Talk to high net worth individuals (HNIs) and non-resident Indians (NRIs). They express tremendous anxiety over the provisions of the government’s new piece of legislation. This spells trouble for all of us, even if we are largely law-abiding, they grumble.

At the same time, many wonder if the recently promulgated laws will succeed in unearthing black money.

All eyes are on the Black Money(Undisclosed Foreign Income and Assets) and Imposition of Tax Bill, 2015, which received Presidential assent May 26 2015 and thus became an Act (commonly referred to as the “Black Money Act”). It has already come into effect from July 1 2015, The stated purpose of the Act is to deal with the menace of black money. It seeks to, among other things, levy tax on undisclosed assets and income held abroad by Indian residents and non-residents. It provides for stiff penalties and even rigorous imprisonment. In fact, a law for curbing black money was expected since 2004 (http://dnai.in/ccKf).

Individuals, affected by this Act, have a one-time compliance opportunity. They can come clean and streamline their affairs, with lighter penalties. The deadline for declaring offshore assets under the Compliance Scheme is 30 September, 2015.

Many of the provisions of the Act are believed to be the most draconian ever. Among other things they (a) give assessing officers immense discretionary powers to accept or reject the genuineness of disclosures made; (b) allow them to open up income details even for the years when the person was not ordinarily resident in India; (c) provide for payment of at least 60% of the current value of the assets disclosed, and even higher penalties if the amount is discovered by the tax authorities later; (d) introduce the concept of imprisonment for tax evasion — as in VP Singh’s time (Singh was the former finance minister of India, and later Prime Minister, who authorised imprisonment for tax evaders); and (e) allow for immediate seizure of assets, equal to the amount payable to the government, in case actual collection of penalties is not feasible.

There is also some ambiguity about the applicability of other laws like those for corruption, extortion or even terrorism through which the disclosed amounts might have been earned.

But, most worryingly, the Act takes away the right of the affected party to appeal to any higher authority. It is, however, quite possible that the sanctity of such laws will be challenged in courts by affected parties once they are actually applied.

However, the moot question remains: Will the government be able to collect a good part of the black money stashed away? The black money figures being bandied around are mind boggling — ranging from US$ 500 billion to $1.5 trillion. The higher amount is what Ram Jethmalani, leading lawyer and former legislator, mentioned in his half-page advertisement in the Indian media in April 2015: “Whether it was the previous government or the present one, my battle — for the return of our national wealth illegally parked in foreign banks, estimated to be around $1500 billion or Rs90 lakh crore, back to our national coffers — continues unabated.” It was through these advertisements that Jethmalani bemoaned the government’s studied silence, and termed its various actions as an “unpardonable betrayal”.

Even if one were to discount the figure of $1.5 trillion, will the government will be able to rake in at least 50% of the lowest estimate of black money? Can it elicit disclosures worth $250 billion.

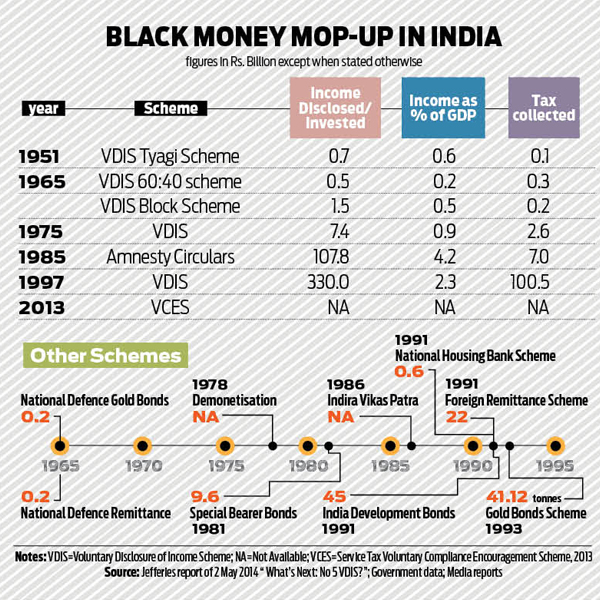

Most professionals dismiss such a possibility. They point to how the government — even with extremely attractive carrots dangled before tax dodgers — could never bring in more than $7 billion or Rs430 billion (see chart) at current exchange rates. A sum of $250 billion would translate to over Rs15.5 trillion. Already there is talk that the window for making disclosures will be extended to 31 December instead of 30 September. Many claim that in order to save face, the deadline could get further stretched to 31 March 2016.

Government officials, however, insist that the disclosures could well involve incredibly large amounts. India, they point out, is in a sweet spot, where — thanks to countries like US, Germany and France — global tolerance for tax havens is at its lowest. Almost all banks have agreed to make all transactions public by 2017.

If disclosures are not made now, say these sources, tax dodgers could lose everything. Under the global campaign against tax evasion, banks are now required to impound such sums post-2017. Indian tax evaders could then lose their money, and also face imprisonment.

But what about political will?

The government’s unwillingness to stop Participatory Notes (PNs) (http://dnai.in/bLIQ) is a good example. When, last fortnight, the Special Investigation Team (SIT), appointed by the apex court to look into black money, asked the Securities & Exchange Board of India (SEBI) to clamp down on PNs, the finance ministry promptly clarified that PNs could not be touched (lest they affect stock-market sentiment). This is despite everyone knowing that PNs remain one of the biggest conduits for hot money into and out of India. Nor has the finance ministry cared to announce a deadline by when PNs will finally get banned.

Critics point to how this ‘PN-play’ has continued to swell even after the new government assumed power. PNs accounted for Rs167,566 crore as of December 2013

(http://www.sebi.gov.in/cms/sebi_data/commondocs/ODI2013_h.html). By October 2014, the figure had ballooned to Rs265,675 crore. To be fair, it must also be admitted that PNs which used to account for more than 50% of total FII inflows have seen their share decline to almost half that level.

But this does raise disturbing questions about the government’s seriousness in curbing black money generation. Eventually, the acid test will lie in the amounts that the Black Money Act will eventually unearth. If the amounts are small, the new laws could trigger abuse of the wide ranging discretionary powers that have been given to tax authorities. That could even lead to much more corruption and further black money generation.

COMMENTS