MARKET PERSPECTIVE

By J Mulraj

March 18-24, 2023

The mess created by Joe Biden in US foreign policy

After the end of WW II, USA, whose finances were intact, initiated two plans, GARIOA (Government Aid and Relied in Occupied Areas and The Economic Recovery Act, aka the Marshall Plan, after then Secretary of State George Marshall, to help in the economic recovery of war torn Europe. A Republican Senator, Arthur Vandenburg, proposed the idea of a collective organization to defend Europe against the military might of Russia, giving birth to NATO. Thus USA made a lot of allies, in European countries, and in Japan, out of its foresight, and generosity, in economics and defense.

In October 1973 Arab forces, led by Egypt and Syria, launched a war, known as the Yom Kippur war, against Israel, in Sinai Peninsula and Golan Heights, occupied by Israel in 1967. Israel emerged victorious. Arab nations, led by Saudi Arabia, imposed an oil embargo, and sharply raised the price of crude oil, resulting in the first oil price shock to the developed world. US President Nixon sent Henry Kissinger to negotiate an end to the oil embargo. The historic deal that ensued not only resulted in Saudi Arabia, the largest oil producer, becoming a US ally, but also laid the foundation for the US $ becoming the world’s reserve currency. Saudi agreed to price its crude oil in US $, giving birth to the petrodollar, in exchange for military protection. USA became a triple winner! The embargo ended and petrol became cheaper; the petrodollar created demand for USD, which, in effect, exported its inflation; and USA got a huge customer for its defense equipment.

So USA then had friends and allies and goodwill in Europe, in Japan, in Saudi Arabia and also, by virtue of its economic dominance, in other countries. Alas, it has, over time, lost some allies and distanced others. This is sad, because USA is a liberal democracy which values freedom of speech and equality, in contrast to China, a one party system that does not have free speech nor privacy.

The US encouraged EU to reduce its dependency on cheap Russian gas, delivered via pipelines, including the two Nordstream (veteran journalist Seymour Hersh believes USA deliberately destroyed both, in order to cut the umbilical cord between Germany and Russia). The impact on the economies of European countries of such acts has been devastating. Bereft of cheap energy, EU companies are finding it unviable to continue operating in Europe and are contemplating shifting a part of their manufacturing to other countries. German BASF, the world’s largest chemical company, is thinking of a shift to China (China now buys more crude oil from Russia than from Saudi!) EU citizens are facing high energy prices to heat their homes. EU, as an ally to USA, is peeved that it, having egged EU to cut its dependence on cheap Russian gas, the US is now overcharging EU with far more expensive American LNG.

Saudi Arabia has also been peeved at its ally, USA, after its efforts to replace fossil fuel energy by renewable energy. In May 2022, the US Senate passed a NOPEC bill (No OPEC) in order to pressure OPEC to reduce oil prices. As the largest oil producer, Saudi Arabia lashed out at NOPEC. USA is pushing banks to pursue ESG, or Environment, Society and Governance, norms whilst lending. This has resulted in banks denying fossil fuel companies funds for exploration or expansion. Earlier, in May 2021, US intelligence agencies had concluded that Saudi Crown Prince was involved in the Khashoggi murder. In a visit to Saudi Arabia by Biden in July 2022, MBS welcomed him with a fist bump, in sharp contrast to the warm welcome he gave Xi Jinping during his Dec 2022 visit. Biden failed to get assurances from MBS that oil prices would be brought down by increasing production, so as to bring down petrol prices in USA, which were becoming an issue in forthcoming mid term elections. However, MBS agreed to sell his oil to China in renminbi, instead of in US $, thus watering one leg of the earlier agreement.

To be fair, USA has had some notable foreign policy successes. Such as the Abraham accords, a series of treaties, facilitated by USA during the Trump Presidency, to normalize diplomatic relationships, to normalize diplomatic relationships between Israel and four countries, viz UAE, Bahrain, Sudan and Morocco, signed between Aug-Dec 2020. Other countries are expected to sign in future. Biden also launched AUKUS in Sep 2021, a trilateral defense pact between Australia, UK and USA, under which UK will build and supply Australia with nuclear powered (but not nuclear armed) submarines, primarily as a joint defense against China. USA has also developed the QUAD alliance, a strategic dialogue between Australia, India, Japan and USA, primarily to contain China.

