India witnesses flight of capital and millionaires

RN Bhaskar

The image has been generated through https://deepai.org/machine-learning-model/text2img

In a way, this was to be expected. Geopolitical turmoil has resulted in political uncertainty about the future of several economies. Millionaires and capital which appeared to be very safe in some territories, suddenly find itself at risk. Savvy fund managers want to ensure that their money is safe. The crisis appears to be greater for India.

Significantly, the cut-off year appears to just around the same time that the Maidan revolts took place. Theswe were agitations funded by the CIA, aimed at toppling the government in Ukraine, and to instal a pro-West leader named Volodymyr Zelenskyy at the helm of affairs (https://www.theguardian.com/world/2024/feb/20/maidan-kyiv-protests-10-years-ukraine).

Suddenly, the whole of Europe began feeling jittery. But NATO allies, keen on bringing Ukraine into the NATO fold, kept assuring Zelenskyy that victory would be his, and that Russia would soon capitulate. But almost everyone misjudged Russia’s tenacity and ability to weather the initial losses and stage a counterattack. This overconfidence born of arrogance was to exhibit itself once again when both the US and Israel attached Iran. In both war theatres, the US began losing face, credibility and money (free subscription — https://bhaskarr.substack.com/p/trump-fiddles-and-usas-biggest-exports).

That could explain why money began being moved around more rapidly – from one country to another.

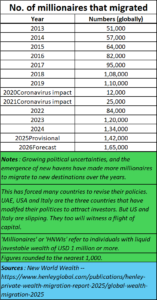

Henley and Partners began recording the way millionaires move. If you look at the number of people who chose to move, you find discover that this number of migrating millionaires has tripled since 2013 from just around 51,000 in 2013 and is forecast to 165,000 in 2026. You can find earlier reports of Henley at https://asiaconverge.com/2023/06/india-stores-gold-overseas/).

Henley and Partners began recording the way millionaires move. If you look at the number of people who chose to move, you find discover that this number of migrating millionaires has tripled since 2013 from just around 51,000 in 2013 and is forecast to 165,000 in 2026. You can find earlier reports of Henley at https://asiaconverge.com/2023/06/india-stores-gold-overseas/).

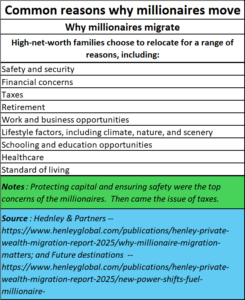

The factors that appear to be at work involve protecting capital and ensuring safety of millionaires followed by the issue of taxes.

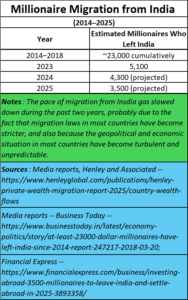

In India, there were several issues at work. First was the acknowledged fact that more people were surrendering their passports than ever before (https://asiaconverge.com/2023/09/inflated-views-and-deflated-economy/). Then in 2021, there was Amit Mitra, (former finance minister of West Bengal, and earlier the secretary general of FICCI) who disclosed that at least 35,000 HNIs (high networth individuals) had quite India since 2014 (https://www.telegraphindia.com/business/35000-high-net-worth-entrepreneurs-left-india-during-narendra-modi-regime-amit-mitra/cid/1835449).

Against this backdrop, Henley’s figures do seem a bit understated.

Why were Indians quitting this country’s shores? Clearly, the numbers surrendering their passports was increasing. So was the number of millionaires. Something seemed to be amiss.

The answer lies in a poor investment climate, a highly polarised climate where communities were being pitted against communities and a regime where raids and seizures becme common. These raids and seizures were often interpreted as being politically motivated. Whatever the reasons, the numbers indicated that millionaires, and even common folk, were voting with their feet. Capital and millionaires can be quite flighty at the first sniff of trouble.

Then why did the numbers begin declining in 2023 and 2024 according to Henley’s finings? This was probably due to the fact that migration laws in most countries have become stricter, and also because the geopolitical and economic situation in most countries have become turbulent and unpredictable.

