The India infrastructure hype

RN Bhaskar

Last week, the government announced that it would be embarking on another large investment outlay for infrastructure. As a media report (https://indianexpress.com/article/india/govts-big-infra-push-nod-to-road-projects-worth-rs-50655-crore-9491780/) put it, “In a big push to infrastructure spending, the Union government Friday approved eight national high-speed corridor projects under which 936-km length highways will be constructed at a cost Rs 50,655 crore. After a meeting of the Prime Minister-chaired Cabinet Committee on Economic Affairs (CCEA), a statement by the government said the implementation of these projects will generate 4.42 crore mandays of direct and indirect employment.”

Great news. But celebrations could be premature. If the past is anything to go by, it should be a cause for worry. The government does not appear to have the right controls in place to ensure that the money is not squandered.

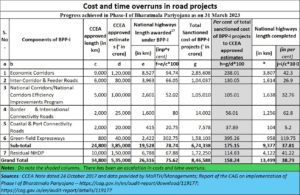

Consider the report of the Comptroller and Auditor General of India, popularly known as the CAG (https://cag.gov.in/en/audit-report/details/119177). He is part of the Government of India, and plays a very crucial role in identifying flaws in expenditure and implementation of projects that involve government expenditure. Observe how the cost has increased by 158.24% even while only 38.79% of the work on the roads has been completed.

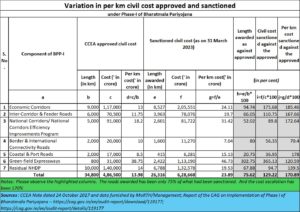

Take another table from the same CAG report on the “Variation in per km civil cost approved and sanctioned”.

Once again you find that costs have escalated by 170.89% even while only 75.62% of the sanctioned road length was awarded for completion, Even civil work costs were found to have escalated by 129.22%.

Once again you find that costs have escalated by 170.89% even while only 75.62% of the sanctioned road length was awarded for completion, Even civil work costs were found to have escalated by 129.22%.

Then consider how the BJP government under Atal Bihari Vajpayee managed to complete almost 98% of the Golden Quadilateral with hardly any time or cost overrun, under the supervision of the then minister for roads, B.C.Khanduri. If one has to go by performance parameters, and not by the thumping of the chest, clearly the earlier government of Atal Bihari Vajpayee did a magnificent job on infrastructure building.

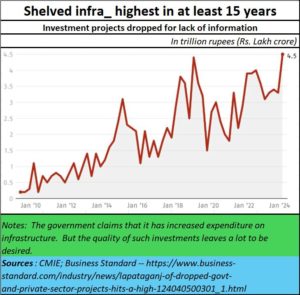

As CMIE data shows – faithfully captured by Business Standard in its report at https://www.business-standard.com/industry/news/lapataganj-of-dropped-govt-and-private-sector-projects-hits-a-high-124040500301_1.html — the number of projects that got shelved has shown an increasing trend.

As the report points out, “The government had Rs 2.31 trillion worth of dropped projects. It was Rs 2.18 trillion for the private sector. In value terms, the last three quarters have had more government projects being affected than those in the private sector. This is unlike previous election cycles.”

The other big problem is the poor quality of the infrastructure that has been created. A good indicator is the way 12 bridges collapsed in Bihar alone within a span of 17 days. A list of these bridges can be found at https://www.financialexpress.com/india-news/a-brief-history-of-bihar-bridge-collapses/3549514/. A day later, National Herald put the tally at 13 bridges collapsing within 18 days (https://www.nationalheraldindia.com/national/bihar-an-unenviable-record-of-13-bridge-collapses-in-18-days). Once again, compare the record of collapsing bridges built during Atal Bihari Vajpayee’s term, and you can then appreciate how terribly project implementation has slipped.

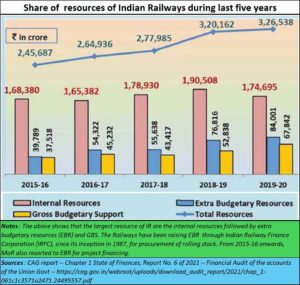

As the CAG report on Indian Railways shows (https://cag.gov.in/webroot/uploads/download_audit_report/2021/chap_1-061c1c3571a2471.24495557.pdf), allocation of funds have been increasing year after year. Nothing wrong with that. But a look at the financial performance of the railways shows you that not all is well.

You begin to realise the huge price the country pays because of the government’s penchant for subsidies – especially those which don’t really show up as subsidies on the government’s balance sheet.

The desire to subsidise passenger traffic has hurt the railways dearly, compelling it to increase freight charges. Consequently, industry is compelled to pick up these additional costs, which are then passed on to consumes by way of higher prices and tariffs. This thus becomes one more factor which stokes inflation, weakens industry, makes the country less competitive against international players and makes things extremely difficult for the railways. In 2015-16, passengers accounted for a higher share of railway revenues than did freight. By 2020, passenger traffic was loss-making, and the burden had to be taken up by freight.

