Scrapping old vehicles: cash for clunkers

RN Bhaskar — 23 May 2016

Media reports this morning, quoting a PTI source, referred to Nitin Gadkari, Union minister for surface transport, commenting on the need for an old-vehicle-scrapping-policy.

In fact, it is quite possible that he had a SIAM (Society of Indian Automomovile Manufacturers) report in mind that also advocated such a policy. Firstpost, which has accesss to the SIAM report, finds it so illuminating and convincing, is surprised that the finance ministry has not jumped at it as yet.

But first, a word on what the scrapping policy means.

With the Supreme Court coming down hard on air pollution, and the banning of diesel vehicles (which is being contested), almost everyone is agreed that the biggest polluters are old vehicles that do not observe the strict vehicle emission norms. Had they done that, it is possible that the quality of the air we breathe would have been a lot better.

The government has two options. It can ban old vehicles. But that would create a wave of resentment among pensioners who would prefer to use their old vehicles as they would not like to be out of capital for purchasing a new vehicle. It would antagonize truck owners too, who do not like junking a vehicle if it can be used for a few more years. The other option is to allow them to ply on the roads and streets and belch out more fumes. Thus the government runs the risk of becoming unpopular with common folk who want air pollution to be curbed, or with vehicle owners who do not like their old vehicles banned.

What SIAM does is to offer a midway path that benefits customers, the government and the automobile industry and other ancillary industries too. And some of the numbers they have given to quantify the benefits that could be availed of are staggering. That is why, it is quite bizarre that the finance minister has not paid heed to these numbers.

The SIAM proposal

SIAM suggests that all vehicles that are over 15 years old should be given a chance to scrap them under an incentive scheme. The logic is simple. Since these old vehicles are being used, it is unlikely that the owners will purchase a new vehicle unless incentivised.

If a new vehicle is not sold, then the government does not get additional money through excise and other taxes that are slapped on each vehicle sale. Normally over 50% of the vehicle cost is accounted for by excise and taxes.

So if the owners are incentivised to scrap their old vehicles, then there are many beneficiaries. First, the owners get a deal. Second, the government gets more money. Third, automobile production (hence jobs and GDP) goes up. Fourth, the steel industry gets good quality scrap which would otherwise have to be imported. Fifth, as a result, foreign exchange is saved. Overall the entire economy gets a boost.

The other benefits are that the entire fleet of vehicles on the road becomes younger, with more modern cars plying up and down. Fuel consumption is saved (more foreign exchange saved) and the incidence of air pollution is checked. And the government displeases nobody, which is always a good thing to do politically and socially.

In fact, as the SIAM report points out, all over the world vehicle scrappage and fleet modernisation is regulated through an end of life policy, which is implemented through a robust Inspection and Certification (I&C) system. Notwithstanding a robust I&C system in countries like Europe, etc. even these countries, at times, had to resort to schemes like “Cash for Clunkers” for weeding out old and polluting vehicles and replacing them with new environment friendly ones. SIAM believes that “this scheme will have benefits of reducing pollution, reducing fuel consumption and improving safety (reducing fatalities from 1,40,000 people presently killed annually in road traffic crashes).”

For successful implementation, SIAM suggests the following:

1) Encouragement to the last owner to scrap the old vehicle

2) Provision of environment friendly scrapping of the vehicle by notified agencies eg: MSTC (the government controlled company for trading in metal scrap) in the presence of RTO officers.

3) RTO to de-register the vehicle and issue a Scrappage Certificate or Certificate of Destruction (CoD) to the registered owner.

4) Scrappage Certificate to be treated as a tradeable certificate for availing various incentives.

In order to initiate this scheme, the Road Transport Authorities should authorise nodal agencies eg: MSTC for setting up Scrap Yards across the country.

The plan and the process

SIAM recommends that the incentive should be a reduction in excise duty by 50%. This way the government gets 50% of the excise duty that it would not have earned otherwise (as owners would continue to use their old vehicles). Vehicle owners, lured by the 50% excise duty reduction would flock to new vehicle showrooms. Vehicle owners would also stand to benefit from a share of the scrap value of the vehicle itself.

Step-1: The vehicle owner visits the nearest vehicle dealer for purchasing a new vehicle, with all the necessary documents of the old vehicle. At the time of availing the scheme, it should be ensured that the vehicle has all valid documents, such as Registration Certificate, Road Tax receipt, Pollution Certificate, Insurance, etc.

Step-2: The customer hands over the old vehicle to the dealer who further sends it to the scrap yard for scrappage. The dealer will inform the customer that Certificate of Destruction (CoD) could be collected after a few days – may be a week – once the vehicle is completely scrapped.

