MARKET PERSPECTIVE

By J Mulraj

Dec 19-25, 2021

The imperatives for USA and China to work together

China is an enigma. It has had remarkable economic achievements (lifted millions of its citizens out of poverty). It now has 5 times India’s per capita GDP, which were equal in 1992) and technological achievements (it is a leader in several technologies for the 4th Industrial Revolutions, including AI, robotics, facial recognition, etc.).

Yet, it has its own sets of problems, which lead commentators like Cathie Woods, founder and CEO of Ark Invest, to opine that China, today, is similar to Japan in 1989. In 1989 people expected Japan to be an economic superpower. The value of the land in the Emperor’s estate was worth more than all the land in California!

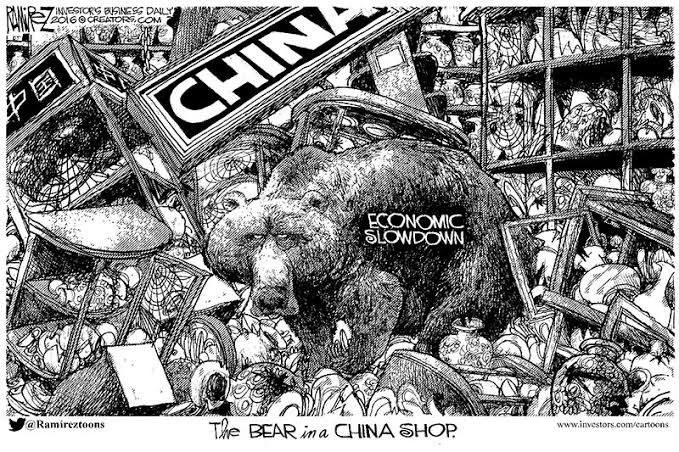

So is there a bear in the China shop?

In China today, investing in real estate is the predominant form of household savings. Bank deposits, equity, bonds, etc. form a small component of saving. The real estate sector constitutes 29% of China’s GDP. Importantly, it provides millions of jobs, and demand for cement and steel, in both of which China has built up excess capacities. As exemplified by over indebtedness problems at real estate firms like Evergrande, Fentasia and Modern Land, China Properties and others. Evergrande has been declared by rating agency Fitch to be in default, and is facing lawsuits from suppliers in China.

Property sale in China has already started declining. This would have a negative impact on sale of inputs like cement and steel, which, in turn, is negatively impacting sale of their inputs, limestone and iron ore. China accounts for 15% of global trade, so a drop in imports of these raw materials would have a global impact.

Then look at international investment. A Risk Management Committee has been appointed for Evergrande, and the city of Chengdu has siezed control of two plots of Evergrande’s land without compensation. Of the $ 305 b. debt of the company, roughly $ 19 b. is owed to foreign lenders, the balance is borrowed domestically. The aim of the Chinese Government seems to be to first take over and complete construction projects, handing over incomplete apartments to buyers who have partly paid for them, then to salvage as much as possible for domestic banks. Foreign lenders have little hope of recovery.

China has also clamped down on e-commerce and edtech firms, causing sharp falls in their value, something that has also irked investors who dislike policies by whim.

All this would further hit foreign investment in Chinese instruments. USA is seeking to get Chinese companies delisted from US exchanges. The Governor of Florida is trying to get the State pension fund, FRS Pension plan, one of the largest, to divest its investments in China.

Yet China has some remarkable achievements. It has undertaken a massive project to stop desertification of the northern deserts like Gobi, and, in the past ten years, a whopping 13 m. hectares of land have been planted. Each citizen above the age of 11, is required to plant 3 trees a year, and is compensated for it, providing livelihood.

So China remains an enigma.

However, its views and opinions have to be factored in, in several areas. It remains a manufacturing hub, with a dominant position in several fields, such as cement, steel, rare earths, API (active pharmaceutical ingredients) and other sectors. It’s co operation is sought in various areas like weapons control (including nuclear), technology standards, space, and climate change.

Most worrying is the arms race. Weapons are now becoming autonomous, and the fear is that they could, in future, start or escalate conflicts, with disastrous results.This excellent article in the Wired outlines the dangers of autonomous weapons. At a recent conference of 120 countries, they wee unable to agree to a joint effort to stop their development.

Meanwhile, the US, too, is having its own set of issues. The US polity is sharply divided and it looks increasingly likely that the Democrats will lose one, possibly both, houses in coming elections to the Congress and Senate. Hence, important policy matters may not get the needed bipartisan support.

The US Fed has accelerated the taper of its bond buying programme, after which it plans to start hiking interest rates. Such a hike would make the debt markets relatively more attractive to equity markets, and cause a shift towards the former.

Equity markets are at a high, in almost all countries. The S&P 500 hit a new high last week, and DJIA and Nasdaq are close to their highs. But a hike in Fed rates, long overdue, would cause a correction. Perhaps a needed one.

The reason for the S&P 500 hitting a new high was because of the announcement that omicron, though more transmissive, was less virulent. It would not strain the medical infrastructure (let’s pray it doesn’t mutate again) and perhaps may not be as disruptive of normal life, whatever that means now.

There is also a plan to provide vaccines to the developing countries, so that by mid 2022 around 70% of the world population would have been vaxxed. Policy makers have finally realised that, just as there can’t be a ‘no pee zone’ in a swimming pool, it is impossible to have some countries fully vaccinated and others not.

Last week the BSE sensex fell 1662 points to 57124. Looking to the accelerated taper by US fed, and the possibility of a rate hike in Q1 of 2022, the liquidity driven rally can be punctured. Add to that geopolitical tensions, and caution is advocated.

The biggest risk for investors are bad decisions made by policy makers, in an increasingly fragile world. In flashpoints like Ukraine, or Taiwan, or Middle East, an error of judgement can lead to disastrous consequences. More so in a world of dangerous weapons of mass destruction (nuclear) or even autonomous weapons.

As R. Scott Bakker said, ““A beggar’s mistake harms no one but the beggar. A king’s mistake, however, harms everyone but the king. Too often, the measure of power lies not in the number who obey your will, but in the number who suffer your stupidity.”

The kings, at the moment, do not inspire confidence in their wisdom.

Picture Source: https://www.timesfreepress.com/cartoons/2016/jan/12/bear-china-shop/2359/

COMMENTS