https://www.freepressjournal.in/india/the-taxman-can-be-a-snoop-and-extortionist-too

Curb snooping and draconian powers of the taxman

RN Bhaskar – 27 June, 2019

Last fortnight, the government — in a move aimed at stanching corruption in the income tax department — dismissed from service 12 senior income tax officers (https://www.freepressjournal.in/topnews/govt-dismisses-12-senior-i-t-officers-for-corruption-misconduct). Within ten days the government also sent into compulsory retirement another 15 officers of the revenue department.

It was one of the biggest purges in recent times.

It was one of the biggest purges in recent times.

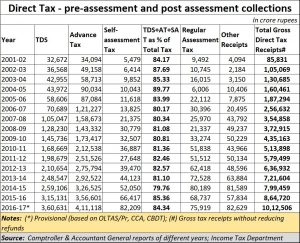

But businessmen are far from being pleased. They are happy with the government’s move to curb corruption. But they are sore about the draconian powers given to revenue authorities. Among them is the power to arrest people for non-payment of GST (Goods and Services Tax) without any recourse to adjudication processes, to promote laws that create financial inequity between common people and the government and to tap telephones, thus invading privacy on the one hand, and allowing access to private and personal information which could be used to potentially blackmail victims. The irony is that the draconian and unfair rules have not boosted tax collections much. Almost 80% of the tax income comes from pre-assessment collections (see table). The draconian laws contribute to just around 10% of the collections. The remaining 10% form part of miscellaneous receipts which also includes penalties.

Is it worth muddying the wheels of commerce for this illusory 10% mobilisation? Even this 10% is illusory because much of it eventually goes back in the form of refunds (the total tax collections in the table do not include refund amounts).

Take GST first. The failure to create a core set of laws and a central appellate authority has resulted in state tax offers coming up with their own interpretations (https://www.freepressjournal.in/interviews/one-nation-one-tax-tangled-in-complexity). The refusal of the government even to allow people to file revised returns is patently unconstitutional. And the multiplicity of interpretations of rules have abetted the proliferation of confusion and increase in corruption. Many such interpretations are now being challenged in the courts. The legal quagmire has allowed many GST officers to find excuses to extort money for settling cases. They fly in the face of the concept of one-nation-one-tax.

Take fiscal inequity next. As Chandan Parmar, chartered accountant, points out, “When an assessee fails to pay to the government in time, he is slapped with an interest penalty of 12%. But when the government fails to refund the assessee’s money in time, the government pays only 6%. The absurd requirement that an assessee pays up 20% of the disputed amount till the first appeal is decided is also patently unfair.”

All that an official has to do is to disallow expenses and compel an assessee to pay up 20% of a huge amount before decision of the appeal. It is a recipe for corruption or bankruptcy. It defies the axiom that the right to appeal is a constitutional birth-right. It goes against the very grain of fairness and equity. So if an assessee does not kowtow to the whimsical demands of a corrupt officer, he could be thrown into a financial crisis which requires him to cough up 20% of the disputed amount which could be beyond is consolidated income sources.

As a result many assesses agree not to dispute many additions made by tax officials to their income assessment, if the amounts are small, and if the inconvenience caused by litigation or needless harassment is perceived to be very great.

Take the third aberration. Tapping of phones by security agencies for ensuring national security is one thing. Permitting such powers to income tax officials is quite another. It is not necessary. The collections arising out of phone taps are minuscule or even non-existent. Such power allows officials to quietly slip across the lines that divide finance and personal habits and practices which should not be of any concern to revenue officials.

The list of vexatious rules can the long. Consequently, lawyers and accountants rightly believe that if corruption has to be stopped in the Income Tax Department, it must begin with the removal of draconian powers on the one hand, and the removal of laws that permit the authorities demand 20% of the disputed amount upfront.

What is the most galling is that as of today there is no provision to check accountability of (or to even penalise) an officer who makes high-pitched assessments. Many of these huge additions are invariably deleted by appellate courts. Some of these additions are believed to have been made by officers whom assessees could not satisfy, and some out of incompetence. Either way, penalties and accountability are definitely required here.

The government has taken the first step in weeding out corrupt officials. It must now remove the factors that encourage honest officials to become corrupt.

COMMENTS