When buying goods, look for CGST credit facility

RN Bhaskar

Update 2 – 1 March 2023: Croma is working towards being more customer friendly. It is now working on ways to ensure that outstation customers also get CGST credits. That’s the way to go! Responsive to customers. Heeding their complaints.

Update 1:

On 28 February, I received six calls from Croma. Some asked me to explain the nature of the complaint, when the complaint has already been given on this page and in writing.

Another person said he could not allow CGST credit when a purchase is made from another state. I asked him to give his statement in writing, which he refused to do (Tel No+91-22-6921-7200). I had to disconnect his calls because he did not want to give anything in writing.

If laws prevent Croma from giving this benefit to customers, it should give such a statement in writing. It is strange that they are unwilling to do this.

The original grievance is given below:

Croma is a respected name, belonging to the Tata Group. Croma proudly declares itself as a member of this group.

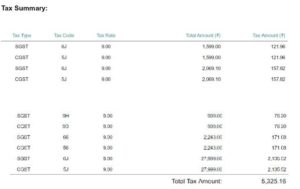

That is why, when I was travelling through Bangalore for a few days, I opted to make my purchases for a tablet and accessories — there. I am regretting that decision now. I wish I had placed the order on Amazon or Flipkart. I would not have to suffer a loss of Rs.2664.58. The full invoice can be downloaded from here.

That is why, when I was travelling through Bangalore for a few days, I opted to make my purchases for a tablet and accessories — there. I am regretting that decision now. I wish I had placed the order on Amazon or Flipkart. I would not have to suffer a loss of Rs.2664.58. The full invoice can be downloaded from here.

Let me explain. The total bill came to Rs.32,909.10. When I had paid the amount – by credit card – I discovered that the Croma staff had not asked me for my GST details. I gave it to them, but they refused to enter the GST details. They said that my GST number was from Mumbai Maharashtra, and that they were only registering GST for Bengaluru, Karnataka.

I protested, stating that I was not interested in the state GST, but that I should get credit for CGST (central GST). They told me that they were not compliant with IGST.

I was furious. So when I returned to Mumbai, I lodged a complaint with Croma.

I was furious. So when I returned to Mumbai, I lodged a complaint with Croma.

The company confirmed my complaint and then called me up. I explained my problem to the held desk executive. An hour later, she rang me up, and told me that the staff in Bengaluru had already explained that it was unable to register a Maharashtra GST number. I told her that in that case, the central accounts team should do so, and give me credit for the GST.

She said that this could not be done, and asked me if I had any other complaint. I reiterated my need to get credit for GST. She refused to help me out, and disconnected.

The same afternoon I got an email from Croma telling me that my case had been “resolved”. Wrong. It had been closed, not resolved. Someone in Croma should be told that there is a difference between ‘closed’ and ‘resolved’. I still believe that I was wronged.

And then I realised, that I had been a fool. I should have ordered my goods from Amazon or Flipkart. They give you GST credit irrespective of the place from where you purchase the goods. And the process is hassle free.

I also realised that places like Croma may be excellent in terms of perception, but terrible when it comes to protect customer interests. Their own software rules matter, not the losses to customers.

I also realised that places like Croma may be excellent in terms of perception, but terrible when it comes to protect customer interests. Their own software rules matter, not the losses to customers.

The least that Croma should be doing is to put up a well-positioned board which states that the store cannot give GST credit to customers coming from outside the state in which its outlet is located.

COMMENTS