R N Bhaskar

February 16, 2014

As expected, smuggling of gold into India has continued. While on paper the current account deficit (CAD) appears to have been addressed, the smuggling in of gold has ended up causing immense damage – it has further undermined the Indian rupee. It could hurt India’s security as well.

Both smuggling and legal imports use up foreign exchange. The only difference is that smuggling has to be paid for clandestinely. That puts a premium on the US dollar, which must be purchased illegally, thus eroding the value of the local currency faster than legal import could. Worse still, once smuggling routes get strengthened, they will be used to smuggle in arms or drugs as well. P.Chidambaram (PC) the finance minister – who was also home minister earlier — should have known that.

As a result, the biggest beneficiaries will now be politicians and other powerful people who want to convert their ill-gotten gains held in dollars into rupees just before elections. In fact, as this column has argued, what matters is not the CAD, but the manner in which fiscal policies are managed.

By the last week of January, PC himself was compelled to admit that gold smuggling had indeed continued unabated into India, reaching volumes of 3 tonnes a month. The acknowledgment was absurd, because World Gold Council (WGC) estimates put gold smuggling at 150-200 tonnes – but nearer the top of the range — during 2013. As a token of ‘remorse’ PC even reduced the import duty on gold by 2% from 10%. He also stated that the time had come to review gold import restrictions by March end. The timing would be most convenient for politicians, right?

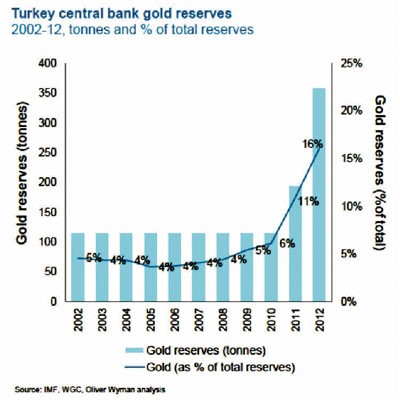

In fact, India could learn a lesson from what Turkey did when it was faced with a ballooning CAD, and with more people preferring to invest in gold than in the local currency (see charts). In 2011, that country’s central bank recognised gold as part of commercial banks’ required liquidity reserves. Banks, in turn, began introducing innovative gold-related products. People could now invest in gold – either as gold accounts, or as ETFs, which could be encashed either in currency or volume for volume.

The result? There was a growth in commercial banks’ deposits. There was sustained growth in commercial banks’ credit. ‘Under-the-mattress’ funds began flowing into the economy. It increased the rate of household savings in the financial sector. Sale of substandard gold declined. But more importantly, it gave a fillip to Turkey’s Anatolia region which had a history of gold fabrication for 5,000 years. Turkey had already set up the Istanbul Gold Exchange in 1995, and had allowed by 2002 the setting up of gold refineries close to key banks. The new reforms rode piggyback on the infrastructure that was already in place. This was in spite of Turkey having a CAD of some $77 billion – almost 10% of its GDP in 2011.

Now compare this with what India did.

First, it choked off supply of gold to a Rs 3,50,000 crore industry employing around 35 lakh people and with some 300,000 registered outlets in the country. The government actually forced it to seek out smuggled gold. There was no way a piece of legislation could take away the faith people have in gold, for traditional and economic reasons. The rupee was weakening, primarily on account of the government’s own policies.

Second, by ordering banks and non-banking financial companies (NBFCs) to stop loans against gold, even this small supply of gold was blocked. It was ironic that in a country where vehicles, houses, raw material, finished goods and almost every other asset could be mortgaged against loans, loans against gold was made illegal. It reminded one of Mohammed bin Tughlaq who bankrupted the treasury with his mad-hatter schemes.

The results are there for everyone to see. The Indian rupee keeps weakening. Its economy continues to falter. And the only ones who have lined their pockets at such times are smugglers and well-connected people who are now richer in rupee terms.

Click here to read the original article.

COMMENTS