MARKET PERSPECTIVE

By J Mulraj

May 11-17, 2024

Can inflation reduce if politicians don’t stop printing money?

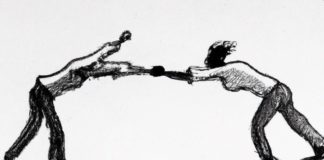

“I’m telling you, Jerome, the unrestrained printing of money doesn’t drive up inflation”

Inflation in April, in UK was, at 3.2%, lower that US inflation, at 3.4%. That does not indicate Andrew Bailey, head of Bank of England, has done a better job taming it, than has Jerome Powell, Chairman, US Federal Reserve. Jerome’s task becomes infinitely more difficult because of his President, Joe Biden’s, propensity to expand the money supply and give aid to Ukraine, Israel and others, to protect their borders even as he neglects his!

As illustrated above, Biden appears to be trying to argue that unrestrained spending of money created through debt issuances, doesn’t impact inflation. Powell appears disinterested and unconvinced, and Vice Fed Chair, Lail Brainard seems amused, as would anybody with a modicum of common sense.

When Covid broke out, America resorted to printing money to give every American citizen a $6000 monthly stimulus cheque (stymmies), as people were confined to their homes. With little options to spend money on (no travel, no eating out, except for Nancy Pelosi or Boris Johnson who broke rules nonchalantly, no movies) around $2 trillion was saved by individuals, pushing up US household savings rate. This averaged 8.5% in the 65 years till 2024, including an unnatural spike to a 32% rate in April 2020, because of the stymmies.

Besides having the propensity to print and spend, Joe Biden displayed his proclivities to fund wars, provided they were on foreign soil and did not involve American boots on the ground. The resultant tensions has, naturally, pushed up the price of crude oil and commodities. The asymmetrical warfare tactics of the Houthis, shooting missiles at ships seeking to pass through the Suez Canal and compelling them to take a longer route, has pushed up logistics costs, and hence inflation. Trade tensions between US and China, arising out of political discord, further push up inflation.

With geopolitical tensions, trade disputes and asymmetrical warfare tactics continuing, inflation remains stubbornly high. Stockmarkets had earlier expected 5 rate cuts by Jerome Powell in calendar 2024 but now expect only 2.

Even for those 2 cuts in H2/2024 Jerome Powell must pray that the problems in America’s commercial real estate (CRE) market simmer down. The 5% hike in interest rates, attempting to rein in inflation, has made the owners of CRE buildings unable to service bank loans taken for building them. This can lead other community banks, like Silicon Valley Bank, to fail. They are the main lenders for CRE building projects.

Nearly half the US national debt of $34 trillion has been built up by the past three Presidents, (Obama added $7.6 t, Trump $6.7 t and Biden $2.5 t).

Interest on the US Government debt now exceeds $1 trillion annually, the largest item of expenditure! The recipe for bringing down debt is to grow GDP fast enough in order to generate surpluses to pare the debt. But, in Q4/2023, US GDP grew by $334 b after US debt was raised by $834 b. So, if you borrow $2.5 to raise an additional $1 of income, you can never never never reduce your debt burden.

Following that path leads to only one result – confiscation. Thomas Jefferson said “a Government big enough to give you everything you want is also a Government strong enough to take away everything that you have”.

Despite resistance from the Republicans to increase further debt in order to give more money to Ukraine, to prolong a lost war, the US Congress passed a bipartisan bill to raise and spend more money on Ukraine, Taiwan and Israel (which Biden withheld). So America is getting deeper into the s***hole without any concern or responsibility for the future.

Biden’s failed policies on energy (banning fresh leases of Federal land for fracking), on immigration, on foreign policy (ignoring Putin’s pleadings to not make Ukraine a NATO member) on fiscal irresponsibility, printing money unrestrainedly, have spurred inflation. The target 2% inflation set by Powell, seems a distant dream. A higher rate may well become acceptable.

The November US elections, if it leads to a change in leadership and policy, could help change US policy directions. India, too, is going through its general elections process, with results being declared on June 4. USA can learn from India’s electoral process!

Last week the BSE Sensex ended at 73917, for a weekly gain of 1253 points.

Famous British author PG Wodehouse once dedicated a book to his wife ‘without whose help’, he said ‘it would have been finished in half the time,’.

When Jerome Powell finally tames inflation, he could use the quote to reference policy makers!

Picture Source: https://www.columbian.com/news/2021/nov/22/biden-to-keep-powell-as-fed-chair-brainard-gets-vice-chair/

Comments may be sent to jmulraj@asiaconverge.com

COMMENTS