Megaphones extolling India’s economy are not in sync with ground realities

By RN Bhaskar

At one level, India’s economy appears to be in good health. That is, if one believes all the things that are being spouted by the government.

At another level, there is cautious optimism. Most fund managers claim that the economy is improving, but that there is still a long way to go.

At a third level, there is disbelief. There are ground facts that just cannot be wished away.

Take your pick. You may still be in great company.

The optimists

First, listen to what the Economic survey has to say (https://www.indiabudget.gov.in/economicsurvey/doc/echapter.pdf): “High economic growth in FY24 came on the heels of growth rates of 9.7% and 7.0%, respectively, in the previous two financial years. The headline inflation rate is largely under control, although the inflation rate of some specific food items is elevated. The trade deficit was lower in FY24 than in FY23, and the current account deficit for the year is around 0.7% of GDP”. It also mentions that further growth depends on reforms. But overall, the survey suggests that things are improving.

Then pay heed to the Prime minister Narendra Modi when he made his statement on 5 August 2024 (https://www.ndtv.com/india-news/pm-modi-releases-big-bang-numbers-on-indian-economy-6279104). It was possibly aimed at talking up the markets. Among several claims were the following:

- Indian MSMEs created over 20.5 crore jobs in 4 years while 39 per cent of MSMEs in the country are now owned by women.

- 4 lakh recognised startups generating 15.5 lakh jobs.

- Employment in India rose by 35 per cent to 64.33 crore over the last six fiscal years

- The manufacturing sector (formal and informal entities) saw an 85 lakh employment opportunities increase from 2017-18 to 2022-23.

- India’s exports grew by 5.5 per cent to $21.2 billion, resulting in a trade surplus of $300 million. Exports are now all set to surpass $800 billion this fiscal year. In June, India’s electronic goods exports rose 16.9 per cent to $2.82 billion.

- India’s trade deficit has narrowed to $20.98 billion in June from $23.78 billion in May.

- India’s outward (FDI) commitments rose to $2.14 billion in June 2024, compared to $1.14 billion in June 2023.

The circumspect

Then look at what fund managers say.

“Political outcome suggests weak sentiment at lower end of the income pyramid. Even as India’s growth remains resilient, there is an apparent dichotomy between household consumption growth (below trend since the pandemic) and real GDP growth (holding up well)” — is what UBS has to say in its report on “India Economic Perspectives” dated 4 June 2024.

CLSA in its report on India Themes 2024 dated 4 January 2024 has this to say, “While India’s EPS growth should be steady, it will not be the fastest among top world markets. Yet it is trading at the biggest relative premium.”

More instances can be found in reports from the World Bank and the IMF as well. At times, they paint a glowing picture, and at times they strike a warning note.

But the most worrisome are reports from those who are shocked at what is happening which could adversely derail India’s economy.

One of the most shocking was a tweet (https://x.com/Swamy39/status/1824701922693222715) sent out by BJP’s Member of Parliament, Subramanian Swamy. His views are highly respected because (a) he has seldom shied away from calling a spade a spade; and (b) he used to teach at Harvard earlier, and held important posts in India under different governments.

He also writes, “Modi govt claim of GDP growth is a fraud on the public. Statistics show the avg GDP growth since 2014 is barely 5 % per year and since 2016 is 3,7 % per year.”

Such figures are in sync with what economists like josh Felman and Arvind Subramanian point out (https://www.business-standard.com/economy/news/union-budget-2024-25-three-macro-puzzles-and-policy-implications-124071901345_1.html). They suspect that the GDP figures have been inflated. This has been further elaborated in an earlier post in these columns (Free subscription — https://bhaskarr.substack.com/p/what-the-economic-survey-and-budget).

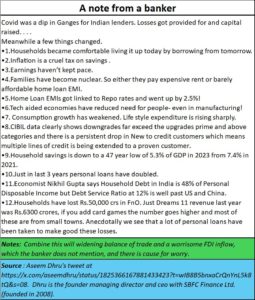

Then consider a note that Aseem Dhru, founder managing director and CEO of SBFC Finance, put up on both LinkedIn and X.com (earlier Twitter). He points out among other things that

- Consumption growth has weakened. Lifestyle expenditure is rising sharply.

- CIBIL data clearly shows downgrades far exceed the upgrades prime and above categories and there is a persistent drop in New to credit customers which means multiple lines of credit is being extended to a proven customer.

- Household savings is down to a 47 year low of 5.3% of GDP in 2023 from 7.4% in 2021.

- Just in last 3 years personal loans have doubled.

Something has been going on which raises the level of discomfort.

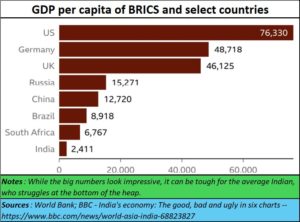

While at the national, aggregate, level the country has been talking about becoming the third largest economy, the picture is quite the opposite when one looks at ground realities. The worm’s eye view suggests that India has catered more to the rich and has forgotten the poor. Its per capita GDP is among the lowest when the much-touted BRICS is considered (https://www.bbc.com/news/world-asia-india-68823827). India seems to be rapidly turning into a story of exploitation, and not of cheer and strength.

