MARKET PERSPECTIVE

From J Mulraj

Sep 27- Oct 3, 2025

Trump’s disastrous tariff wars and the consequent decline of America

Image created by Bing

Thomas Friedman pointed out in his book, ‘The World is Flat’, how a globalised world, enabled by advances in communication and Internet technologies, will allow the outsourcing of many jobs, without the challenges of immigration, thus leading to higher global growth. In essence, the world became flat, and work became more easily accessible.

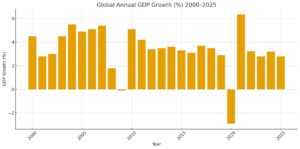

It worked! Global GDP growth grew, as did international trade and the outsourcing of supply chains, to enhance shareholder wealth, as dictated under shareholder capitalism.

Barring two dips in 2009 (post the 2008 GFC) and 2020 (Covid shut down) global GDP growth has been at around 4% a year.

In his second term, President Trump has been bashing both allies and foes with the sledgehammer of excessive tariffs, creating turmoil in international trade. He unfairly and illogically blames high tariffs imposed by other countries on America, for its high debt, and seeks to extract his financial pound of flesh by penal tariffs.

In truth, the high US trade deficit stems from over-indulgent consumption (Americans want a choice of 6 flavours of ice cream in the freezer, as an example) and the debt arises from the over-jingoistic deep state, aided by over-indulgent politicians to fund wars, with borrowed funds. Not because America has been continually ripped off by trading partners, as alleged by Trump.

The fact that USA is the world’s largest economy, with a $29 trillion GDP, of which 70% is consumption belies the fact that it has been ‘continually ripped off’ (else it would’ve been poorer) and emphasises the consequence, viz a $36 trillion debt overhang. The illogically and unaffordable high tariffs have pissed of America’s allies and adversaries alike, accelerating the move towards de-dollarisation.

Trump’s tariff sledgehammer will negatively affect America in several ways:

Defence preparedness: The ongoing conflicts in Ukraine and in the Middle East have depleted the inventory of US weapons, including artillery weapons and shells. It’s capacity to replenish stocks through domestic manufacture is insufficient, so it must depend on its friendly allies. Alas, inventory of those is also depleted by Trump’s pomposity and expressed desire to takeover Canada, Greenland, Panama, and his aggressive tariffs. As a result, US preparedness for fighting more conflicts say, over Taiwan, or Venezuela, or an escalation in the Middle East is poor.

More crucially, it’s defence infrastructure is highly vulnerable because of it’s reliance on China, on whom it has imposed tariffs ranging from 25-145%, for the supply of rare earth elements (REEs) and finished magnets. These are needed for guidance (the missile must be able to hit the target with precision), propulsion, sensors and electronic warfare. The vaunted stealth fighter F-35 would be ineffective without a continuing supply of REEs. As would other awesome weaponry in the US arsenal, plus those being developed.

Given these vulnerabilities, one wonders why Trump passed an Executive order to change the name of it’s Department of Defence to Department of War, to convey a stronger message of readiness and resolve.

The weakening of its corporate sector: Companies with international customers are victims of the crossfire of escalating tariffs. After USA raised the tariff rate on China to 145% in April, the Chinese Government asked it’s airlines not to take delivery of Boeings ordered by them (has reportedly ordered its people familiar with the matter). Similarly, Air India, has earlier placed a large order of $14.3 b. with Airbus, not with Boeing.

In order to remain competitive, Boeing, which sells 80% of it’s aircraft overseas, decided to shift a part of it’s production line to Mexico. This did not sit well with Trump, who threatened to impose a 200% tariff if planes produced in Mexico were then sold in USA.

Furthermore, the aircraft manufacturing industry was, hitherto, a duopoly, with Airbus and Boeing capturing 80% of global sales. They now face a third, large competitor, China’s COMAC. COMAC displayed it’s C919, a narrow bodied aircraft competing with Boeing 737 and Airbus A320, and it’s C929, a wide bodied, twin aisled, long range aircraft. They were well received.

Boeing is a constituent of two indices, the Dow Jones Industrial Average and the S&P 500; besides, in 27 ETFs it is among their top 15 holdings. It’s hands are tied by tariff policies and it’s operational freedom hampered by tariff threats if it shifts it’s manufacture to another country.

Leading farm equipment maker, John Deere, faced similar threats when it proposed manufacture of a few items outside USA ().

Even more alarming are the travails of Jensen Huang, CEO of Nvidia, the world’s most valuable company, with a m. cap of $ 4.6 trillion. Trump banned sale of it’s advanced chips (H20) to China, in a bid to allow America to retain it’s lead in the semiconductor race. Despite (or perhaps because of) that, China has developed it’s own semiconductor industry to the point where, opines Jensen Huang, it is just nano seconds behind the USA.

Trump allowed Nvidia to export a less advanced chip, the RTX Pro 6000D to China. But last week, China has banned the use of this chip, causing Nvidia stock to drop.

China has the capability, acknowledged by Huang, to develop advanced chips of it’s own and will do so. In effect, Trump’s tariff war has failed to restrain technological advancement by China; instead it is breaking the world in two parts. Both countries will have their own standards and platforms, not interoperable.

This is disastrous! Remember the simple electric plug? Different countries have different plugs, operating on different voltages and needing the user to travel with different adapters? Do we want the same mess in digital devices as well? And for what? For a tariff policy that has failed badly to stanch the growth of others but is damaging the growth of the perpetrator?

How utterly insane and bizarre!

The sorry state of American farmers: Sale of American soya to China, the world’s largest consumer of soya meal, used as animal feed, has collapsed. Not because of a weather failure, not because of poor quality, not because of price, but because Trump angered China with usurious tariffs. It transferred its patronage to Brazil. American soy farmers are facing bankruptcy, unless the tariff wars are resolved swiftly. Farmers represent one of Trump’s largest voter blocks, so, in effect, he is cutting his nose to spite his face!

As you sow, so shall you reap!

In summation, because of Trump’s abrasiveness, his insane tariff policies, his untamed jingoism, and his poor treatment of old allies like Canada, he has succeeded in weakening America’s war preparedness, damaged some America’s leading companies by interfering in corporate management and ruined parts of the farm industry, his voter base. Other sectors getting hammered are tourism/hospitality and higher education, in protest by countries treated badly.

He certainly won’t get the Nobel Prize in Economics.

Let’s see how he fares in his quest for the Nobel Peace Prize.

On top of all this, the US Government is shut for absence of funding. Interestingly, in the past when US Governments were similarly shut down, the stock market rose, during it, more often than it fell!

Last week the BSE Sensex ended at 81207, for a gain of 781 points.

Trump tried to pressure India, with a penalty tariff for prolonging the Ukraine war by buying Russian crude oil, at a discount. He duplicitously forgets the fact that America provoked the war, America directed Boris Johnson to tear up a ceasefire both sides had agreed to, just 2 months after the invasion, America fed the war with supply of weapons and funding to Ukraine and America buys uranium and other things from Russia.

In view of all this, caution is advisable. It’s very likely that common sense will return to investors before it does to US policymakers.

Hallelujah!

Comments may be sent to jmulraj@asiaconverge.com

COMMENTS