Reinsurance and the dangers for India

RN Bhaskar

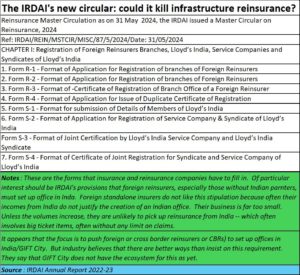

Reinsurance markets are in a state of confusion. They cannot comprehend what could have driven the IRDAI (an acronym for Insurance Regulatory and Development Authority of India — https://irdai.gov.in/) to come up with a circular on 31 May 2024 which seeks to introduce curbs on foreign reinsurance companies. That could hurt India badly. Its infrastructure growth could be stalled. Its health services could remain stunted. And some of the large projects could remain exposed to uncovered risks. Ironically this circular comes in at a time when India is on a roadshow in London to get reinsurers to cover risks for its biggest oil company – ONGC. It will slow down the pace of power projects, hydroelectric dams, metro rail and large roadways. It will be Disadvantage India.

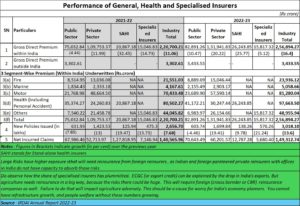

So, why should the reinsurance sector be perturbed? This is because of the very nature of insurance in India. Hitherto, the government focussed more on life insurance, and less on general insurance. Much of the general insurance was taken up by Indian companies, usually public insurance companies. But when the private sector was allowed, all types of insurance activities began growing. Today, the private sector is larger than the public sector in the field of insurance.

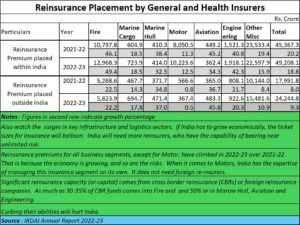

As India began taking up bigger projects, the cover size for many projects became too big and too risky for Indian balance sheets to take up. There is where Indian companies sought the help of foreign reinsurance companies (often referred to cross border reinsurance companies or CBRs). Eventually, all insurance deals with risk. As the risk becomes larger, Indian balance sheets must justify the taking up of risk.

Interestingly, almost the entire private sector wants to take up risk where the cover is limited. Limited claims allow such companies to earn money without smearing their annual reports with a sea of red ink. Huge risk, with potential unlimited risk cover is often taken up by the government-owned General Insurance Corporation or (in cases where the risk is far too big for the GIC to pick up the tab alone) by CBRs. Gradually, Indian private insurance companies began tying up with foreign partners and began taking up some of the large risks, but with limited claim cover. The big-ticket insurance had to be given to CBRs. Not surprisingly, the share of CBRs has grown.

Interestingly, IRDAI’s annual report mentions that unlike advanced countries where life insurance accounts for 39% ($2.1 trillion) and non-life for the balance 61% ($3.4 trn), India accounts for shares of 76.6% ($99.5 billion) and 24.4% ($31.5 bn) respectively. Clearly, India’s percentage shares are in sharp contrast to the developed world.

True, India’s insurance business has been growing. But it is still way behind in terms of penetration of the market, and even smaller in terms of insurance density.

This is on account of several factors.

One big handicap in the way of insurance is the fatalistic belief of many Indians that disasters and crises in life are part of destiny. That, in turn shrinks the appetite to cover risk.

The second is the poor purchasing power of Indians, no matter what the government may say with considerable chest-thumping.

The third is the way the government itself has approached insurance. In India Life Insurance is still a tax-saving instrument and investment avenue. Obviously, when it competes with other avenues of investment with higher returns, the lure of Life Insurance is low.

India low on non-life insurance too

India low on non-life insurance too

Non-Life Insurance in advanced countries is skewed towards liability and causality, because laws there allow for people to sue both governments and corporations for any neglect on their part. As a result, the compulsion to cover risk is lower in India. Governments and municipalities think they can get away with anything, because they cannot be sued for damages. Corporates too can challenge large awards, and get away with liability or class action claims. Hence risk ownership is denied, and insurance remains low.

Motor Liability is compulsory by law and thus contributes more. Health insurance growth is evident during the last two decades — starting with Tax incentive 80-D — and nowadays it has become a source of income to meet hospital charges which are increasing day by day. But it remains a loss-making activity for insurance companies because of poor actuarial studies, collusion with private medicare, collapse of public sector medicare, shortage of doctors (Free subscription — https://bhaskarr.substack.com/p/medical-education-in-india-is-growing) and other such causes. Even the Ayushman Bharat scheme (https://asiaconverge.com/2018/08/ayushman-bharat-great-concept-doctors-overlooked/) – grandly announced by the government – is not properly covered with decent insurance packages. And the recently announce insurance of Rs.5 lakh per annum for senior citizens (https://www.india.gov.in/spotlight/ayushman-bharat-pradhan-mantri-jan-arogya-yojana) remains largely on paper, with no clarity whether private sector medical insurance of Rs.5 lakh should be dispensed with, and only top-up policies should be taken up.

India needs to revamp its medical insurance policies and practices – right from upgrading its medical schools, increasing the number of seats, and reworking medicare costs by reining in private medicare. A good example of how private sector medicare keeps rates high artificially, is by studying occupancy rates of private sector hospitals. Many hospitals report an occupancy rate of just 70% — that too after elongating the hospital stay of patients and making them go through needless tests. Public sector healthcare is terrible, with collusive practices between government doctors and private diagnostic clinics. Not surprisingly, blood tests, x-rays, and CT scans are often referred to private clinics on the grounds that the hospital infrastructure has broken down. Reinsurance is urgently required here.

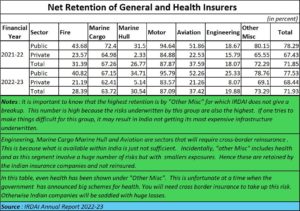

Already, the slowdown has seen a decline in retention for many sectors.

Engineering, Marine Cargo Marine Hull and Aviation are sectors that will require cross border reinsurance. This is because what is available within India is just not sufficient. Incidentally, “other Misc” includes health and as this segment involve a huge number of risks but with smaller exposures. Hence these are retained by the Indian insurance companies and not reinsured.

Now, with IRDAI trying to make things difficult for CBRs, the slowdown could get further accentuated. Of course, private insurance companies will be glad that the CBRs are being restrained. It could mean more collaboration opportunities for them. But the CBRs themselves are not amused. They see the stipulation of opening offices in India as a sop either for GIFT City, where they are being pushed, or an attempt to make them set up offices in India. Given the small volume of business from India, compared to global opportunities, the costs of managing offices in this country could become a very expensive proposition. That could result in a further slowdown for major projects that India needs, and for the healthcare sector.

Key engineering sectors stumped

Key engineering sectors stumped

Some sectors like marine hull, marine cargo and aviation have witnessed an increase in placement shares. But not fire and engineering. This was before the IRDAI circular of May 2024.

Now there are fears that many CBRs will not take up Indian businesses, because there is already a huge demand for reinsurance globally. Introducing such restrictive clauses may not help India’s case.

So, will IRDAI take back the May 2024 circular? Or will the government step in as it realises the huge impact the country would suffer from if these measures are insisted upon?

That, as they say, is what IRDAI and the government will have to decide. Many CBRs are clear that such restrictions will not do. You cannot have the tail trying to wag the dog. Or pygmies trying to pin down a Gulliver.

===========

Do watch my podcast on culture and the story of humanity through the eyes of five Jews at https://youtu.be/yGA3fLEacGc

=============

COMMENTS