MARKET PERSPECTIVE

By J Mulraj

Nov 28- Dec 4, 2021

The many challenges of policymakers

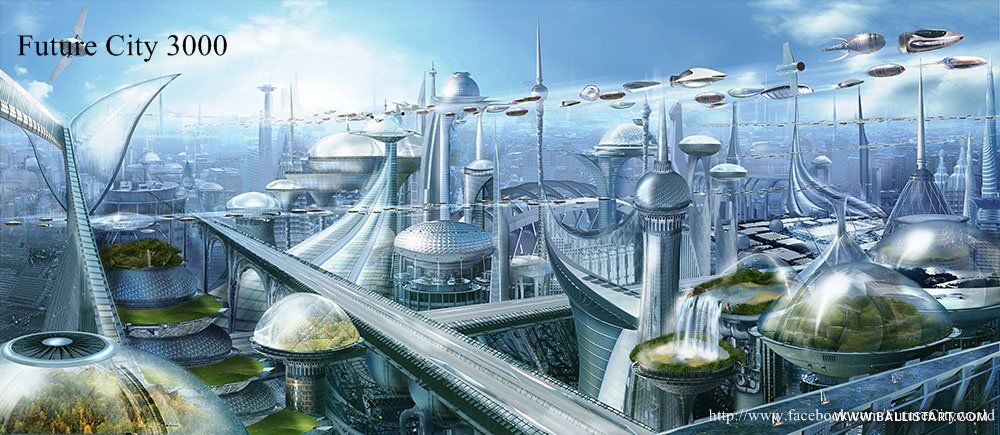

The world of the future, driven by new technologies, will be unrecognisably different, holding many promises.

Imagine that, once you incur the capital cost of installing a solar roof, plus storage, the sun will provide free electricity for your home, and your electric vehicle (EV). No electricity bills and no ever rising petrol bills. Surplus energy can be sold to the grid, thus a cost centre turns into a profit centre.

Imagine that, having bought an autonomous EV, capable of driving itself, you get dropped off at your workplace, and, not needing the EV till the evening, offer it, using your phone, to an UBER like service. That makes your vehicle a profit centre, instead of a cost centre!

Imagine the savings in cost, and disruption to the retail system, from 3D printing, another future technology which is developed and awaiting widespread commercial use. Today, to sell a shirt, for example, a store would stock say, 10 designs, with 10 sizes and 10 colours, or a 1000 times the requirement. This results, naturally, in unsold stocks, which are disposed at a hefty discount, which means the cost of that discount is loaded on to the sale, increasing the price of the shirt. However, with 3D printing, a customised shirt is ordered, after looking at designs, colours, and sizes online, avoiding the need to stock finished goods, but, instead, to stock the raw materials (fabric, buttons, thread and accessories). This would result in huge cost savings to the customer, the producer and the distributor, and release display space. A store visit would be a ‘virtual’ experience with the selection done wearing virtual glasses.

Using artificial intelligence (AI), robotics, Internet of Things (IoT), where machines talk to each other, factory productivity would improve. This would provide the increased income to take care of other costs, including the provision of a ‘universal basic income’ for people displaced by technology.

A brave new world!

The transition would, of course, help protect the environment. Solar, and other renewable sources of energy would reduce the need for polluting coal, thus reducing carbon emissions. Transiting from fossil fuel charged vehicles to EVs would help reduce the former, further aiding the environment. 3D manufacture, being an ‘additive’ manufacturing process (the material is added, layer by layer) instead of a ‘subtractive’ process (a piece of cloth is cut, now, to the desired dimensions, resulting in surplus), would reduce wastage.

But the transition to the brave new world is going to take time. In the interim, a lot of problems are going to be cause, requiring tough decisions to be taken, not always palatable.

For example, energy shortages. One has heard about severe shortage of electricity in China, which impacts both households (no heating during a cold winter), and factories (high consumption users, like aluminium, face power cuts, forcing production cuts and rising prices).

Brent crude has fallen from $ 84/b recently, to just under $ 70 today, mainly thanks to US pressure on OPEC to increase production. US investment bank, Jefferies, feels, however, that when life reverts to normalcy, crude oil could hit $ 150/b.

