What US magic will be on display after 20 January 2025?

RN Bhaskar

Picture from https://www.canva.com/

The countdown has begun. The world watches with bated breath. All eyes are on the US. What will it do after January 20, when Trump assumes charge of the most powerful country as its President? Can it hold its audience spell bound by its old tricks. Unfortunately, the old US magic is missing.

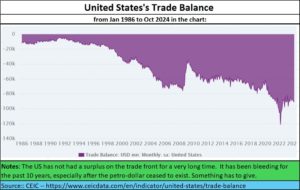

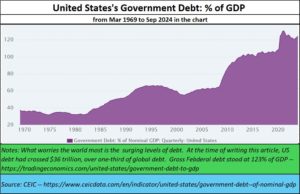

First, there is the huge USA debt that must be reckoned with. Much of it was built up during the past two decades. Nearly half the US national debt of $36 trillion was built up by the past three Presidents (Obama added $7.6 trillion, Trump $6.7 trillion and Biden at least $2.5 trillion). — https://asiaconverge.com/2024/05/trade-and-currency-wars-move-centre-stage/. Money was what created the US magic.

Thw wars in Ukraine and the Middle East have drained the US even further, not just in terms of money, but also in terms of reputation. The blind support the US has extended to the massacres in Gaza, and the continued supply of arms to kill more people has left the world aghast. The benign façade has faded, and brutality of the world’s largest and most powerful country is now in display. Today, the US has become the biggest supporter of genocide, and even global disruptor. The US seduction and magic are waning.

Two recent videos by some of the most respected experts explain why.

The first is by John Mearsheimer (https://www.youtube.com/live/cyzQAIRTci8?si=tCF1hDo1F85cuZDN). He explains how the US has been responsible for the death of at least 800,000 Ukrainians. While Western downplays the number of Ukrainian deaths, and overplays the damage done to Russia, the numbers that are documented is the exchange of dead bodies by Russia and Ukraine. They indicate that the ratio of Ukrainian deaths is 8 times larger than Russian deaths.

The US is now without large stocks of ammunition. It is without the military leadership that Russia exhibited with its Oreshnik, first deployed on 21 November 2024. It has a reported speed exceeding Mach 10 (12,300 km/h; 7,610 mph; 3.40 km/second) and is said to be unstoppable. According to senior journalist, Pablo Escobar, Russia has challenged the West to a content where it can select the target and put in all the defences it wants, and then see if Oreshnik can be stopped. This challenge was made by none less than Vladmir Putin (https://www.youtube.com/watch?v=IEiAUmfitVM) just two weeks ago.

One of the most strategically disastrous moves the US made was to attack Russia (through NATO and Ukraine) even though its was advised in 2008 not to do so through a document titled NYET means NYET (https://asiaconverge.com/2024/05/trade-and-currency-wars-move-centre-stage/). It also sanctioned Iran, and made threatening moves against both China (over Taiwan) North Korea (over its missile tests).

Today, all the four have moved closer to each other. Together they have become a formidable challenge for the US, and can thwart any sanctions that the US may choose to import on them, collectively or otherwise. China’s export surplus of 1 trillion last year jolted trade observers. Even more startling was that almost half these surpluses came from non-G-7 countries. China does not overly depend on Western markets anymore.

Obviously, Western media did not cover these events with the importance they deserved. As another commentator explains (https://journal-neo.su/2024/12/24/washingtons-unstoppable-superweapon/) the biggest super weapon that the US has is “not military might, but a sophisticated network of political and informational control that reshapes nations and regions to serve its interests.”.

But more disturbing than that are the financial underpinnings.

Gold more seductive than the dollar

Gold more seductive than the dollar

Today, you have a situation where the Russians the Chinese and the Saudis are not willing to hold their money in US treasuries any more (https://www.youtube.com/watch?v=6js6gfKPEkg). The way the US weaponised the dollar and the SWIFT sent shockwaves across the world. Not surprisingly, people have begun diversifying away from the dollar both in terms of movement of money and store of value. Gold reserves for China, Russia, Saudi, India have been rising. Gold is gaining more trust that the dollar. The US magic is fading.

That leads to the question – While Trump dump gold into the market to make it unattractive? After all, the US currently holds the largest official reserves of gold in the world. The only other country which has the po0tential to counter the US is India, with unofficial gold holdings (in private hands) of around an estimated 25,000 tonnes. But India lacks the political will to introduce investor friendly policies that will bring the gold out in the official market.

India is no stranger to gold, though the British and post-independence Indian governments have actually weakened India’s abilities on this front (https://www.youtube.com/watch?v=ibJJXeGyZxA&t=45s). That is truly a pity.

Effectively, the US could hold the key to the price of gold, at least for now. Though that won’t work over the long term.

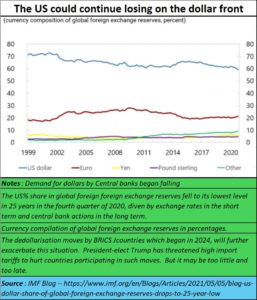

The disenchantment with the US dollar has pushed many countries to look to other currencies. The share of the dollar is dipping. Even then, it continues to enjoy a 60% share.

A lot will depend on the dedollarisatin moves by the BRICS countries (https://bhaskarr.substack.com/p/brics-gold-and-gdp). Trump’s threat of penalising countries that agree to join the new money exchange mechanism promoted by China, Russia and Iran along with other RIICS countries (India has opted to sit on the fence) may not work. There are two reasons for this.

If Trump levels higher duties against many countries, it will only lead to higher inflation within the US. The latter is already tottering under two other negatives.

It has a frightening yawping negative trade balance. With higher duties, the cost of US imports will grow. So, it will be hit with a worsening debt, an even more worsening trade balance, and inflation.

