The US could end up damning the world

RN Bhaskar

“An evil enemy will burn his own nation to the ground to rule over the ashes.” – Sun Tzu (https://twitter.com/Byoussef/status/1347003718772924416)

The trouble with megalomaniacs, and warmongers is that their obsession with being Numero Uno can become so great that they will be willing to destroy the very ground they stand on.

The trouble with megalomaniacs, and warmongers is that their obsession with being Numero Uno can become so great that they will be willing to destroy the very ground they stand on.

Warmonger USA

In many way, the US fits this picture quite well. John Mearsheimer spoke about this recently (https://www.youtube.com/watch?v=YsFwKzYI5_4). Also, do look at some of the tweets of John Pilger (https://twitter.com/search?q=john%20pilger&src=typed_query), award winning documentary maker. Pilger talks about what the US has been doing in the world and the implications of the AUKUS (an acronym for the Australia-UK-USA) accord:

“It is estimated that over 2 million people died in Iraq as a direct result of the unprovoked invasion led by Bush and Blair. The whole horror was a fraud, based on lies and corrupt ‘intelligence’. So why believe similar sources on Ukraine, Russia, China?”– 21 March 2023

Or

“Only former Prime Minister Paul Keating has broken the craven silence surrounding the Australian Labor govt’s push to war with China. For speaking the truth, Keating has been abused by witless journalists, who are warmongers. He is right. Dead right.” – 17 March 2023

Or

“It is not enough for journalists to see themselves as mere messengers without understanding the hidden agendas of the message and the myths that surround it” 24 March 2023

In many ways, the US is trying to ring-fence China in much the same way it did with Japan just before the Second World War, and them blaming it for the “unprovoked” attack on Pear Harbour. It is reminiscent of the ring-fencing of Russia and then blaming it for the unprovoked attack on Ukraine. And now it is China’s turn.

Monetary whiplash

Not that the US has won each time. It lose so badly in Vietnam, and spent so much of money waging that needless war, that it was compelled to break the relationship currencies had with gold (https://www.imf.org/external/about/histend.htm), It is facing the same wrath of the monetary system now. The expenditure on the Iraq war had its effect on overspending, and then in flooding the markets with subprime assets sold off at good investments. The financial mayhem that followed was there for everyone to see.

Not that the US has won each time. It lose so badly in Vietnam, and spent so much of money waging that needless war, that it was compelled to break the relationship currencies had with gold (https://www.imf.org/external/about/histend.htm), It is facing the same wrath of the monetary system now. The expenditure on the Iraq war had its effect on overspending, and then in flooding the markets with subprime assets sold off at good investments. The financial mayhem that followed was there for everyone to see.

Now the same spending has surged again. This time with Ukraine. Once again, the US desire to finance the war has reached limits of overborrowing. On the other it is attempting to coerce its European allies into financing this mindless war. Once again, the US has printed so much of money that it found inflation going out of control.

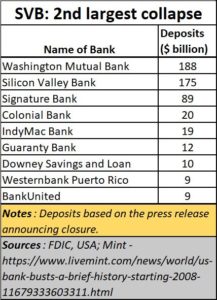

Finally, it was compelled to call an end to quantitative easing, and began raising interest rates. That in turn caused the first major banking crisis after 2008. As Sajid Chinoy points out (https://www.business-standard.com/article/opinion/will-the-global-economy-bend-or-break-123032001401_1.html) , the increase in interest rates was bound to create problems somewhere. “Something somewhere was bound to eventually break. The question always was, where, and more pertinently, would it bring the system down with it?” It finally did with SVB – the second largest bank-collapse.

That in turn caused other banks to collapse. Beyond the US shores, it resulted in the collapse and takeover of Credit Suisse, and is now threatening to affect Deutsche Bank as well.

In the US, the worst casualties will be both the affluent and the middle classes. They will find their savings disappear. Money that they thought was safe just won’t be available anymore.

In the US, the worst casualties will be both the affluent and the middle classes. They will find their savings disappear. Money that they thought was safe just won’t be available anymore.

Sadly, the banks too made a fatal mistake. True, they had invested their money in the most risk-free asset –US Treasury Bonds. The problem was that they used short term deposits and funded long term T Bills. So when there was a rush for reclaiming deposits, the banks were caught swimming naked. But that was also because the US did not tell the banks that it would begin tightening money supply. Had there been enough advance warning, it is possible that the banks would have redeployed their funds.

Could this have been avoided?

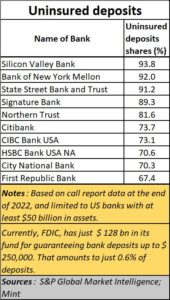

And, yes, expect a lot of pain. This is because much of US deposits (as in many other countries) are not fully insured. In the US the problem is worse. That is because the government encouraged overspending, hence over-saving – by both corporates and wealthy individuals.

