MARKET PERSPECTIVE

By J Mulraj

Apr 6-12, 2024

Lyrics of the song written by Merle Travis, about the life of a coal miner, describes the current over-indebtedness well.

You load sixteen tons, what do you get?

Another day older and deeper in debt,

St. Peter don’t you call me, cos I can’t go,

I owe my soul to the company store.

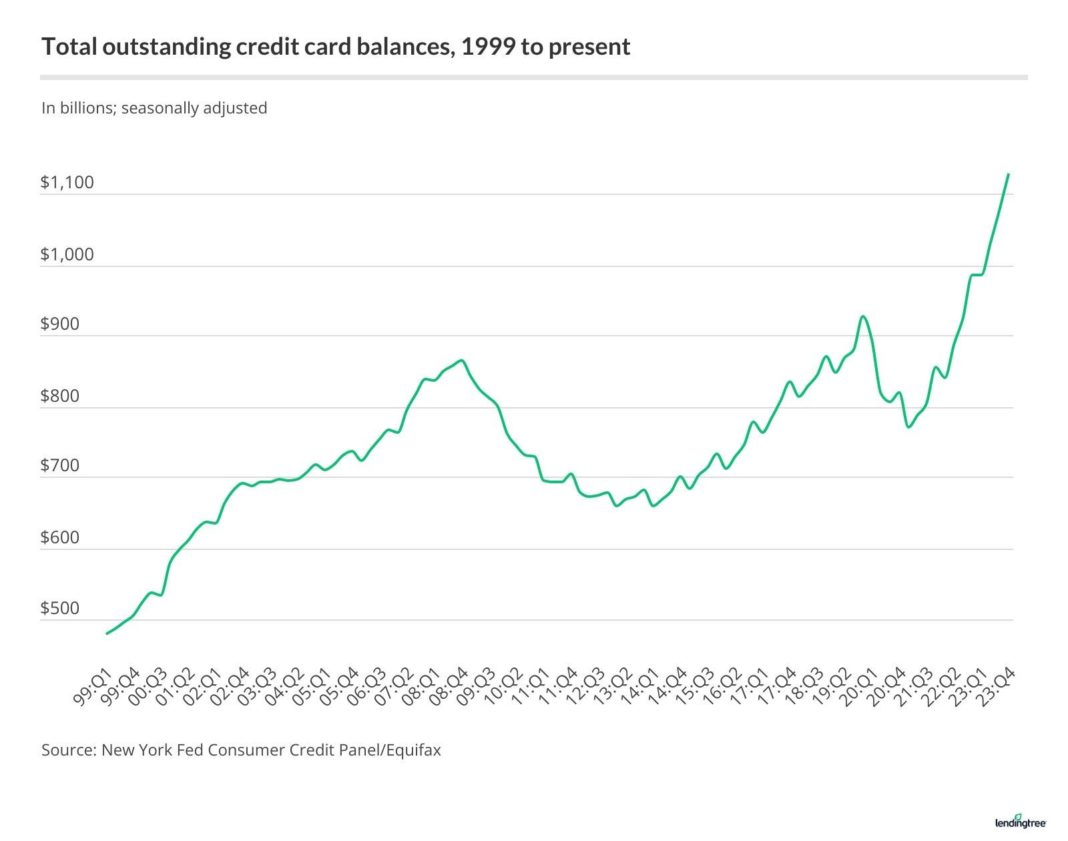

Total US credit card debt has more than doubled since 1999, to $1.1 trillion now. US Government debt has crossed $33 trillion, the annual interest burden on which is over $1 trillion.

Meanwhile, US household saving rate has fallen to 3.2% in Feb 24. This is less than half the average of 8.5% for the past 85 years (including an aberration during Covid, when stymmie, or stimulus, cheques had temporarily pushed it up to 32% in April 2020). People, unable to spend all the money when locked down, saved it. The fall in household savings rate to 3.2% indicates the exhaustion of the stymmie savings. Consumption should, consequently, slow down, and with it, US GDP growth (consumption accounts for 70% of US GDP).

So, American households are saving less, but spending more, using their credit cards generously, for this purpose. Something has to give. It’s most likely to be consumption. A reduction in consumption is an easier decision for individuals, than it is for a Government addicted to borrowing and spending. Government spending, too, can’t last long, since, at $1 trillion, the interest on US Government debt will exceed what it spends on defense, on social security and on healthcare.

Till debt do us part!

As per this article US GDP grew by $334 b. in Q4/23. But to get that growth, US Government borrowing increased $834 b! This means that the Government borrowed $ 2.5 to generate an additional $ 1 of income! Even a high school student would realize that it is folly to borrow 2.5 units to earn an extra 1 unit – how will you repay the 2.5? It is shocking that Treasury Secretary Janet Yellen, a summa cum laude (passed with distinction) in Economics, would not understand that. The US is addicted to borrowing.

Till debt do us part!

Excess, debt generated, money supply, has its own, bizarre consequences. Recently, one Sohail Prasad launched a new fund, called Destiny Tech 100 Fund. The purpose was laudable; to provide retail investors to invest in hot start ups, especially new technologies, ab initio. Investing in these hot start ups is restricted to accredited investors, and Prasad, being one, had invested over $50 m in 23 companies. When the stock of the fund was listed, the stock, valued at around $4.8 / share before listing, became a meme stock, and went up to just under $100! At this valuation, investors will lose money even if all the unlisted stocks held by the fund were to go up 1000% by the time they go public. Such irrationality is a signal of stock market excesses.

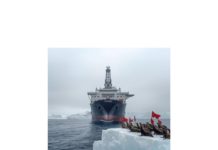

Geopolitical tensions rose in the Middle East after Iran threatened an immediate retaliation against Israel for its attack on an Embassy that killed several top Iranian commanders. As a result, the price of Brent crude rose above $90/ b. Such an attack will, likely, lead to a further escalation, and continued high oil prices, spurring inflation.

As a result, investor expectations for a rate cut by the Fed now stands at only 2 cuts in calendar 2024, possibly 25 bips each.

In India it’s election season. Some 970 m. people will be eligible to vote in General elections between April 19 to June 1. Results will be declared on June 4. Perhaps the US can learn from this!

Last week the BSE Sensex closed at 74244 (after making an all time high of 75124, for a weekly loss of 3 points.

Globally, stock markets are high, with P/E multiples far higher than historical average. Many are skewed in favor of a few stocks outperforming the rest. In USA seven such stocks, called the Magnificent Seven, are the darlings. Expected earnings for the Magnificent Seven are expected to be up some 10% this year, but for the balance 493 stocks in the S&P 500 they are expected to be down around 4%. The skewness is concerning. The Indian market is also skewed.

A piece of good news is that there is a trend, now, of Return To Office in several American cities, as large corporations are insisting on a phasing off of WFH, or work from home. That reduces the risk of a major collapse of the Commercial Real Estate sector, which these columns had been highlighting.

Investors should watch the price of crude oil, as it would impact the timing of interest rate cuts. Should Jerome Powell further postpone the interest rate cut, William Shakespeare may describe it as the unkindest cut of all.

Picture Source: https://www.lendingtree.com/credit-cards/credit-card-debt-statistics/:

Comments may be sent to jmulraj@asiaconverge.com

COMMENTS