Be careful! Spouting hopeful figures about the economy is not enough.

RN Bhaskar

If one listens to the euphoric outpourings of India’s Chief Economic Advisor (CEA) V Anantha Nageswaran, the country’s economy is in great shape. Just last week he exuded confidence and said that “As we go into the rest of the decade beyond FY25, the omens are good for us to continue the steady growth rate between 6.5 and 7 per cent” (https://www.business-standard.com/economy/news/omens-good-india-can-grow-6-5-7-in-the-next-decade-cea-nageswaran-124050800625_1.html). Inspiring words indeed. But some smoke signals that don’t look good.

First, to check out the CEA’s utterances we need to look at past data. Unfortunately, the government has little to offer because all the data is so truncated that to get information one must take page after page, copy the data from each page and then arrive at a five- or ten-year picture.

Consider two examples. Check out The RBI for Foreign trade statistics — https://www.rbi.org.in/SCRIPTS/Data_ForeignStatistics.aspx. The data provided stops at 2014. No joking.

Similarly, check out the data provided by the Directorate General of Commercial Intelligence and Statistics. It too gives data till 2014 — https://www.dgciskol.gov.in/Writereaddata/Administrative/book_3e.pdf.

Even when the latest data is available, it is given in a truncated manner. For instance, RBI’s data on service exports and imports gives data for three months only (RBI – https://rbidocs.rbi.org.in/rdocs/PressRelease/PDFs/PR23189DE062040304FD88773CDED1F7F6E1F.PDF). To get a five-year perspective, you will have to download page after page in pdf formats, copy the data on an excel sheet and then tabulate it. It is easier to go to other service providers. Depending on government for data inputs can be a terrible experience.

This is even though service exports is a good story for the government to tell. It is what has saved the Indian economy from a higher balance of trade deficit than exists at present.

The economic health of a country depends on various factors. One of them is the balance of trade.

A casual look at the chart shows that India does not have the same economic resilience it once had. It seemed to gain this bounce in 2020. It was possibly the draconian laws that were used to hound industrialists, and which are driving millionaires away (https://asiaconverge.com/2023/09/inflated-views-and-deflated-economy/). Or it could be the high import tariffs that made the cost of manufacturing even more difficult in India. Or again, it could be the entire legal framework of compliances that bedevil any manufacturer. But the Balance of Trade chart does show that India is slipping. And the latest figures are nothing great to write home about. The end of 2024 will tell whether India has finally decided to turn the corner.

To understand the problem with balance of trade one needs to look at exports and more specifically imports.

First, on the export front, there were some inherent strengths that India had which the government stomped on.

Consider textiles where India could have done a lot more than what it has done till now. The government seemed to forget that the textile turnaround took place in 2005 when the quota system was abolished, and trade was allowed to blossom (https://asiaconverge.com/2021/08/indo-count-expects-to-grow-in-a-favourable-textiles-market/). Suddenly, there was a huge opportunity to ship goods globally. This challenge was taken up by entrepreneurs. They established world-class facilities with state of art machinery. A lot of effort was placed to establish India in the global supply chain by running front-end marketing, setting up distribution, branding etc. Today the government has a heavy hand on everything.

Consider two other items – beef and leather. The government’s myopic policies for the cattle sector hurt farmers. But they also hurt two key export and labour intensive sectors — leather and beef (https://asiaconverge.com/2023/01/sodhis-resignation-has-dire-warnings-for-agriculture-and-milk/).

Similarly, the government decision to ban export of agricultural products one after another, and instead take up commodity trading itself, doesn’t augur well for an economy that is supposed to become vibrant (Free subscription — https://open.substack.com/pub/bhaskarr/p/kuriens-amul-can-legends-be-erased?r=ni0hb&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true).

If the export strategy outlook is a bit blurred, just look at India’s imports.

India’s largest import item is mineral fuels, oils, distillation products which account for a value of $277 billion in 2022 and accounts for a 38% share in the country’s import basket.

This is where the government has been most unwise. It could have promoted rooftop solar almost ten years ago (Free subscription — https://open.substack.com/pub/bhaskarr/p/a-new-policy-direction-for-solar?r=ni0hb&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true). Instead, the government (both this government and the previous one) went about promoting solar farms which neither create jobs, nor provide a big bang for the buck. It overlooked lessons that Germany held out for us (https://open.substack.com/pub/bhaskarr/p/german-lessons-that-india-did-not?r=ni0hb&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true). And it ignored Jammu & Kashmir which has the second largest solar potential in India.