Similarly, Singapore has seen an incredible 1290% hike in electricity prices due to a shortage of natural gas, which accounts for 95% of its supply!

US pressured OPEC to increase production, and so cut crude prices, in order to bring down high gas prices in USA, which would be a political time bomb. He saw the protests in France when it tried to introduce carbon taxes. But increasing crude production goes against Biden’s pledges to reduce emissions, made recently at COP26. So these are the impossibly tough decisions needed to be made.

India, too, is highly dependent on thermal power, using dirty coal, for half its energy needs. So the Adani group bought a large coal mine, the Carmichael mine, in Australia, which was mired in controversy, led by an environmental group. It is now set to export 10 m. tonnes of thermal coal to India a year. A transition to a renewable energy system will take years, and, in the interim, such decisions would need to be taken, even though they militate against the COP26 pledges.

You can’t always get what you want.

Then there are the geopolitical challenges, primarily, now, in Taiwan and in Ukraine. China has long expressed its intention to re-unify itself with Taiwan, with military means if needed. That poses a risk of conflagration. Japan’s former, and respected, PM, Shinzo Abe has just spoken out on the need to defend Taiwan, if attacked.

Besides the emotional desire for reunification, there is a commercial reason. Namely, TSMC (Taiwan Semiconductor Manufacturing Corp. Ltd), which is a significantly large supplier of computer chips, which are in short supply and needed in all industries.

Here is an out of the box strategic idea. What if all, or at least the key employees, were to be relocated in, say, Japan, or other, location, and a new fab. facility built there ($2b.). That would keep secure the skillsets (which are rare) to produce high end chips, thus making a military takeover that much less attractive. It would be less expensive than a war, for sure. The US accepted 65,000 Afghanis, surely it can accept 54000 TSMC employees, who will add value.

India has taken steps to invite FDI, though it can do more. The US State Department, in a July 2021 report, states India is a challenging place to do business. This is due to both policy decisions as well as bureaucratic ones, and only serve to deter Foreign Investors, as these decisions tend to deviate from internationally accepted norms.

For example, when Essar Steel went to IBC (bankruptcy court), trade creditors objected to getting a far lower share of the pie than secured creditors. They sought, and initially obtained, an equal treatment! This is contrary to all international practices. Secured creditors (who have collateral) are superior to trade creditors, giving them comfort to lend. The decision was ultimately reversed, but should never have been made in the first place.

Or take NSEL, where 13,000 investors have been duped, and the Government is doing nothing about it. All of them must be treated equally, as per international practice, yet, in India, a court ordered ‘small investors’, arbitrarily judged to be those whose exposure was under Rs 1 million, to be paid first, contrary to all international norms. To reduce this argument to its absurdity, if we presume Mukesh Ambani, Asia’s richest man, had invested Rs 9 lacs, and a retiree had invested life savings of Rs 11 lacs, the former would be fully reimbursed and the latter, waiting.

Such bugbears serve only to annoy and discourage foreign investment, direct or indirect.

Policy wise, we saw the futility of imposing retrospective taxation on Vodafone and Cairn, and the egg on the face consequence of it.

It is not surprising that several Indian succeed abroad, where they operate, unfettered by senseless regulations. The CEO’s, for example, of Google, IBM, Microsoft, Twitter and others. Indians form 38% of doctors, 36% of NASA scientists and 37% of all scientists in the US, whose system works on deserving rather than reserving.

The sensex closed the week at 57696, up 589 points over the week.

The factors investors should watch out for are the speed of the Fed taper (the Fed wants to taper faster, and raise interests rates by June 2022, but Omicron (interestingly an anagram for moronic) virus may give it pause, depending on its virulency, the geopolitical situations in Taiwan and Ukraine, and the growth of inflation.

Hearteningly, PWC in its report ‘The World in 2050’ believes India will be the #2 economy (after China) by then. Yes, it can, but we have a lot of work to do to get there, especially in cleansing the judicial system and the bureaucracy.

Picture Source: https://www.facebook.com/FutureCityworld/photos/a.10150775706998529/10150775722223529/?type=1&theater

COMMENTS