https://www.freepressjournal.in/analysis/pmp-and-pli-and-more-backdoor-licensing-moves

Will the PLI scheme really boost India’s economy?

RN Bhaskar

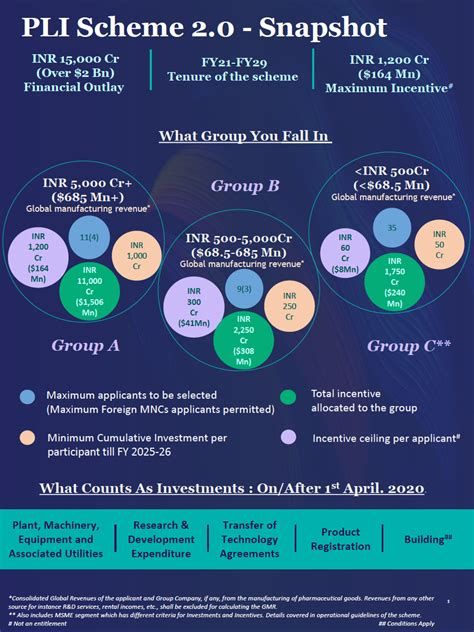

On 18 October, 2022, Raghuram Rajan, former governor of the RBI, India’s central bank, created a furor among investors when he harshly criticized the government’s PLI scheme (https://www.opindia.com/2022/10/raghuram-rajan-latest-india-manufacturing-hub-china-why-he-is-wrong/). Rajan is currently the Katherine Dusak Miller Distinguished Service Professor of Finance at University of Chicago’s Booth School of Business

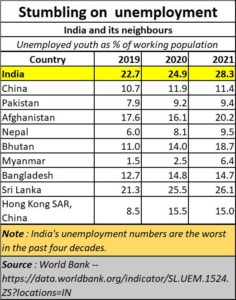

He said that the PLI (or production linked incentive scheme) had focussed on capital intensive projects and not on projects that could create jobs. Consequently, the economy was not growing healthily. “People leave agriculture for services and manufacturing. Here, over the last couple of years, we have seen people go back to agriculture. So the unemployment numbers are in a sense misleading because they don’t account for this effective underemployment of people who have gone back into agriculture,” he said (https://www.moneycontrol.com/news/business/economy/raghuram-rajan-says-indias-job-situation-really-alarming-needs-equal-focus-on-services-9395291.html). In any case, India’s unemployment problem is worse than that of any of its neighbours. Misplaced agricultural subsidies (https://asiaconverge.com/2022/08/rural-markets-will-decide-indias-revival/), the tendency to ban forward trades on commodity markets (https://asiaconverge.com/2022/10/the-folly-of-banning-futures-trading-in-commodities/) and a reliance on imports (as in edible oils – https://asiaconverge.com/2022/01/the-government-lets-down-indias-edible-oil-industry/) had collectively further blighted the agricultural sector.

As for the PLI, “I am not in any way saying that we should not focus also on manufacturing jobs. What I am saying is that the enormous subsidies that are now going into manufacturing, we need to think of whether they would be better employed in creating the underpinnings of strong service jobs, not just in this country but as exports,” said Rajan.

In many ways these fears were well articulated a couple of years ago by Arvind Subramanian — the former chief economic advisor of the government of India as well (https://www.youtube.com/watch?v=XVXm57tD7tQ ).

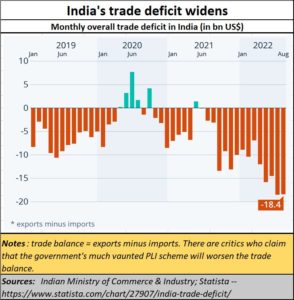

Weakening economy

The cumulative result of all these was a weakening of the Indian economy as pointed out by Statista (https://www.statista.com/chart/27907/india-trade-deficit/). The data has been compiled based on figures provided by the government (https://www.dgft.gov.in/CP/?opt=bulletin-foreign-trade-statisics). As Statista pointed out, “India’s trade deficit shrunk again in August after having widened in July to $18.5 billion. . . . The deficit has been increasing significantly since May.”

The cumulative result of all these was a weakening of the Indian economy as pointed out by Statista (https://www.statista.com/chart/27907/india-trade-deficit/). The data has been compiled based on figures provided by the government (https://www.dgft.gov.in/CP/?opt=bulletin-foreign-trade-statisics). As Statista pointed out, “India’s trade deficit shrunk again in August after having widened in July to $18.5 billion. . . . The deficit has been increasing significantly since May.”

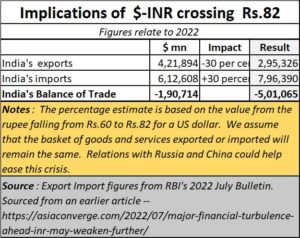

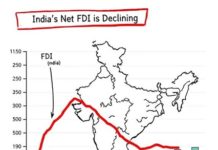

The current PLI scheme is bound to cause a surge in imports, which is likely to worsen the balance of trade. That is compounded by the weakening of the rupee, which in turn has been exacerbated by the government’s encouragement more to portfolio investors (FPI) than industry investors (FDI).

As the dollar has been strengthening globally, an unfavourable rupee exchange rate has further contributed to Indians foreign trade pains. Other factors driving up spending on trade include much higher fossil fuel imports – though discounted fuel from Russia has helped India control the balance of trade. But the consequences of a weakened rupee will continue to be severe.

