https://www.freepressjournal.in/interviews/how-to-bounce-back-post-coronavirus

Using Coronavirus as an opportunity for doing other things

March 21, 2020

Everybody’s been talking about Coronavirus and its impact on lives and economies.

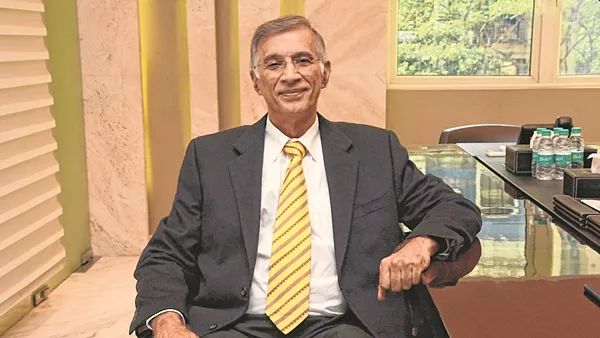

While India fights the virus, it also needs to strategise on life after the outbreak is over. In a conversation with Free Press Journal’s Jescilia Karayamparambil and R N Bhaskar,

Niranjan Hiranandani, President ASSOCHAM and NAREDCO, talks about the way forward for the country.

Edited Excerpts:

The Coronavirus has hurt the world in terms of commerce and lives as well. What do you think the impact of Covid 19 would be on India?

There is a World Bank report which talks about the total impact of Coronavirus on world economies. As far as India is concerned, it should be in the region of 0.4 per cent of GDP.

Now, I don’t know how these estimates are calculated, but I do not want to disagree with that estimate. At present, I would rather stick to these figures.

More than anything, it is all about the way the crisis is handled. There will always be upturns and downturns in the economy— the question is how to take advantage of the downturn.

For instance, China became a manufacturing country, when the entire world was not interested in the manufacturing sector. So, I feel that a downturn should be viewed as a hidden opportunity for India.

In the last couple of years, we have not picked up these opportunities, but I think we must understand that there is an equal economic opportunity there.

Take education, for instance, lakhs of students studying in countries like the US, Italy, Germany, France, the United Kingdom, Australia, etc are petrified. This is an opportunity for India, only if we ramped up the education system in India. This is a chance to have more overseas students in India instead of Indian students going overseas.

In the case of textiles, the sector in China has been facing challenges. While countries like Vietnam, Bangladesh, Sri Lanka and even Pakistan have taken advantage of the opportunity, India has missed it.

Yet another sector is tourism where India can prosper if it acts faster. If we can eliminate this (Coronavirus) issue quickly, the tourists will favour and flock into India. While India is fighting Coronavirus, it should also look at new possibilities.

I agree that opportunities are plenty and it is about how you grab and execute them. Grabbing opportunity is an ambition, a desire and a want; but rolling out the plan is a different ballgame.

China had been badly affected by Coronavirus. But now it is back on its feet. Which are the new areas China should look at?

The biggest advantage China enjoys is that it is an autocracy, whereas India is a democracy. So in their case getting back to shape and planning a direction is going to be much easier than for India. For China, the process of recovery will be much faster and stronger.

They know how to make corrections and bring the economy back. China will spring back faster. I strongly believe that India needs to do the same. We cannot afford to continue doing what we have been doing.

We need to close down offices, call for social distancing and do whatever it takes to fight Covid 19. We need to have a stronger mandate.

Like the World Bank, I would also say, test, test, test… And the announcement asking the private sector to test is a very good move. I think the private sector will take up all these responsibilities seriously.

The usage of IT should not be limited to the present crisis, but be used for perpetuity. For instance: Can we make education more IT-enabled or can healthcare be remotely monitored? So that commuting can be mitigated or minimised to an extent.

All these should be a kind of a byproduct of a situation that has been created. In the case of the Hiranandani Group, we have increased our communication with our staff and client; we are making sales pitches through video conferencing.

This was never done before as no one was comfortable. But today the situation is different. The younger generation is very happy about using technology as they are very comfortable with it.

SMEs are already suffering. What would be the pain points of SMEs if there is a lockdown situation?

SMEs have been badly affected. Out of the 4,50,000 SME members, around 2 lakh are grievously stressed. Their businesses are down between 20 and 70 per cent. And this is something we (at Assocham) are very worried about.

We are looking at the credit opportunities through the amendment of the policies of the Reserve Bank of India. We are deliberating on ways to help these SMEs by suggesting relief in terms of Goods and Services Tax (GST), income tax relief, payment relief in terms of taxation by postponing, etc.

There has been a case where a public sector company delayed payment of dues to an SME for over two months. Due to the invoice raised, the GST authorities came to the office of this SME to attach their office because the GST payment was due.

While the public sector is let off for non-payment, the SME ends up suffering. So, I think these types of things should not happen, and it is inhumane.

How do you persuade the government to be more proactive in making such payments to businesses, rather than expecting business to make payments to the government?

The problem has been flagged off with the Reserve Bank, government bodies, finance minister and other authorities. The authorities have taken cognisance to this.

It has been informed to us that they will push a mandate to the public sector to make payments within 30 days. It is not happening on the ground, but at least a directive has been issued, and we are looking forward to its implementation.

Now, the problem is gone beyond one’s control. The crisis has now crossed all the barriers. It has come to a stage where we need to give them a one-time rollover for all debts owed to the banks. Or we do not consider the non-payment of loans as NPAs (non-performing-assets) for six months.

There will be a point where 80 per cent of the people and enterprises will end up with the NCLT or get reported as NPAs in this country. If we do not address this issue quickly, there will be huge job losses. SMEs are large employment generators in the country.

India is talking about quantitative easing again. But would that create adverse repercussions?

At this point, deficit financing has to be considered. And we need push more money into the marketplace. This needs to be done very quickly. We think that the GST for the next six months should be withdrawn and that should be done by deficit financing completely.

Central Banks around the world have cut rates understanding the impact of Covid 19 on the economy. What is your view on the delay in cutting rates by the RBI?

We need a rate cut. We need the repo rate to be zero. Banks are putting too much money in the Reserve Bank of India and that needs to stop. Banks are giving credit to the Reserve Bank of India, but that is not the intent of the banking system.

Banks have kept Rs 3.5 lakh crore in the system and are not giving it to the common man. It sounds like the British times, when there was food in the granary, but not given to the people.

I think if the banking system doesn’t trust its people, but they are willing to trust foreigners and other people, it is time we need to rethink how the system is working.

COMMENTS