MARKET PERSPECTIVE

By J Mulraj

Dec 13-19, 2025

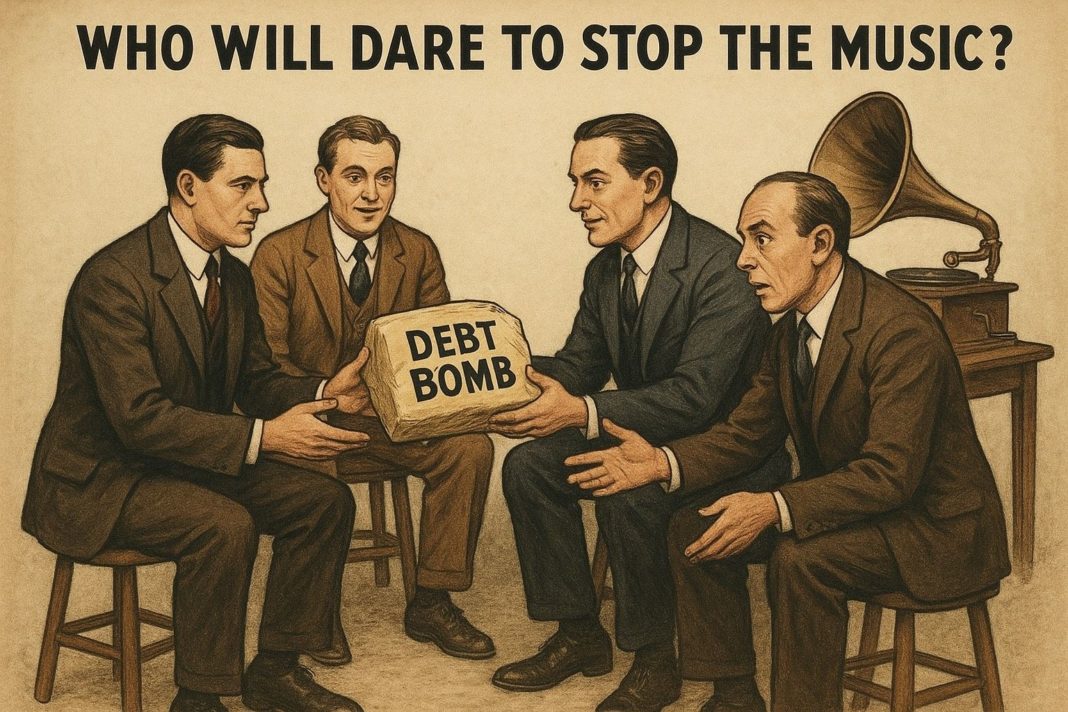

Or does nobody want to stop the music of passing the parcel?

Image created using chatGPT

Global debt (sovereign plus corporate plus household) has grown to $ 315 trillion, more than 3X global GDP. One wondered how it would ever be repaid. No country has outlined any plan to even reduce debt, far less repay it.

What if they never intend to?

This video outlines how four people have contributed, over the past 335 years, to create a system of perpetual sovereign debt.

The first, a Scottish merchant named William Patterson, approached King William 3rd in late 17th century, suggesting that a group of merchants lend the crown a sum of money (to fight wars) which would bear 8% interest but never need to be repaid!

Second was the Rothschild family, of five brothers, headed by Nathan, who located themselves in five different cities, London, Paris, Frankfurt, Vienna and Paris, and developed the interconnected, geographically spread, bond market. The tiny brokerage fees earned by buying and selling bonds made the family immensely wealthy. The information gleaned from their network and trade made them more so.

The third was an influential American banker, J P Morgan who, during a financial crisis in America in early 20th century, cobbled a group of private bankers and restored confidence by collectively pledging support. Subsequently, following the panic of 1907, one of his associates, Henry Davison, (from J P Morgan and company), gathered prominent bankers and officials at Jekyll Island Club, a remote island in Georgia, to create the Federal Reserve and institutionalise debt. Luckily the club was not named the Edward Hyde club!