The desire to subsidise passenger traffic has hurt the railways dearly, compelling it to increase freight charges. Consequently, industry is compelled to pick up these additional costs, which are then passed on to consumes by way of higher prices and tariffs. This thus becomes one more factor which stokes inflation, weakens industry, makes the country less competitive against international players and makes things extremely difficult for the railways. In 2015-16, passengers accounted for a higher share of railway revenues than did freight. By 2020, passenger traffic was loss-making, and the burden had to be taken up by freight.

Gujarat UP, Delhi and Mumbai

The poor attention given to infrastructure is visible in other areas as well. On October 30, 2022, a pedestrian suspension bridge over the Machchhu River in the city of Morbi in Gujarat, India, collapsed, causing the deaths of 135 people.

In November 2023, a section of an under-construction railway overbridge crumbled to the ground in Palanpur town of Banaskantha district in north Gujarat., killing two people. As a media report points out, this marked “the latest in a disturbing series of incidents that have plagued the state over the past couple of years” — https://www.indiatoday.in/magazine/up-front/story/20231120-gujarat-the-plague-of-falling-bridges-2461500-2023-11-10. There were allegations that the contract was awarded to GPC Infrastructure in 2021 with the knowledge of its dubious operations that exist on government records.

Gujarat also suffers from the ignominy of some of the most embarrassing accounting practices. Consider the revelations about the Hatkeshwar Flyover, Ahmedabad. It was assured to last 100 years. (https://x.com/mshahi0024/status/1817138954165960897). The construction cost was Rs. 34 crore; the flyover was inaugurated in 2017; it was closed and declared unfit in 2022; and now the demolition cost is higher at Rs.51 crore than the construction cost.

Allegations of favouritism in the allotment of contracts touched many other projects. One of the most glaring reports related to Megha Engineering (https://economictimes.indiatimes.com/industry/indl-goods/svs/construction/megha-engineering-electoral-bond-purchases-close-to-bagging-contracts-for-major-projects/articleshow/108714987.cms?from=mdr). The unlisted firm donated the highest amount of about Rs.585 crore to the BJP followed by Rs.195 crore to the BRS and Rs.85 crore the DMK. Some of its projects have been in the limelight because of collapses and deaths as was the case with a part of the he 4.5 kilometres long Silkyara tunnel project in Uttarakhand, which is part of the central government’s strategic 900-km ‘Char Dham Yatra All Weather Road’ (https://www.newindianexpress.com/nation/2023/Nov/29/silkyara-tunnel-project-to-continue-after-safety-audit-repair-of-broken-structure-official-2637294.html). While the collapse was on account of an avalanche, there are many who wonder if Megha Engineering was too hasty in its construction without taking the right precautions (https://www.outlookindia.com/national/uttarkashi-tunnel-collapse-a-lesson-for-himalayan-projects-no-room-for-deadline-driven-approach-say-experts-news-333432). Was it pressured by the government to make haste? Or was it just bad luck? It now appears that work on the project will continue after some additional safety checks.

But that is not the only bit of bad luck. There have been cracks in the much-touted Atal Setu Bridge within months after its inauguration by Prime Minister Modi. Similarly, there have been several reports of leakages in the much advertised Ram Mandir in Ayodhya and even the new Parliament building in Delhi. Both projects involved huge financial outlays, and were heavily advertised by the government. Leakages have been reported even at key airports.

The list of things going wrong is growing longer and longer.

The time and cost overruns, the failed and collapsed projects, the leaks and the non-implementation of several projects, all point to the sheer inadequacy of controls. This also suggests a willingness to splurge money on projects and their promoters. All this underscores the scant regard for return on capital employed.

This in turn has other implications. It means that the much-touted figures of capital formation by the government of India need to be discounted for the overruns, and the non-implementation.

This in turn will mean that the government will have less money to create additional capacities for employment.

Unless money is wisely spent, there is a grave danger of the country slipping badly both in terms of GDP growth as well as in economic upliftment of the citizens of this country.

Even the Economic Survey 2024 hints at these dangers: “recent studies by the Asian Development Bank and the World Bank and recent estimates made by agencies like CRISIL have identified gaps in infrastructure investment in different sectors.”

All these go a long way in undermining the strength of the Indian rupee. For instance on Saturday (3 August, 2024) Bloomberg highlighted the fact that the Indian Rupee had become the second worst Asian currency this quarter (https://www.bloomberg.com/news/articles/2024-08-02/india-stock-market-today-rupee-goes-from-hero-to-laggard).

Obviously, stricter controls and more vigilant programme management are called for.

====================

Do watch this story on my latest podcast at https://www.youtube.com/watch?v=_weSch3NPiA

COMMENTS