MARKET PERSPECTIVE

By J Mulraj

JUL 1-7, 2023

It can, but we must correct some weaknesses

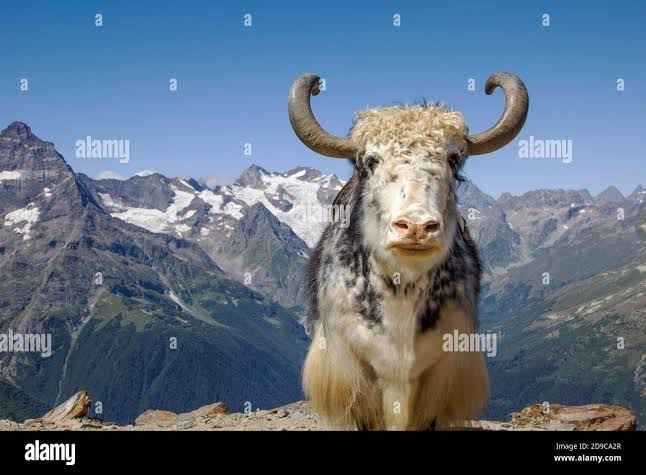

The stock market bull has, with enough fodder provided by domestic as well as foreign investors, climbed a new peak. In the above selfie, taken by it at the recent peak of 65898, the bull appears strong enough to climb a higher one, visible in the background.

Domestic investors have invested over ₹ 14,000 crores a month, in mutual funds via Systematic Investment Plans (SIPs). By year end this is expected to grow to between ₹ 17-18000 crores every month. By mandate, around 85% of this must be invested in equity; in practice funds have under 5% in cash. In addition FIIs, foreign institutional investors, have invested $ 10b. (₹ 82,600 crores) in Indian stock markets since April 1. No jokes!

So, combined, about ₹ 40,000 crores a month has gone into buying Indian stocks, fodder for the Indian bull. And, as SIP inflow is, by definition, a committed monthly inflow, it will not only continue, but increase. FIIs, disenchanted with China, are diverting more of their emerging market investment to India. A new Chinese Espionage Act, coming into force from Saturday July 8, makes it dangerous for foreigners to operate in China. The Act does not properly define what constitutes espionage. A simple question ‘is your business growing?’ may be construed as espionage, leading to a jail term.

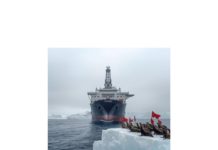

The FII inflows should grow. The total pool of global capital invested in financial assets is around $ 250 trillion, so the FII investment thus far is a drop. India has completed a survey for oil and gas near Andaman and Nicobar islands and the basin has 70 MMTOE (million metric tonnes of oil equivalent) to be exploited. This would help reduce our current account deficit. That would strengthen the ₹ and so boost the $ returns for FIIs.

If the Government wants to keep holding out the promise of India as a good investment destination, it will need to reform the moribund judicial system. There are 50 million pending cases in India, the highest in the world! That is utterly shameful. Of these 85% are in district courts. Justice in higher courts is reserved for those who can afford the cost of expensive lawyers and have the clout to get their cases heard instantly. Given 50 m cases, that’s a Herculean task. The Government itself is a party to half these 50 m cases, and can easily reduce the burden by settling them. It HAS to, to be considered a developed economy.

For this, our polity should be mature. Judging by the lack of scruples in switching alliances, for the benefit of power and lucre, it is not. This political discord affects development. China, a one party system, has the world’s largest high speed rail network of 42,000 kms. India started work on the Mumbai-Ahmedabad high speed train in 2017 which is expected to be completed by 2028. Political differences result in stalling projects.

After hitting an all time high of 65898, the BSE Sensex closed the week at 65280, for a weekly gain of 562 points.

What are the things to watch out for? On July 10 NATO and EU leaders are meeting at Vilnius, Lithuania, to discuss the Ukraine war. Some nations like Poland and Lithuania are willing to put boots on the ground. That would be an unnecessary and foolish escalation. One can only pray that there is a modicum of common sense left in their heads. A decision that a few countries would enter the war in Ukraine would be a bearish signal.

The next thing to watch out for is the Jul 19 deadline to extend the grain deal which allowed, under UN auspices, Ukrainian and Russian grain to be evacuated from the Black Sea. If the deal is not extended, the shortage, and resultant high prices, of grain would lead first to civic unrest and then to famine and millions of deaths. Is the toxic desire to teach Russia a lesson so strong in the collective West as to be impervious of the inhuman damage they would inflict upon the poor in Africa? Has their collective conscience taken leave of their bodies, following the departure of their minds, in allowing this senseless war to happen?

After these two hurdles we come to July 25/26, when the Fed will decide on interest rates. A rate hike of 25 basis points is likely, and has been hinted by J. Powell. Roger Altman, head of financial advisory firm Evercore, has warned that a recession can begin in the last quarter of ‘23 and will be worse than J. Powell estimates. The next banking crisis will be triggered by a collapse in commercial real estate, the sector to which regional community banks are most exposed. Many are expected to default. Even storied firms like Goldman Sachs are laying off workers (Goldman is expected to sack 250 employees). This, plus closure of several well known retail stores, has reduced the demand for commercial real estate. So the #1 economy in the world is not expected to be an engine of growth.

Neither is China, the #2 economy. There is so much malinvestment in China. It’s leaders freely lent money for infrastructure assets, encouraging building of apartment and commercial buildings, now vacant. In Tianjin the Goldin Finance 117 was to be the fifth tallest building in the world, at 597 metres. It has become the world’s tallest unused building. Owners of apartments which are unfinished, without water or electric connections, are using them to store urns, containing ashes! The exit of foreign companies has created high youth unemployment (estimates range from 20-50%) and potential unrest. It is unlikely to be an engine for growth.

Neither will the next three, #3, Japan (an aging society with more demand for adult, rather than baby, diapers), or #4, Germany (already in recession after foolishly agreeing to war with its supplier of cheap energy, without which its industry is uncompetitive) or #5 UK, with high inflation and entering recession. None will be growth engines.

It is only when we reach #6, India, that there is a ray of hope. Which explains the stock market peak, and the FII enthusiasm.

The ones fighting the Indian bull are the politicians, who are either stupidly bad mouthing the country on foreign soil (the words of Sir Walter Scott’s poem, Patriotism, come to mind – breathes there a man with soul so dead, who ne’er to himself hath said, this is my own, my native land..), or are defying the electoral mandate and, for the love of lucre and power, joining other parties. This is an abomination of democracy as it is neither for the people nor by the people nor yet of the people. Plus, of course, the denial of justice thanks to judicial delays caused by 50 m. pending cases. This is also an abomination of democracy.

Given all this, will the Indian bull climb higher?

Look at the image again. To reach the higher peak, the bull would need to first descend.

And then hope that the path to the next peak has been cleared of the detritus of political myopia, bureaucratic pettiness and judicial insouciance.

Picture Source: https://www.alamy.com/stock-photo/bull-mountain.html?sortBy=relevant

Comments may be sent to: jmulraj@asiaconverge.com

COMMENTS