INVESTMENT PERSPECTIVE

By J Mulraj

Mar 20-26, 2022

WYDSIWYG – What you don’t see is what you get!

By: J Mulraj

We ought to draw up a balance sheet for the Ukraine war.

Before the Russian invasion, Putin was seeking a discussion with Biden and NATO to address his concerns over Ukraine joining NATO. They did not discuss things with him, but stressed the need for each nation to have the freedom to choose their alliances. So on the asset side of the balance sheet, the principle of freedom of choice appears.

Biden and NATO to address his concerns over Ukraine joining NATO. They did not discuss things with him, but stressed the need for each nation to have the freedom to choose their alliances. So on the asset side of the balance sheet, the principle of freedom of choice appears.

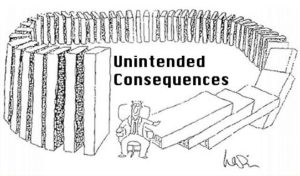

But, unless USA and NATO are willing and able to fight to uphold the principles, there would be, and are, unintended consequences of their (in)actions. As in the cartoon above, their action comes, like a boomerang, back to hit them.

USA/NATO relied on severe sanctions to financially cripple Russia and, initially, they appeared to be working. The Russian ruble dropped 30%, the foreign exchange assets of the Russian central bank were frozen, large oil exploration companies like Exxon, and service companies like Halliburton and Schlumberger, left Russia, taking with them essential skills to extract oil from, and preserve oil infrastructure in, Siberian fields in a permafrost region. It is unwise to shut down such fields because the time taken to restart them after checking for frost, extends to years. Buyers of Russian oil/gas made payments, as per contract, in $ or in Euro, but the amounts were frozen by sanctions. So it looked as though the financial arm twisting was working.

It was Aldous Huxley who advised people to ‘Dream in a Pragmatic Way’. The US/NATO did not, either out of hubris or myopia. They now face the prospect of unintended consequences for this failure.

So, denied an audience for its security concerns, Russia invaded Ukraine. On the liabilities side is hundreds of dead/wounded/stranded in places like Mariupol without drinking water, food or medical aid, and over 3 million Ukrainians migrating to neighbouring countries. It was a human disaster of unimaginable proportions, one that was totally avoidable. All this goes to the liability side of the war Balance Sheet. But yes, the principle of freedom of choice was upheld! US was unwilling, and NATO unable, to fight, but vowed to carry on fighting till the last Ukranian! Their dream that Russia would be dissuaded from a military offensive because of sanctions alone, was dreaming in an unpragmatic way.

There are worse consequences, though, also unintended.

The sanctions were applied pragmatically, excluding imports (like oil/gas, especially to Germany) and exports (luxury goods from Italy) that Europe needed. So, even as Europe imported more oil/gas from Russia than they did before the war, the West was castigating countries like India for considering a Russian offer to buy oil at discounted prices, in Indian Rupees. US/Europe do not, apparently, consider sauce for the goose as equal to sauce for the gander.

Putin just made a move in this geopolitical chess game. He declared that oil/gas would be sold to ‘unfriendly countries’ in Ruble, which would be convertible into gold at the rate of 5000 Ruble per ounce. This serves to create a demand for Ruble, as Europe is dependent on Russian oil/gas to heat their homes and power their factories. The unintended consequence is that the Ruble has recovered its value, which had dropped after sanctions were announced, and is back to pre-war levels.

Another unintended consequence is that this becomes yet another nail in the de-dollarisation coffin. Prior to this was the decision by Saudi Arabia, agreeing to price its oil in Chinese yuan instead of US $. In the 70s, USA and the Saud royal family, came to an agreement that created the petrodollar. In return for America protecting the family, the Kingdom of Saudi Arabia would price its oil in US $. This created a demand for the US $, which, essentially, gave America the ability to spend beyond its means and grow its economy to become the largest in the world.

That switch, now, from US $ to the yuan, is a huge step towards the de-dollarisation of the world. Sure, it will take a lot more effort to displace the US $ as the leading currency. The Chinese yuan does not have the trust, yet, and it is under capital controls, which impedes its acceptance. So the components of the de-dollarisation so far are the Saudi led petro-yuan, the sale of Russian oil/gas in Ruble pegged to gold, the alternative Sino-Russian bank messaging system to SWIFT (which is used to impose sanctions), and a MIR-UnionPay card as an alternative to VISA. Unintended consequences.

The war has highlighted the need for co-operation and Russia’s bargaining power emanates from the time lag required to transit global economies to a fossil fuel stage. Germany is especially vulnerable. It decided to shut down its nuclear plants; had these been running, its dependency on Russian oil/gas to meet its energy needs would be reduced. The establishment of renewable energy capacity to replace Russian oil/gas will take years. So Putin is playing a time arbitrage.

As a result, though, Germany is hugely dependent on Russian supply of oil/gas. The CEO of the world’s largest chemical producer, BASF, has warned that cutting off of Russian gas/oil imports would imperil the existence of small and middle sized German companies. It would lead to the biggest ever crisis in Germany post WWII. Could not this unintended consequence have been foreseen by Biden and NATO leaders?

Perhaps more alarming is the coming food crisis, and, likely, famine, that will hit the world. Russia and Ukraine supply some 40% of the world’s wheat, and Mid East/African countries are big buyers. This wheat is unable to be lifted from the Black Sea war zone. Ships lose insurance cover upon entering a war zone. Worse yet, the planting season has begun in Ukraine, and not possible when there is a war going on. So the 2022 crop will be hit. Moreover there is a huge shortage of potash and nitrogenous fertilisers, whose prices have shot up. Higher prices have led to farmers in other countries slowing down on planting. All this can cause a famine in 2022 which, in turn, would lead to civic unrest, as it did during the Arab Springs riots, which were also triggered by a shortage of wheat.

High oil prices, a potential collapse of German manufacturing, a global famine, are all unintended consequences, which go to the liability side of the Ukraine war balance sheet. But yes, the principle of allowing countries to choose their alliances is standing on the assets side.

China’s PMI for manufacture and services are under 50, showing a negative view. Goldman Sachs expects India’s FPI inflow to fall drastically. US employment grew by a healthy 431,000 last month, which strengthens the case for the next Fed hike to be a more aggressive 50 basis points, rather than 25.

But yet, stockmarkets continue to rally, in the absence of better alternatives. The BSE sensex close at 59276, up 1914 points over the week.

It would be prudent to lighten a bit. As the world has discovered, what you don’t see is what you get!

Picture Source: https://interactioninstitute.org/unintended-consequences/

COMMENTS