So, sadly, the US has gone from Dale Carnegie’s ‘how to win friends and influence people’ to ‘how to lose friends and distance people’. Nothing, though, that can’t be corrected.

China, meanwhile, has shown its political heft, in stitching a deal between Iran and Saudi Arabia, to re-establish diplomatic relationships. Both countries seek a big buyer for its crude, which is China, and have agreed to price it in renminbi, instead of in USD, dealing a blow to the petrodollar. De-dollarisation has gathered further momentum after 18 countries agreed to trade in Indian ₹ instead of in US $. Seventeen countries sold part of their holdings in US T-bills.

China is also trying to arrive at a negotiated end to the Ukraine conflict. Xi Jinping is currently meeting with Putin in Moscow and may talk to Zelensky over a video call. USA is overtly seeking a Russian withdrawal from all Ukranian territories, (which would never happen) but would be secretly relieved, as its monetary and equipment support to Ukraine is becoming onerous.

There is a delicious irony exposed recently. Biden is ordering 401K retirement funds to invest money using ESG norms. Trustees of 401K money are obligated to invest funds in order to fetch the highest returns, and ESG norms don’t provide them. Biden vetoed a bill seeking to negate his order. The irony is that whilst pushing ESG norms on its own retirees, to save the environment, (the E in ESG), in the same week Biden provided some further monetary and military assistance to Ukraine, which would help destroy it!

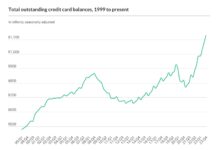

USA also witnessed a banking crisis, which appears to have been averted, but it is actually just kicking the can down the road by a year. This is how. Treasury Secretary Janet Yellen created a backstop facility under which banks holding long dated Government bonds and mortgage backed securities, whose market value has fallen due to hike in interest rates by the Fed., can give them as collateral to the backstop facility. They get a loan for full value, not depreciated value, for the bonds. The loan is repayable after a year. That is kicking the can down the road by a year.

Besides that, the US Treasury will run out of funds. Federal Deposit Insurance Corporation, FDIC, has a fund to guarantee bank deposits up to $ 250,000. The fund has $ 128 b. in it. US banks have $ 17.6 trillion deposits. So if Janet Yellen says all deposits are secure, one wonders where the rest of the money will come from! as FDIC can cover only 0.6%.

The banking crisis spilled over to Switzerland, where badly managed Credit Suisse, was forced by the Swiss Supervisor, FINMA, to be taken over, for $3 b. in an all stock deal, by UBS. As part of the deal, Credit Suisse’s AT1 bonds, issued earlier, to raise $ 17b., were wiped out. AT1 bonds were issued after the 2008 global crisis. In essence they are perpetual bonds, relieving the issuer of repayment obligations, for sacrifice of which holders get higher interest rates. The prospectus, at the time Credit Suisse issued them, allowed the Regulator to wipe out the bonds under certain circumstances. In effect, by effacing AT1 bonds, shareholders got more.

Two central banks, US Fed and Bank of England, raised interest rates by 0.25% last week, less than the 0.5% earlier expected, before the banking crisis. The runs on banks weakened their resolve, which is probably right.

Last week the BSE sensex dropped 462 points to end the week at 57527.

A negotiated ceasefire in the Ukraine war will lead to a rally. The collective west is against a ceasefire under which Russia could retain a part, or all, of captured territory. It had, in fact scuppered an earlier negotiated settlement, brokered by Erdogan, a month into the conflict, which would have saved thousands of lives. So its yet unclear if there will be one.

The banking crisis isn’t over; as explained in my previous column, the structure of the industry creates an asset-liability mismatch. Banks borrow using short term deposits and lend/invest long term. So any jolt to investor confidence can result in a run! And long term assets can’t be easily disposed. Rising interest rates, to fight inflation, reduces the value of bonds invested in. Although Fed Chair Powell has indicated that the rising interest rates cycle is getting over, it may not be so. Inflation continues to rise, both energy and food inflation, and, should China open up its economy and hoover up global commodities, it will be higher still.

Global tensions, continuing inflation and high interest rates are not the signals of a start to a bull market. The bear still growls.

Picture Source: https://www.globaltimes.cn/page/202211/1279451.shtml

Comments may be sent to: jmulraj@asiaconvere.com

COMMENTS