This is borne out by unemployment figures as well. Somehow, notwithstanding the big claims made by the government, the above figures suggest that unemployment is a nightmare from which the country will have to emerge.

The Economic survey admits this, but puts the onus on the private sector “It is worth reiterating that job creation happens mainly in the private sector. Second, many (not all) of the issues that influence economic growth, job creation and productivity and the actions to be taken therein are in the domain of state governments. So, in other words, India needs a tripartite compact, more than ever before, to deliver on the higher and rising aspirations of Indians and complete the journey to Viksit Bharat by 2047. In more than one respect, the action lies with the private sector.”

Really?!

There are three root causes for unemployment.

The first is that the quality of people seeking employment is poor. Barely 30% of candidates are employable. This is primarily because of the terrible quality of school education (free subscription — https://open.substack.com/pub/bhaskarr/p/poor-education-will-eventually-damn). This is within the domain of the Central Government because primary and secondary education are constitutional requirements. The central government has wide reaching powers to ensure that even state governments deliver, because the funding for primary education and the grant of tax exemption to trusts which run schools lie with the centre.

Moreover, 70% of Indian students go to government schools. The picture becomes bleak when one learns that over 50% of the students don’t even have a science laboratory to do their experiments in. It is therefore not surprising to learn from ASER reports that one in four high-schoolers cannot read; and half cannot do maths (https://www.freepressjournal.in/education/1-in-4-high-schoolers-cannot-read-half-cannot-do-maths-aser-2023-report). Or than 26.4% of 14–18-year-old youths cannot fluently read Class 2-level text in their mother tongue.

When these students go into the marketplace to find jobs, they are found to be unemployable. There exist vacancies for jobs, but not the candidates to fill them up with. Unemployment is inevitable.

Second, many of the high-net-worth individuals who could have invested in projects that could employ people have left India. Amit Mitra, former secretary general of FICCI, the industry and trade organisation in India is on record stating that almost 35,000 HNIs have left India since 2014 (https://www.telegraphindia.com/business/35000-high-net-worth-entrepreneurs-left-india-during-narendra-modi-regime-amit-mitra/cid/1835449). Some have left for better pastures, but many have left because of a business environment that is not investor friendly. This is evident in the poor capital formation in India.

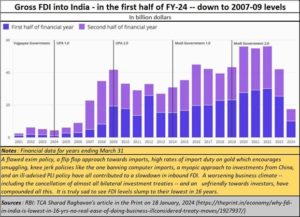

The absence of private investment is compounded by a sharp dip in foreign direct investment (FDI). The reasons are the same – poor investment climate coupled with India’s refusal to allow for international arbitration (https://asiaconverge.com/2020/01/arbitration-and-investment-protection/).

Third, even vocational training institutes ( or ITIs, the Industrial Training Centres) which could train people in skills for self-employment or even employment have not been functioning well. These too come under the purview of the Central government. Unfortunately, recent announcements by the government on how to remedy this situation are not expected to work (Free subscription — https://bhaskarr.substack.com/p/a-vocational-disaster-in-the-making).

Improvement in employment seems unlikely unless all the three problems listed above are addressed satisfactorily.

This in turn results in a worsening balance of trade, which makes India import more than it exports. Poor handling of agriculture – India has encouraged agri imports and has often interfered with agri exports – is one reason. Another is the government’s misplaced focus on capital intensive manufacturing (https://asiaconverge.com/2022/10/pli-and-the-indian-economy/), instead of labour-intensive businesses like leather and garments. Its inability to provide a similar thrust to services – it could have outsourced a lot of government data collection – is another major failure. A weakening trade balance and poor FDI are surefire ways of weaking the Indian rupee.

In conclusion

While the Economic Survey of the government does admit, though halfheartedly, that India faces a problem in respect of investments, employment, education, and health, it is up to the government to work on them if it wants a stronger and resilient India. Distracting people’s attention over issues like Bharat or India, or the replacement of the Indian Penal Code with the Bharatiya Nyaya Sanhita, 2023, is not the solution. Changing the penal code has the potential of further worsening India’s judicial and police administration (https://www.aljazeera.com/news/2024/7/1/concerns-as-india-replaces-colonial-era-laws-with-new-criminal-codes).

The government needs to become more investment friendly. It needs to get investments into sectors that create more jobs. It also needs to totally overhaul the norms used for granting schools funds and tax exemptions. Unless outcomes are measured, and a proper grading system is put into place – vetted by the best vocational and academicians, India will soon face a demographic nightmare. You will have hordes of N INJAs seeking to undermine public safety, governance, even employment opportunities. Ninja is an acronym for no job s, income, or assets.

Beware of the NINJAs in India’s economy.

================

Do watch my latest podcast on Why Verghese Kurien and his ideas matter a great deal to India at https://www.youtube.com/watch?v=AutA01BBwd8

COMMENTS