By 30 September 2022, it was clear that India’s current account deficit, an indicator of the balance of payment position, in the first quarter of the fiscal had widened to 2.8 per cent of GDP at USD 23.9 billion (https://currentaffairs.adda247.com/indias-current-account-deficit-widened/). Even the RBI stated that “Underlying the current account deficit in  Q1:2022-23 was the widening of the merchandise trade deficit to USD 68.6 billion from USD 54.5 billion in Q4:2021-22 and an increase in net outgo of investment income payments.”

Q1:2022-23 was the widening of the merchandise trade deficit to USD 68.6 billion from USD 54.5 billion in Q4:2021-22 and an increase in net outgo of investment income payments.”

But coming back to the PLI, it is worth remembering that this is nothing, but a rehash of the indigenization programme introduced by the government in the 1980s. The government had then agreed that licences would be given to potential producers if they could agree to a phased manufacturing programme (PMP)ensuring that the production would be fully indigenized in five years’ time. In many cases, am export obligation was also insisted upon.

Licence raj

Most of the producers agreed to the government’s conditions because they wanted the licence to begin production (https://www.thehindu.com/opinion/lead/phased-manufacturing-policy-that-is-hardly-smart/article32856521.ece). Many of them indulged in trading operations for the first two years – first using SKDs (semi knocked down kits) that were imported. Some went on to CKDs (completely knocked down kits). But many folded up because they could not fully indigenise, or became uncompetitive.

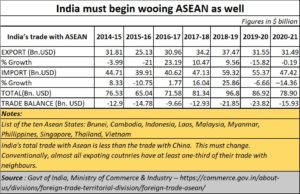

Adding to this problem is India’s penchant for looking to countries in the West for solutions and support. It debunks the posturing of being anti-colonial when it comes to education or  street names. Conventionally, all exporting countries and developed nations have 60% of their trade with neighbouring countries. This is not the case with India, a point forcefully brought out by Ravi Boothalingam of Manas Advisory (https://asiaconverge.com/2021/12/india-china-the-long-view/)

street names. Conventionally, all exporting countries and developed nations have 60% of their trade with neighbouring countries. This is not the case with India, a point forcefully brought out by Ravi Boothalingam of Manas Advisory (https://asiaconverge.com/2021/12/india-china-the-long-view/)

Undoubtedly, India has begun wooing some of the Asian giants to set up manufacturing in India under the PLI scheme. But as Arvind Subramanian points out, (https://www.youtube.com/watch?v=XVXm57tD7tQ), PLI is a kind of licensing, where only those favoured by policymakers get access to the honeypot of funds. The rest, which could also have immense potential, might get dropped. It allows policymakers to play favourites with sectors, projects, and promoters. That does not sit well with economic liberalisation.

On the contrary, PLI might result in promoters taking the money and backing out when the going gets tough. Most analysts single out India’s plans to boost the country’s capability in semiconductors and chips to be one such swamp. Making semiconductors and chips needs a complete change in the ecosystem – the way raw materials are picked, the way end to end processes are planned, the need to keep government inspectors away, as they could needlessly meddle with work schedules. It is not just one thing, but an entire ecosystem.

More imports

Consider the statement from Meity (Ministry of Electronics and Information Technology) (https://www.meity.gov.in/writereaddata/files/production_linked_incentive_scheme.pdf). It has approved 16 firms (https://www.thehindu.com/sci-tech/technology/india-approves-16-companies-including-top-apple-suppliers-for-smartphone-plan/article32789324.ece) in the mobile manufacturing sector for the PLI scheme (for large-scale electronics manufacturing, notified on April 1, 2020 ) to transform India into a major mobile manufacturing hub. These are five domestic and five foreign mobile phone producers and six component manufacturers. Interestingly, firms such as Apple, Xiaomi, Oppo, and OnePlus have invested in India, but mostly through their contract manufacturers.

True, production increased from $13.4 billion in 2016-17 to $31.7 billion in 2019-20. However, analysis of factory-level production data from the Annual Survey of Industries (ASI) shows that in 2017-18, value addition for surveyed firms (barring two outliers) ranged from 1.6% to 17.4%, with most of the firms being below 10%. For most of the surveyed firms, more than 85% of the inputs were imported. Effectively, while the PMP policy increased the value of domestic production, improvement in local value addition remains a work-in-progress.

This was borne out by a study by Ernst & Young for the India Cellular & Electronics Association. It showed that if the cost of production of a mobile phone is say 100 (without subsidies), then the effective cost (with subsidies and other benefits) of manufacturing mobile phone in China is 79.55, Vietnam, 89.05, and India (including PLI), 92.51. This shows that incentives under the PLI policy may not turn out to be a game-changing move, and it may be premature to expect a major chunk of mobile manufacturing to shift from China to India.

But the financial incentives for setting up production units in India is large enough to attract entrepreneurs who seek to make hay while there is sunshine.

What this means is that the PLI could actually encourage a return to a licence raj on the one hand, and a frittering away of government money (taxpayers’ money) on the other. Many units could shut shop when the moolah disappears. But, as the old saying goes, India has companies which go broke, but not promoters.

COMMENTS