Instead, it propped up Gujarat (which has the fifth largest potential) to the second largest installation base. It pushed down Maharashtra to #7 (even though it has the third largest potential for solar).

Worse, it imposed huge import duties to protect domestic manufacturers. The 15% and 20% safeguard duty that was to expire in a couple of years has now become 40% and 25% plus GST, pushing up solar installation costs by 70% (https://www.soleosenergy.com/impact-of-import-duty-on-solar-panels-effect-on-its-price/). This has made a strategic advantage for India a very expensive proposition. Had the government worked on rooftop solar, it might not have solved much of the unemployment problem it currently faces. Even the oil and coal import bill would have declined.

Then take edible oil imports. That is a large item accounting for around $17 billion. If only the government had given a price assurance to oilseed growers, India wouldn’t have had to import edible oils. It would also have created farmer wealth. That would have pushed up farm purchasing power which in turn would have made industry more vibrant. It is like the fable which talked about how “For the want of a nail, the kingdom was lost”.

But that is not all. The government even banned the export of agri crops. It banned futures in more agricultural commodities than any time in India’s history. And it allowed the import of pulses. Australia is now growing pulses in anticipation of a demand from India (https://economictimes.indiatimes.com/news/economy/foreign-trade/australia-starts-india-focused-pulses-programme/articleshow/42940306.cms?from=mdr). Once again, instead of protecting and nurturing India’s farms, and increasing national wealth, the government has encouraged other countries to look for income from India.

Instead of doing all this, the government spent more time and money on giving out freebies and trying to erase the legend of Verghese Kurien, the milkman of India (https://open.substack.com/pub/bhaskarr/p/kuriens-amul-can-legends-be-erased?r=ni0hb&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true). Kurien had taught the country how to grow an industry by focusing on two things. First teach farmers to be self-reliant. He also ensured that the market prices of milk would not fall. Second, he did all this without any subsidy from the government. Instead of promoting the Kurien model for India, the government has kept promoting imports.

It has done this with gold as well. Instead of storing India’s gold on its own land, it has preferred to keep its gold overseas (https://www.youtube.com/watch?v=y37tnx4S00c).

The one silver lining India enjoys is its service sector (in addition to remittances). But even here India’s growth has plateaued because of its myopia about education (https://open.substack.com/pub/bhaskarr/p/poor-education-will-eventually-damn?r=ni0hb&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true).

Watch how transport, which requires the least education has thrived. Other sectors could thrive as well. Medical services (medical tourism) could have done amazingly well if India had enough doctors and a sensible health policy (https://open.substack.com/pub/bhaskarr/p/medical-education-in-india-is-growing?r=ni0hb&utm_campaign=post&utm_medium=web).

If only the government had a policy of outsourcing all its land mapping and digitising work to its IT companies, the growth of this IT sector could have been mid-boggling. But the government has damned the future of both education and the country.

Compliances, dispute resolution and FDI

Compliances, dispute resolution and FDI

Then look at India’s laws. The number of compliances businesses have to cope with is terrifying (https://www.orfonline.org/research/jailed-for-doing-business).

More laws have been added to the government’s arsenal. You have laws like PMLA (now being debated in the courts) where a person can be picked up for economic offences even before a chargesheet is filed. Mere suspicion is enough (https://www.livelaw.in/top-stories/judgment-upholding-pmla-provisions-was-contrary-to-law-must-be-reviewed-soone-by-supreme-court-p-chidambaram-kapil-sibal-249112).

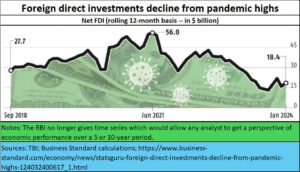

Investors are naturally frightened about putting their money in India. They would have liked to have the protection of international arbitration. But the government has blocked that as well (https://asiaconverge.com/2020/01/arbitration-and-investment-protection/). It is thus not surprising that foreign direct investment has taken a hit.

It is quite possible that the CEA has access to more information that makes him jubilant and optimistic. If so, he must share it with India’s citizens. People lose confidence, and even get suspicious, when the country tries to hide information.

It is quite possible that the CEA has access to more information that makes him jubilant and optimistic. If so, he must share it with India’s citizens. People lose confidence, and even get suspicious, when the country tries to hide information.

That is why the CEA should look at the ground ahead, and not just look at the stars and his fantastic visons. Ground realities matter as well.

COMMENTS