Trump also wants to stop immigration from its southern border. But the economies of the southern states in the US depend on orchards and cotton. That move will result in labour inflation. The only way to prevent this is to do what Israel is doing – import Indian workers (the US won’t trust Chinese workers). But even then, just like Israel, it will have to pay a higher wage to the Indian workers. Once again, labour inflation. The US magic won’t work.

Trump also wants to stop immigration from its southern border. But the economies of the southern states in the US depend on orchards and cotton. That move will result in labour inflation. The only way to prevent this is to do what Israel is doing – import Indian workers (the US won’t trust Chinese workers). But even then, just like Israel, it will have to pay a higher wage to the Indian workers. Once again, labour inflation. The US magic won’t work.

Trump may find himself in a bind. It will be interesting to see what he does.

Significantly, Trump’s team has already been advocating immigration by H1-B Visas. Without them, even the lead the US has in technology may get badly blunted. But the number of voters is extremely large in mid-and-south America who depend heavily on Mexican workers, who come in when there is work, and return when there is none. What this will mean for domestic politics of the US will be interesting to watch.

Will this sustain?

For a variety of reasons, the US has been the destination for money., at least for the past 75 years.

Watch how by the end of 2023, the MSCI estimated that the US Market capitalisation stood at around $213 trillion (https://www.msci.com/www/blog-posts/sizing-up-the-global-market/05073690405) reflecting an 11% year-on-year growth.

Even today, its equity markets are the largest in the world and continue to be among the deepest, most liquid and most efficient, representing 42.9% of the $106.0 trillion global equity market cap in 2023, or $45.5 trillion. (https://www.sifma.org/wp-content/uploads/2023/07/SIFMA-Research-Quarterly-Equity-and-Related-3Q23.pdf).

But is this sustainable? Do bear in mind that its market capitalisation accounted for 156.5 % of its Nominal GDP in Dec 2022, compared with a percentage of 205.8 % in the previous year (https://www.ceicdata.com/en/indicator/united-states/market-capitalization–nominal-gdp). There is reason to believe that forces of deceleration are already in play. Fewer countries are investing in US dollars for reasons already explained above.

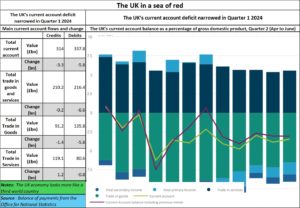

Its closest ally, the UK, is actually on its knees, and – like Israel – has stayed afloat only because of US (deficit) funding.

Its closest ally, the UK, is actually on its knees, and – like Israel – has stayed afloat only because of US (deficit) funding.

Germany too is bleeding, and it is not clear now whether it will remain part of either NATO, or EU or both. It needs the subsidised gas Russia used to provide to give its small and medium firms the competitive edge in the world. The US has actually wounded the whole of the EU. The current heads of governments in Germany and France may be on their way out. And the mood in both countries is definitely against the genocide in the Middle East and the reckless destruction in Europe. Few can predict the destinies of Italy Greece and Spain.

What about India?

Once again, India continues to be in a sweet spot. It is being wooed by the BRICS countries on the one hand (Russia and China are keen that India joins them in their dedollarisation plan). On the other hand, the US wants it as a bulwark against China.

But India knows that, just as it was for Ukraine, the US is far away. China remains its next-door neighbour, with a lot more to offer or deny. This is also true of the people of Taiwan. They don’t want the US to make it another Ukraine. In fact, popular polls in both the US and Taiwan show the common folk’s anger at the war mongering talk endorsed by both US and Taiwanese legislators. Will Trump make history by turning his back on war? Looks unlikely. But one cannot be sure.

The only thing not working for India, geopolitically, is its anti-Islamist stance, which could alienate the populous and wealthy markets in Southeast Asia and even the Middle East. India is advised to go easy with this stance. Even as this column is being written, the pro-Hindutva moves in the Northeast threaten to inflame anti-India sentiments. They have become serious enough for intelligence agencies to warn the government of serious consequences.

Even the chief minister of Manipur, Nongthombam Biren Singh, who had been egging on the Hindutva forces against the minorities, came out unexpectedly with an apology (https://www.thehindu.com/news/national/manipur/biren-singh-apologises-to-the-people-of-manipur-hopes-normalcy-will-be-restores-in-2025/article69046511.ece). He later tried to wriggle out by saying that the violence was for the victims not for the terrorists. But as the lead edit in Indian Express pointed out (https://indianexpress.com/article/opinion/editorials/express-view-on-biren-singhs-apology-sorry-isnt-enough-9755310/), the apology isn’t enough: – “Unfortunately, it has come far too late. It is prompted, possibly, by political exigency and the growing crescendo of protests not just from the strife-torn people but his own legislators and coalition partners. Allies of the NDA, from the Mizo National Front to the National People’s Party, have called for a change of guard in Manipur because of the government’s persistent failure in curbing the violence that has held the state hostage since May 2023.”.

Israel could survive the genocide, because the US backs it to the hilt. India has no such godfather. It needs to be more careful. It must also recognise that the most prosperous times for India since 8th century BC have been when co9mmunities have lived together and worked together. In fact, the most prosperous princely states before India’s independence did not encourage religious strife, and put it down with a heavy hand. Prosperity and strife are seldom compatible.

The US is faltering. It cannot wow the masses. The US magic is dying. Even students are being arrested, to prevent protests against Israel’s massacre.

So, India has to look beyond the US to win. It can win, if it learns to create more harmony, more growth, and endorse a more benign vision for a friendlier future.

=============

Do watch my latest podcast – a conversation with Manish Chokhani – on What India should do at https://youtu.be/AHVDbsvCT-0?si=Th962afMBPvc8TJ_

==============

COMMENTS