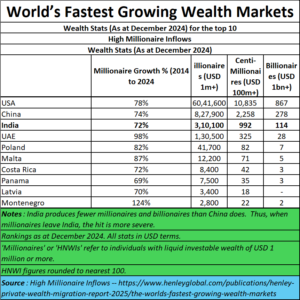

This is further corroborated by the accelerated increase in outward FDI, to the point where India now confronts a negative net FDI (free subscription — https://bhaskarr.substack.com/p/indias-net-fdi-is-collapsing). This is also borne out by data that shows that India lost millionaires, while many other countries saw an inflow of millionaires.

True, even China lost millionaires. But then, China produces more millionaires each year than India does. The loss does not matter much to China. But it hurts India immensely, because these people could otherwise have invested in India, and created weath and jobs. India needs both of them desperately, though the government may not admit this publicly.

Moreover, China’s flight of millionaires must be adjusted against the inflow of millionaires in Hong Kong.

One more thing: While the 2024 data shows USA and UK continuing to attract millionaires, the figures for 2025 may present a different picture. People have begun leaving the US. Its dollar is becoming weaker. And UK (along with Germany) is already the sick man of Europe, propped up by dollops of financial and trade support from the US. The UK which used to be a haven for hot money – much of it invested in real estate in London and elsewhere – is now facing selling pressure. It is therefore best to wait for next year’s numbers.

Fastest growing wealth markets

Fastest growing wealth markets

Henley believes that the US was the fastest growing market. But that was before Trump came on to the scene. Next year’s figures could change this picture. If current trends persist, the US could slip into negative territory.

Ditto with India. Much of the money that came into India was because of a speculative market. This is obvious from the disclosures about Jane Street (now banned, but with appeals pending before courts). They suggest that the special laws created for whetting the appetities of speculative investors (through GIFT City in Ahmedabad) and through benign latitude fiven to high-frequency-traders (https://www.business-standard.com/markets/news/jane-street-fallout-high-frequency-trading-quant-firms-under-lens-125070600814_1.html). Maybe, next year will present a different picture for India as well.

Moreover, India does not respect capital. Consider how it has allowed capital to get destroyed. If Kingfisher, the airline floated by Vijay Mallya, had been sold as a going entity, the banks ould not suffer losses. But it was frozen till its value became zero. Maybe, millionaire Vijay Millya would not have had to flee. Durings raids and seizures, bank accounts are sealed and good like gold and diamonds impounded. People are arrested first, without even the trial taking place Money and millionaires have to be treated differently. And disputes should not allow the capital to be eroded.

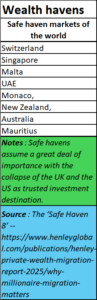

Switzerland seems to be most favoured territory, trouncing even Singapore. But that could be because Switzerland can be more flexible with its wealth and banking laws than Singapore. But the reputation of Singapore as a haven has been increasing dramatically. This centre too could trounce Singapore in the future, especially because the whole of Europe could be on a downwar4d spiral, unless relations with Russia are improved.

Conclusion

With US dollar buckling under immense pressure, and with UK and Germany wobbly at the knees, wealth is likely to remain more skittish than ever. Expect more millionaires to be on the move. Note how Italy and Germany has sought to remove their gold deposits from the vaults in the US. Also observe how many countries, including the US ally Japan, have opted to stay clear of the US Treasury bills.

Today, the most sober and reliable voices, keen on promoting peace are Iran (notwithstanding the shrill cries from the neocons), China and Russia. The whole of Europe, but for some exceptions like Ireland, Norway and Spain, have been reluctant to condemn or chastise the US for the horrendous killings in the Middle East.

BRICS continues to grow stronger with each passing month, as does ASEAN, notwithstanding the sabre-rattling from the US.

The world order is rapidly changing, and with it, the flight of capital and millionaires. The old havens may not be safe any longer.

———————–

Do view my latest podcast “India’s net-FDI collapses” You can view it at https://youtu.be/AjPGCOAnOk0

———————–

And do watch our daily “News Behind the News” podcasts, streamed ‘live’ every morning, Monday through Friday, at 8:15 am IST. The latest can be found at https://www.youtube.com/live/cASXR00oDOQ?si=3sLOxLVOYXB5iIsk.

———————–

COMMENTS