https://www.freepressjournal.in/analysis/government-paying-lip-service-to-solar-and-ev-players/1426663

Is the government serious about solar power and EVs?

RN Bhaskar December 27, 2018

Last week, possibly in order to soften the pain for an electorate in the months preceding general elections, the government (through its finance ministry) reduced GST on several items. Among them was the reduction of GST on batteries from a crippling 28% to a still painful 18%.

At the same time, another arm of the government – the power ministry – announced (https://powermin.nic.in/sites/default/files/webform/notices/scan0016%20%281%29.pdf) that it would be promoting electric vehicles (EVs) by slapping a cess of Rs.25,000 on each new conventional vehicle fuelled by hydrocarbons. The ministry conveniently forgot that there are better ways of promoting EVs than by charging customers.

In an earlier, but critically important, move the government also slapped a 25% import duty (safeguard duty) of 25% on solar panels.

In an earlier, but critically important, move the government also slapped a 25% import duty (safeguard duty) of 25% on solar panels.

Take the three together, and you get an idea of how the government thinks. Its policies run counter to its stated mission of introducing environmentally friendlier cars, encouraging solar power, and of making both affordable.

All the three moves listed suggest that the government is merely paying lip service to the solar and EV sectors. It actually wants to protect its oil and gas businesses and is not serious about either solar or EVs,

Let’s look at the three sectors listed above one by one.

Take batteries first. India’s battery demand currently stands at around 2.6 billion batteries for gadgets – going purely by what Eveready Industries has stated in its 2017-18 annual report. It states that it currently sells around 1.3 billion battery units which account for 50% of domestic market share.

The market for bigger batteries – made by the likes of Exide Industries and Amara Raja — is even bigger.

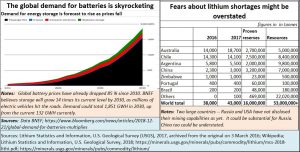

But demand from India pales into insignificance when compared to global demand for batteries. Bloomberg estimates the current demand at 132 GWH (see chart) and believes that this could soar by at least 14 times by 2030. The biggest users are bound to be EVs, consumer gadgets and solar power installations for homes and offices.

In fact, the figures seem to tie in with the major disruption that is expected in the power and automobile sectors. To understand how tremendously disruptive these forces could be, it is worth watching a one-hour lecture by Tony Seba on Youtube (https://www.youtube.com/watch?v=2b3ttqYDwF0).

Batteries are critically important for both EVs and solar power units. So why keep the GST at 18%. They are a necessity. The GST should not have been over 5%. As an MNRE (ministry of renewable energy) document (https://mnre.gov.in/file-manager/UserFiles/Implications-of-GST-on-delivered-cost-of-Renewable-Energy.pdf) itself points out, the effect of this high GST will result in higher end tariffs by 12-20% depending on whether the unit is on-grid or off-grid.

Thus the higher GST on batteries will make EVs, mobile phones and rural solar power more expensive by as much as 20%. That is no way to be customer friendly. The only saving grace is that there are no import duties for batteries. What a relief!

Take solar panels next. The government wants to promote solar power. But it has slapped an import duty of 25% on solar panels, ostensibly to protect solar panel manufacture in India. Check with solar players, and they find that suggestion laughable. Domestic production of solar panel is still too fragmented and too small to be of any major relevance to the solar industry. Most players still import such panels in spite of high import duties. Result: the customer will pay more for solar power as well.

Take the third issue – EVs. Why is the government so keen on charging customers of conventional vehicles Rs.25,000 more? The transition towards EVs is now unstoppable as Tony SEba points out. The government should instead be dusting off the old proposal made by the automobile association in April 2016 (http://asiaconverge.com/2016/04/new-vehicles-for-old/). It had proposed a scheme which would encourage customers to surrender their old (and fuel guzzling) vehicles at designated centres and instead get a 50% excise duty rebate from the government on the purchase of new vehicles. The government has merely to modify that proposal and state that the discount in excise would be for EVs only.

Overnight, there is an incentive for customers to discard (fuel guzzinfg, environmentally unfriendly) old vehicles. The price of EVs falls further for such customers. The government collects more taxes because of an increased sale volume. The steel industry gets vehicle scrap which reduces steel scrap imports. And the switchover to EVs will reduce oil import bills.

One expects the government to think big, and in ways that benefit consumers. Is that too much to expect from the Indian government?

COMMENTS