And the big question uppermost in the minds of most people is – could all this have been avoided?

There are good reasons to believe that the collapse of banks and the mayhem in the financial system could have been avoided. All that was needed was an assurance from the US Federal Deposit Insurance Corporation (FDIC). As a recent GMO newsletter explains (Echoes of ’08? Don’t Bank on it — March 2023 –by Ty Cobb and Kim Mayer), “The Fed has blood on its hands. . . . . We think a statement from the Fed and Treasury that they will temporarily back all domestic deposits would likely cease deposit migration and end the crisis, while costing the government little. There is precedent here – at the outset of Covid, the Fed pledged to buy unlimited corporate bonds, a $10 trillion promise. In the end, the Fed only had to buy $14 billion in bonds and was able to stabilize the market. Sometimes a statement of support can be more important than actual action.”

On the contrary, Bloomberg pointed out how Janet Yellen, United States Secretary of the Treasury, poured oil on the flames by stating on 23 March 2023 that it was not considering ‘Blanker’ bank deposit insurance (https://www.bloomberg.com/news/articles/2023-03-22/yellen-to-stress-no-protections-for-bank-owners-and-bondholders). Clearly, this means that the value of long-dated US T bills will continue to slump. And more banks could be expected to wilt.

Spooked by China?

So why is the US doing this? There seems to be no plausible answer. But there is a possibility that the US was willing to cut its note to spite its face. It possibly wanted to hurt China. But why?

So why is the US doing this? There seems to be no plausible answer. But there is a possibility that the US was willing to cut its note to spite its face. It possibly wanted to hurt China. But why?

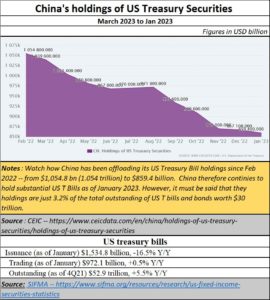

One reason could be that China continues to hold the largest amount of US Treasury Bills. One way to prevent China from dumping these bonds in the market and further depressing it while money supply was being tightened would be to reduce the value of the T Bill horde that China continues to hold.

As recently as February 2023, Yellen said (https://www.cnbc.com/2023/02/23/us-will-resume-economic-talks-with-china-at-an-appropriate-time-yellen.html) that the United States would resume economic talks with China “at an appropriate time” as Beijing continues to sell its vast stock of Treasurys and as Washington warns against possible sanctions violation in relation to Russia.

And this raises two issues. First, even though China’s holdings are large, they are not as large as many would have us believe. Points out NPR in its posts of August 2022 (https://www.npr.org/transcripts/1119126863) “the amount of U.S. Treasuries outstanding is more than $30 trillion. So, $981 billion [at that time] isn’t that much in comparison, but it is still a lot of money. Their ownership now is down to . . . . exactly 3.2% of outstanding treasuries. . . . . most foreign governments actually own less than 1%. The big buyers are Japan with about 4% and China at 3.2.”

But an even more interesting perspective comes from Reuters (on Feb 23, 2023 — https://www.reuters.com/markets/asia/china-slips-away-treasuries-sticks-with-dollar-bonds-2023-02-22/). It points out that “Although China’s selling of U.S. Treasury securities over the past year raises multiple geopolitical questions, it’s merely switching to other dollar bonds – casting doubt about a more alarming strategic investment shift . . . . . Taken as one bucket, China actually increased its combined exposure to U.S. government and quasi-government assets in 2022.”

So, clearly, China’s holdings do worry the US. Hence, the possibility that it allowed the value of its long-term treasury bills to fall — as a strategy to curb China’s attempts to sell the T bills in the markets.

Gold is a factor too

There is one more factor that should be worrying the US. China produces around 330 tonnes of gold a year, larger than even the Russian production of 320 tonnes. Together they account for almost 21% of the global gold production of around 3,100 tonnes (in 2022). Is it possible that China and Russia will go back to a gold backed currency regime that the US once spurned? That move left the entire monetary system without a rudder or a yardstick against which to measure currency generation.

If that happens, it would weaken the US currency even further. Already, at least 18 countries are willing to trade in currencies other than the dollar (https://www.youtube.com/watch?v=1fkN3R595N0. Over 119 countries have begun working with digital currencies (https://www.atlanticcouncil.org/cbdctracker/). China selling US T bills, and a currency with the backing of gold could have far reaching consequences for global trade and geopolitics.

Is that why the US is willing to let its banks crumble, and those of the world as well, so long as it can stall China’s moves?

These could be mere speculations. But they are trends worth watching in the coming months and years.

COMMENTS