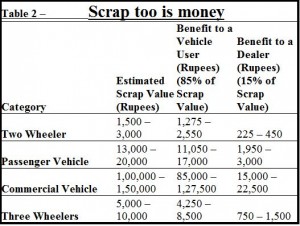

Step-3: The dealers are expected to send all the collected vehicles to the authorised scrap yards, eg: MSTC, etc. for scrapping of vehicles in an environmentally safe process under due supervision of the regional transport authority. The revenue generated by selling the old vehicle to the scrapyard, eg: MSTC, etc. will be distributed among the two parties in the ratio of – dealer (15%) and customer (85%).

Step-4: The dealer of the vehicle under endorsement of Regional Transport Authority issues a valid Certificate of Destruction (CoD) and de-register the scrapped vehicle.

Step-5: Once the customer receives the CoD, he or she is entitled to the incentives against purchase of a new vehicle, of the same category. This CoD would be tradeable within the State/Union Territory where the scrappage took place. The customer could also buy a vehicle of a higher category; however, the total incentive applicable would be limited to the category of the scrapped vehicle.

Step-6: The vehicle dealer receives a copy of the CoD. The dealer could be authorised to give any new customer a new vehicle, of the same category registered in that State, with the agreed discount/incentive.

Step-7: A certificate from the dealer confirming sale of the vehicle against a scrapped vehicle, along with the copy of the CoD, to be submitted to the vehicle manufacturer of the new vehicle, by the dealer, and the dealer will sell the new vehicle at a revised price.

Step-8: The manufacturer will adjust his book of accounts for payment of excise duty to the Central Government by paying 50% of the duty for new vehicles sold through this scheme.

Step-9: The manufacturer will suitably pass on the benefit to the dealer for new vehicle sold at the revised price.

Revenue potential

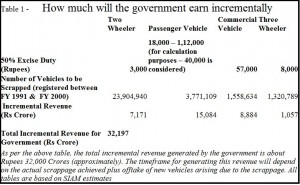

Such a scheme would allow the government to earn the following incremental sums (Vehicles registered from 1st April 1990 to 31st March 2000 have been considered for calculation purposes. Total number of vehicles registered in the country during this period is 30.55 million).

As per the above table, the total incremental revenue generated by the government is about Rs 32,000 crore (approximately). The timeframe for generating this revenue will depend on the actual scrappage achieved plus offtake of new vehicles arising due to the scrappage.

Monetary benefits to a vehicle user

In order to facilitate replacement of vehicles through scrapping, the government is requested to offer an incentive to customers for replacing their old vehicles by new ones.

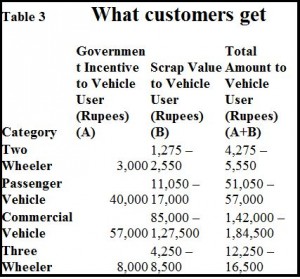

Government of India will offer an incentive amount equal to 50% of the excise duty for the category of the old scrapped vehicle, as per the existing Excise Duty rates.

Incentive amount, for different categories of vehicles, is discussed in the Table-3.

A vehicle user who is willing to replace his/her old vehicle, through the scrappage route, by a new one would be entitled to TWO different monetary benefits:

85% of the total scrap Value of the Old Vehicle – This value will be determined by the scrap yard based on the scrap content in a vehicle and / or on the existing condition of a vehicle. Estimated Scrap Value is given in the Table-2.

Totally an amount depending on the category of the old vehicle will be accrued to a vehicle user, if he/she opts for buying a new vehicle in lieu of the scrapped vehicle.

Table-3 gives the total amount to a Vehicle User based on the estimation done in the Table-2.

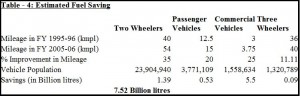

At current average price of petrol and diesel in Delhi of Rs 55 per litre, the saving of 7.52 billion litres would correspond to a saving of Rs 41,335 crore.

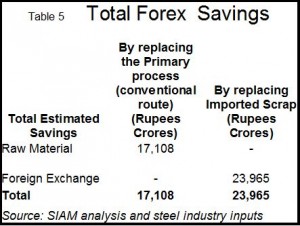

Estimated savings in foreign exchange

Foreign exchange: India imports around 5~6 million tonnes of ferrous shredded scrap per annum due to shortage of quality steel scrap generated in the country. The import price of ferrous scrap is $289 per ton and 12.5% CVD, which is equivalent to import price of Rs 20,522 per ton.

Total savings of foreign exchange, in case 12.85 million tonnes automobile scrap is generated domestically, would be $3,797 million or Rs 23,965 crore (import of 12.85 million tonnes of automobile scrap would not be required due to scrapping of vehicles in the country). Time frame for this savings is not specified.

Table – 5: Total estimated savings from recycling automobile scrap

Since automobile scrap will be used for steel production through the secondary process, hence, in the below table we have specified several savings arising out of replacing primary process and replacing imported scrap

Total estimated savings arising from scrapping of vehicles and utilising automobile scrap for producing crude steel would be in a range of Rs 17,108 crores to Rs 23,965 crores for the country.

So why has the finance ministry not woken up?

COMMENTS