In effect, Patterson made the sovereign debt permanent. Rothschild made it public. Morgan/Davison made it infinite.

Yet, it seems difficult to digest the idea of perpetual debt. Countries have, in the past, failed to repay their sovereign debt, such as Argentina, Sri Lanka, Venezuela, Zambia and others. These, smaller, countries would be subjected to conditionalities imposed on them by lenders like the IMF.

But the perpetual debt machine would probably help powerful countries like USA, China or Japan, roll over their sovereign debt. For them the music can’t interrupt the game of passing the debt bomb parcel.

A lot of this mountain of debt has been accumulated because of wars, like the ones waged by America in Iraq and Afghanistan. Both lasted 20 years, and cost upwards of $2 trillion each. The exit by USA from Iraq after 20 years caused a power vacuum, filled by the likes of ISIS and the spread of terror. The exit from Afghanistan strengthened the Taliban; the abandonment of military equipment led to an arms bazaar through which American arms are used against them; the abandonment of American soldiers led to their loss of morale, possibly to their deaths and to a lowering of respect for America’s military prowess. Yet, the MIC, Military Industrial Complex, continues waging conflicts (shooting down Venezuelan fishing boats and killing sailors contravening international law).

Fingers crossed, we may be nearing the end of the Ukraine war after an offer of security guarantees by USA. The sticking point now is how much Ukranian territory it is willing to cede to Russia. Russia wants all of the Donbas region (it is able to conquer the small part not in its control, albeit at the cost of lives); Ukraine doesn’t want to surrender that. The EU has given $50 b. interest earned on the frozen Russian assets of $ 300 b. as a loan package to Ukraine! Such acts make it more difficult to reach a peace agreement.

The EU, especially Germany, has destroyed itself in this conflict. Chancellor Olaf Schulz of Germany, filled with hubris, stopped buying Russian oil/gas as a pressure point on Russia to accept Ukraine joining NATO. For Russia that was non negotiable, as NATO membership for Ukraine threatened its existence. Russian oil/gas, through the two Nordstream pipelines, provided cheap energy that made Germany the strongest European economy.

Bereft of cheap Russian energy, Germany went on to buy it at 4-5 times the cost. This made BASF, then the world’s largest chemical company, shift its largest production unit, in Ludwigshafen, to China, resulting in loss of market share and jobs. China’s Sinopec has overtaken it, becoming the largest chemical company in the world.

Following BASF, the renowned auto company, VW, has, after 88 years, decided to shut down its plant in Dresden.

This de-industrialisation of Europe’s leading economy (because Germans were hard working, productive and disciplined) is entirely because of the myopia and hubris of its political leadership. The democratic process has been deliberately scuttled in other countries like Nepal, Bangladesh and others, to the subsequent grief of their citizens, after subsequent poor governance.

India is developing its own, indigenous capabilities in various fields. It has recently launched Dhruv 64, a 1 gigahertz, 64 bits, dual core microprocessor, which has been designed, developed (by CDAC) and validated in India. This is momentous as few countries have the capability of end to end manufacture. India imports its entire requirement of these microprocessors and will now need no licenses to do so, or pay any royalties, or be dependent on other countries for supply.

Last week the BSE Sensex was steady, around the 84-85000 levels.

Next week is likely to be choppy especially if the Bank of Japan raises its interest rate, as indicated by Governor Kazuo Ueda. That would lead to the start of unwinding of the yen carry trade. The low cost of money in Japan is giving investors an arbitrage opportunity, borrowing in yen and investing in US T-bills. The calculus is affected by an appreciation of JNY or rise in interest rates. The last major unwinding led to a 30% drop in the DJIA.

There are too many minefields and geopolitical stress points to be complacent. Better to be cautious.

———————————-

Comments may be sent to: jmulraj@asiaconverge.com

COMMENTS