MARKET PERSPECTIVE

By J Mulraj

Jan 13-19, 2024

And the consequences it’s now facing

By: J Mulraj

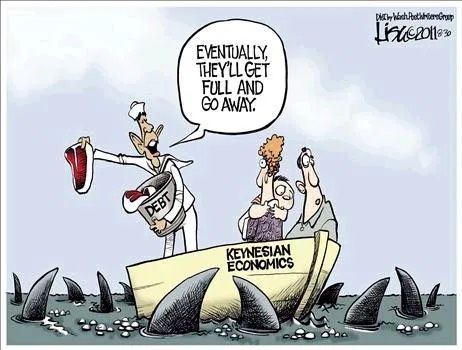

Globally, debt markets are bigger than equity markets, proving the ability for Governments, corporates and municipalities to raise huge sums of money by issuing bonds. Unconstrained by the absence of a gold standard, Governments have overused this by borrowing more than they should, in order to spend, again, more than they should, on their pet projects.

This is called mal-investment, or building assets that do not provide enough economic value, to justify their cost. They ultimately become white elephants, but after decades.

Long after those who decided to build them are gone; hence remaining unaccountable.

China’s economic reforms started in 1978, unleashing its entrepreneurial spirit. It led to one of the largest rural to urban migrations in human history, in search of jobs. The level of urbanization grew from 18% in 1978 to 58% in 2017. This led to demand for urban housing. Owning a house was a precondition of a prospective bride!

Realty companies expanded at a furious pace, initially in major cities and manufacturing hubs, then spreading to smaller towns near. The early migrants did well, like early entrants to a Ponzi scheme, seeing the value of their apartments rise sharply. This appreciation caused a buying frenzy, fueled by debt, with buyers buying multiple properties with the am of flipping. Today, a whopping 70% of China’s household wealth is invested in housing.

Local (provincial) Governments in China were delighted, and so encouraged, the realty boom. The main source of revenue for them was the auctioning of land parcels to developers. Local Governments floated LGFVs (Local Government Financing Vehicles) and raised enormous debt, now $ 11 trillion, to build infrastructure.

Construction requires steel and cement. China built the world’s largest manufacturing capacities in both. In 2022 China produced over 1 billion tonnes of crude steel, 53% of global production.

Today the steel industry is in trouble, following the crash of the real estate industry. See this video with 70% of steel processing units running at a loss and leading to loss of thousands of jobs.

China built up the largest cement manufacturing capacity in the world, at 1.6 billion tonnes per year, (compared to 450 m tpa in India). Cement production is environmentally harmful and China’s production of cement led to carbon emissions of 852 m tonnes, twice the total fossil emissions of South Africa.

Today, the demand for housing has shrunk. Realty firms like Evergrande and Country Garden have defaulted on their debt. Home owners are in trouble, and can’t service mortgage loans but can’t sell either as the value of their home is below the debt owed rto the bank. There are, as per this article in Fortune, 65-80 million unsold apartments. The local Governments are broke as land auctions, their main revenue source, are failing and the LGFV debt is estimated at $ 11 trillion. Since 70% of household wealth is in real estate, the collapse of this sector has huge implications for the economy.

Other tha pan LGFV the realty sector was also funded by shadow banks, ie private firms like our NBFCs (non banking finance companies) which paid high interest rates to household, and lent to real estate firms after adding a margin. Their borrowers are defaulting, and the shadow banks are going bust.

A similar mal-investment had occurred in Japan in 1989 and till today, it’s Nikkei index has not been able to cross its Dec 1989 peak of 38957. So the unwinding of mal-investment bubbles takes decades.

Besides the real estate sector problems, China is also facing issues from withdrawal of foreign manufacturers, seeking to derisk their dependency on China. Closure of these units has resulted in a youth unemployment problem, with unemployment so high that China has stopped releasing figures. China’s demographic profile has turned adverse. It’s population is reducing, thank to the one child policy introduced in 1980.

India’s demographic profile is, however, favorable, with an average age of 28. This will help sustain a virtuous circle of jobs, generating income, which generates consumption (for economic growth) and savings (for investing for the future).

India, though, has weaknesses. More should be done to address them. Some of them are:

Poor primary education: A recent study found that 43% of children aged 14- 18 couldn’t read simple sentences in English. In rural India 25% couldn’t read Class 2 text books. Without primary education there can be no demographic dividend.

A tax regime gone berserk and unequal treatment for politicians: Read this Moneylife article about the treatment meted out by tax authorities to some of the most respected companies, including Government owned LIC. In a quest for higher tax revenue, IT authorities are raising untenable claims. Meanwhile, headline news of mountains of unaccounted cash on the premises of politicians, mysteriously vanishes without explanation of the action taken. At least some people’s backs have stopped itching! Again, India can’t become a developed economy unless tax laws are uncomplicated, fair, and apply equally to all.

Abysmally slow judicial system and a casual investigative system: Last week’s news was conviction of 5 murderers of a man in Borivali, Mumbai, after 12 years. There is a backlog of 50 million cases in India which effectively denies justice; the fraudster knows the case will not come up in his lifetime. Courts have ordered that there cannot be more than two adjournments in any case, but ignore their own diktat. Why can the judiciary not enforce its own ruling? The common citizens are looted in one Ponzi scheme after another, with cases getting tied up in judicial delays. Neither PM Narendra Modi nor the Chief Justice of the Supreme Court hears the cries for justice of millions of victims. India cannot become a developed country when justice has a cataract.

In the rest of the world, last week saw the eruption of one more conflict, between Iran, which fired at terrorists in Baluchistan, Pakistan, in retaliation for a bombing, allegedly by them, killing civilians in Iran, followed by firing of shells by Pakistan into Iran. As if there were not enough conflicts already!

Last week the Sensex ended at 71683, down 885 points over the week.

Global markets are retaining their highs on hopes that there would be perhaps 5 rate cuts, of 25 bips each, by the US Fed in 2024.

Perhaps there won’t, especially if the commercial real estate sector tanks, as expected to, bringing down with it a few more community banks. Besides this, any of the ongoing conflicts can explode, all it needs is a match in the hands of a crazy terrorist, or a button under the finger of a crazy politician.

God knows, there is no shortage of either.

Picture Source: https://medium.com/@loganfrombitcoin/proof-of-work-in-the-year-2040-dfe4807c22b8

Comments may be sent to jmulraj@asiaconverge.com

COMMENTS