MARKET PERSPECTIVE

By J Mulraj

May 17-23, 2025

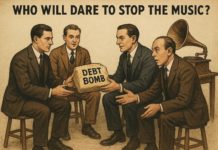

Greed for tax revenue leads to bad decisions

Image created using Bing

India’s tax/GDP ratio seems, on surface, to be low, at 11.7% (direct taxes 6.1% of GDP and indirect 5.6%). The ratio is higher in developed countries like UK (24.9%), France and Italy (24.6%). On surface, because about half the population is dependent on agriculture, the income being tax exempt. This tax exemption benefits just a few, most of whom are not farmers, but politicians, industrialists and high-income professionals who launder their ‘black’, tax evaded, income. They simply show the tax evaded money as agricultural income. Law makers, as beneficiaries, have no incentive to end this travesty.

So the numerator (tax collected) is depressed because of the exemption, but the denominator (GDP) includes the declared income, thus lowering the ratio.

Adjusted for such exemptions (which are misleadingly portrayed as a help to poor farmers tilling the fields) amounting to half the population, the tax/gdp ratio is not low, as it seems on the surface.

The Government says it is unable to tax agri income, because, as per the Constitution, tax on agriculture is a State subject, requiring all of them to agree to modify it. That’s hogwash! It’s quite an easy fix, really. Individuals pay no tax if they earn an annual income of ₹12 lacs. Why not double the limit to ₹24 lacs/annum for farmers (which, I suspect, would cover over 90% of them), after which they pay normal tax rates? By doing this, those misusing the tax exemption for laundering black money would have no incentive to do so. Isn’t that what all Governments have always professed they wanted?

That agriculture is a State subject should also not be a deterrent to an effort to get them on board. After all, when GST was introduced, several taxes were also levied by States, nonetheless, they acceded to it. So why is ‘state subject’ being touted as an excuse, other than for vested lawmakers interested in retaining the agri tax exemption as a money laundry?

Given that tax/GDP ratio, at 11.7%, is not really, after adjusting for agri tax exemption, that low, and given that GST collections.

The greed for increasing revenue results in decisions which are based on wonky logic. Such as the one used to tax caramelised popcorn at a higher GST tax rate than salted popcorn. This on the bizarre argument that caramelizing popcorn makes it a sweet!!! which the rich can afford a higher tax on, but salted popcorn, for the proletariat, ought to be taxed at a lower rate! Such specious arguments negate the appeal of the GOI to consider India as an investor friendly destination for foreign direct investment.

Another example is the logic distortion, in the quest of additional revenue, by the Department of Telecom, portrayed as a corpulent Oliver, asking for more, in the illustration.

Mobile telephones were first introduced in 1973. Initially, European Governments treated spectrum as a scarce resource, to be monetized, through open auction, to fetch the maximum revenue for the Government. They soon discovered that this model made cellular telephony Unaffordable, and shifted, successfully, to a revenue sharing model. The operators paid far less as an upfront fee, but gave the Government a share of the revenue.

India entered the field later, but, funnily, went through the same mistake instead of learning from those of others. Initially it collected high license fees, and, in order to incentivize operators who paid them, restricted competition to two or three operators per circle. Result? High cost of calls (₹ 14/minute, payable by the caller and the receiver) dissuaded users, and the Government soon switched to the revenue sharing model, as had the European Governments. In 1999, telecom operators agreed to pay a share of 8% of Adjusted Gross Revenue (AGR).

After this switch Indian telephony boomed. New entrants increased competition and lowered both handset and calling costs to the lowest in the world, which made mobile telephones widely accepted. Interesting new uses were found. Fishermen, on the high seas, called, from the boat, to find out which market was offering the best prices for their catch, before heading that way. The number of telecom subscribers in India rose to 1.2 billion, #2 in the world.

Low cost mobile call and data rates, combined with Aadhar (unique identification) and UPI, a payments system, ushered in a revolution. It enabled marginalized persons, those without access to a bank, to participate in the growing economy. A street vendor could, using UPI, sell an item for, say, ₹10 (12 cents), get paid in full, electronically. No fee is deducted by UPI from either party.

Sadly, the telecom sector, which has performed brilliantly, has been penalized, instead of being rewarded, in pursuit of the goal of higher tax revenue. This is because, in the definition of AGR, both revenues from telecom operations as well as non-telecom revenue.

In 1999 a greedy DoT raised a demand of ₹ 4 trillion against AGR dues, including non-telecom revenue. Why the issue of spectrum, used solely for mobile telephony, should claim a share of non-telecom revenue is bizarre logic, driven by greed. But, strangely, the Supreme Court agreed with it!

The bizarreness of the demand was revealed when other companies, (such as ONGC, oil exploration, PGCIL, a power grid operator, GNFC, a fertiliser company) were asked to pay 8% of revenue from their core businesses simply because they had been granted a telecom license for internal use!

Please, sir, can I have some more revenue? Asked DoT.

When these claims were deducted, telcos were asked to pay Rs 860 billion, including interest and penalty. Most affected were Vodafone, now VI, after merging with Idea, and Bharti Airtel. Reliance Jio, being a late entrant, was barely impacted.

The Government reduced the demand, converted a part into equity and gave time to pay the rest. Both VI (GOI now hasa 49% equity stake) and Bharti Airtel have, again, filed appeals in the Supreme Court.

What this will ultimately mean is that customers will have to pay higher charges. In short, the large bite of the cake taken by DoT will come from slimmer consumers. This will also dissuade foreign direct investment, which GOI desperately seeks.

Turning to USA, it’s Government debt is $ 36.2 trillion. Each of the past three Presidents have gone on a debt binge! In Obama’s term, debt went up by $ 7.6 trillion, in Trump’s first term by $ 7.8 trillion and in Biden’s term by $ 8.4. So the past three Presidents have added $ 23.8, or 65% of debt, in just 12 years! Complete irresponsibility!

Unsurprisingly, Moody’s lowered US credit rating from Aaa to Aa1. This downgrade follows that of Fitch and S & P. The rating agencies fear rising inflation, as a result of ludicrously high tariffs Trump is seeking to impose. These are riling up US allies, like Japan, which is the largest holder of US Treasury Bills. It holds $1.1 trillion out of the $ 8.5 trillion held by foreigners and is threatening to sell them. Trump’s televised dressing down of world leaders, first Zelenskyy and now, Ramaphosa, is not helping the US win friends. Nor is his unasked intervention to create a ceasefire with Pakistan, endeared him to India, a country which he seemingly depended on to counter China. Trump has also imposed a 5% tax on outward remittances from USA, which will hit India, the largest recipient of remittances.

Given his mercurial and undependable approach on tariffs and geopolitics, rating agencies must wonder at the future ability of US to borrow abroad, pay interest (over $ 1 trillion) and roll over maturing US debt.

Last week the BSE Sensex closed at 81721 , for a weekly fall of 609 points.

India is seeking to indigenously develop more of it’s defense equipment needs. One effort is to make a suitable engine for advanced fighter aircraft, with stealth and advanced electronic features. The US, under Trump, is untrustworthy.

The tariff war is also on ceasefire, creating a lot of uncertainty. The fall in Brent Crude price to $ 64/ b is providing relief from inflationary forces, but this can be negated by high tariffs any time. Wars in Ukraine and the ME seem to continue endlessly. All in all, not a rosy picture in the short to medium term.

Comments may be sent to jmulraj@asiaconverge.com

COMMENTS