https://www.firstpost.com/business/falling-price-of-food-isnt-always-good-news-it-signals-deep-trouble-for-indias-rural-economy-5552731.html

But for oil, inflation is down. But the rural economy is still hurting

RN Bhaskar — Nov 15, 2018

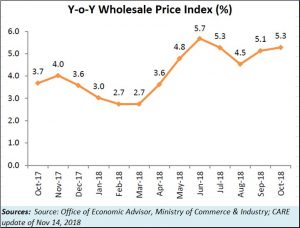

First the bad news. Inflation continues to climb (see chart). The wholesale price index (WPI) kept climbing since August this year,

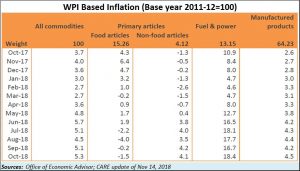

But when one looks at the items that make up the WPI basket (see the next chart), you think there could be something to cheer about. You realise that the culprit behind the climbing WPI was oil – hence fuel and power – and manufacturing (which uses oil).

But when one looks at the items that make up the WPI basket (see the next chart), you think there could be something to cheer about. You realise that the culprit behind the climbing WPI was oil – hence fuel and power – and manufacturing (which uses oil).

Discount the rise in oil prices and it is surprising to see that the prices of both food and non food items have actually climbed down.

When it comes to food prices (which enjoy a sizeable weightage of 15.26% in the WPI basket of 100) , prices continued to climb down for the fourth consecutive month – from -2.2 in July 2018, -4 in August, -0.2 in September and -1.5 in October. Even non-food items registered a cline =– though only in October over September – from 4.2 to 4.1.

This is strange because almost everyone was predicting a rise in food inflation. The government – possibly as a pre-election sop – had announced MSPs (minimum support prices) for several crops, hoping to stanch farmer distress. Everyone therefore expected a surge in agricultural prices. Instead prices continued to climb down. And the question ‘why’ was on the lips of many.

This is strange because almost everyone was predicting a rise in food inflation. The government – possibly as a pre-election sop – had announced MSPs (minimum support prices) for several crops, hoping to stanch farmer distress. Everyone therefore expected a surge in agricultural prices. Instead prices continued to climb down. And the question ‘why’ was on the lips of many.

The answer was simple. MSP had clearly not worked.

When the government announces MSPs for rice and wheat, this is backed up by procurement by government agencies. Unless MSP is backed up by procurement – either by the trade, or commodity markets, or the government, the mere announcement of MSP has no meaning at all.

Predictably, traders refused to pick up crops at their MSPs from farmers. The farmers desperate to sell, must have agreed to sell them at any price. It is quite possible that the farmers resorted to distress sale, maybe at prices lower than what they used to get earlier, because the traders just refused to pick up produce at the recently announced MSPs.

That is when agriculture can become a value-destroyer, unless supported by robust market mechanisms (http://www.asiaconverge.com/2018/03/record-food-grain-production-but-value-destruction-as-well/). After all, nobody can force a trader to buy. He can always claim that he either does not have the money, or does not have the confidence that he will be able to sell the produce to someone else.

And since the government has not bothered to strengthen the commodity markets with a market maker who can ensure that prices remain high – the ill-famed National Spot Exchange Ltd (NSEL) tried to play this role, but by cutting too many corners.

There was clearly a vacuum. Result: there was an MSP announced. But there was no market. Continue with such a situation for some time, and the farmers will crash to their knees because they have little sustenance power. The traders win because the government has not even bothered about expanding the warehouses, and food storage facilities at reasonable prices (http://www.asiaconverge.com/2017/08/is-wdra-a-functioning-organisation/).

It is quite possible that non-foot WPI and manufacturing will also fall in coming months for two reasons. Oil prices have begun to taper off. Second, market demand is still too weak. With lower input costs, but with weak markets, expect prices to fall in the coming months.

Yet, as a CARE report points out, prices of potato have gone up and can spike the food inflation number in the coming months.

It is also important to read the WPI figures in conjuction with figures for the Index of Industrial production. Last month, IIP stood at 4.5% which is slightly lower than CARE’s estimate of 4.9%.

Industrial production will pick up if there is consumer purchasing power in the markets. Or there should be a resurgent in export orders. At the moment, there is little sign of that happening. A trigger for industrial growth could be accelerated infrastructure spending. But the government has little money of its own. And its reluctance to be improve its dispute resolution mechanisms.

This is one time when falling prices spell trouble – both economically and politically.

COMMENTS