-agri-markets/). Either someone is having a paid holiday, or there are instructions not to share data with the general public.

You do not cut your nose to spite your face. And do remember that the largest bonanza Indian young entrepreneurs in the IT space have got is from Chinese Investments. China funds have helped grow the largest number of Unicorns in India (http://www.asiaconverge.com/2020/03/china-investments-in-india-are-strategic-and-profitable/).

Tomorrow, when Western countries do not bring in their money to help India grow its industries, India may have to go back to the Chinese. It will then have lost much of its bargaining strength, even a loss of face. Or the government will spin another yarn about the supreme sacrifice Indians have made in coping with bad times. The Cobra effect?

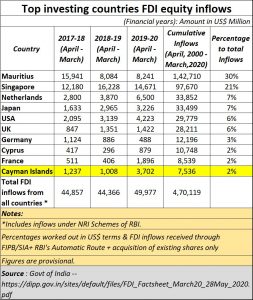

Such financial policing has in fact driven much money to come into India not from sound manufacturing countries but from tax shelters like Cayman Islands (see chart). Already, according to the DPIIT (Department for Promotion of Industry and Internal Trade), Cayman Islands is now the 10th source for investor inflows to India. It is so impervious that India won’t even know if the money comes from China, or from Pakistan. Hah!

Watch the numbers from Cayman Islands move from $1.2 billion to $1 billion to 3.7 billion from 2017-19, 2018-19 and 2019-20 respectively, accounting for a cumulative inflow of 7.5 billion during this millenium. Expect such numbers to grow if India does not get its financial regulations right. The Cobra effect is now beginning to show.

Telecom tangle

A similar cobra effect is now happening in the telecom sector. By changing rules, and making some of its players sick, the government has made the entire telecom industry sick. Revenues have begun falling. Competition has been reduced. And average revenues per user (ARPUs) have slumped. Like in nay business, if you drive away competition, and run it to the ground, you could cause customers to pay more later.

This will have the deleterious effect of the cost of packages going up gradually, and the quality of service going down.

This will have the deleterious effect of the cost of packages going up gradually, and the quality of service going down.

This is one sector that has tremendous potential (see chart). But the government’s on-again-off-again policies could destroy the revenue potential from this industry.

It does not take a genius to realise that an investment inflow of $2 billion from five competing companies can always become larger than $5 billion from just one company. That is why, governments should always take care to ensure that competition in the industry does not diminish, that all players make money fairly, and that rules are not tilted in favour of one player and against others.

Not surprisingly, good investors are loath to come to India. It does not have investor protection in place. Rules are often tweaked to favour one and penalise another. For instance, the fines SEBI levies on an NHAI for delay in making timely disclosure about financial results are a laugh when compared to the still penalties it levies on others (https://auto.eco omictimes.indiatimes.com/news/industry/sebi-slaps-rs-7-lakh-fine-on-nhai-for-disclosure-lapses/76033119) .

Investors do not like rules of business to change after money comes into India. This is what happened with Amazon and Walmart. (http://www.asiaconverge.com/2020/05/5-reasons-that-leave-many-unenthused-about-the-atma-nirbhar-schemes/). This is what happened with telecom companies. This is what is happening with debit and credit cards, wallets, and payment gateways. And this is what is happening with IT as well, even as the government allows a shrill tirade against Chinese apps. Policymakers forget that some of these apps have been made by Indian developers, even though the funding was Chinese.

Can India change. Yes, it can. It did so in 1991. The pain and the anguish India will go through in the coming months may strip policymakers of their arrogance and know-it-all approaches to business.

Hopefully, policymakers will deliberate more, discuss more, and not allow regulatory capture. Hopefully, India will emerge as a destination for investments as it realises the crucial need for effective dispute resolution, including international arbitration.

Hopefully, India will not witness the resurrection of the cobra effect.

COMMENTS