https://www.freepressjournal.in/business/shankar-sharma-reading-the-market-tea-leaves

Shankar Sharma: The downslide has just begun

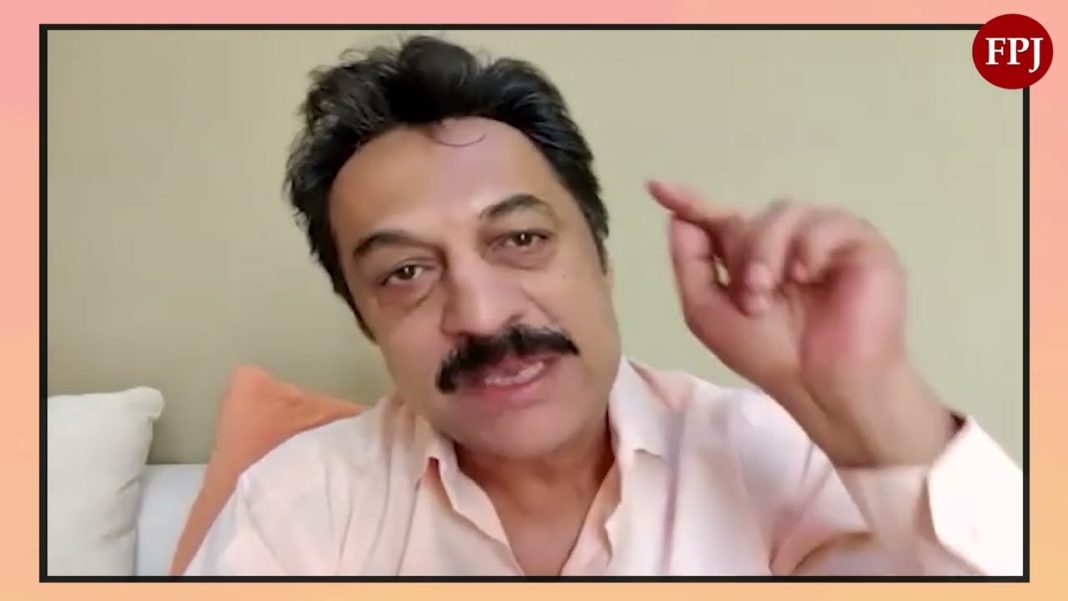

Ace investor and money manager Shankar Sharma is known to deliver robust returns for himself and his clients. Over the years, he has identified sectors and spotted several multi-baggers which have delivered more than 200% plus returns. He is the Vice Chairman & Jt. Managing Director at First Global, a firm with over 30 years of pedigree in the investing business. The main mantra of his firm is ‘Avoid the Big Losses’.

In an interaction with RN Bhaskar, Consulting Editor of Free Press Journal, Sharma discusses the current turmoil in the market, his investment strategies and stated that currently, the Information Technology sector appeals to him.

His advice to investors: “If markets change, you change your game to suit the market. Do a bit of hard work, buy 20 to 25 good small-cap stocks which are inexpensive and they will easily double your money in the next two years.”. Editorial support for this interview has been provided by Dominic Rebello.

Due to the Ukraine crisis, the stock markets are in turmoil, which has affected almost every asset class across the world. How do you see the global markets now?

The markets have seen such turmoil many times earlier. This is neither the first time nor the last time. The important thing here is to understand the context in which the turmoil assumes importance and the context in which the turmoil becomes a non-event. It is very important to focus here. There can be inflation risk, geopolitical risk, rising oil prices and everything else. This is not the first time, it has happened dozens of times earlier in the last 100 years.

But the thing to focus here is at which point in the cycle of the economy and the markets do these problems become serious problems and at which point they become really one of the many other problems. The world will never be short of problems and that’s the way life is. The issue here is that we are making a correlation between these problems and what has caused the markets to get into this turmoil situation. The markets are assuming that stocks are tanking due to Russia’s invasion of Ukraine, rising oil prices, inflationary trends and expectations of tightening of everything. But is that really the case? Or were the markets anyway primed to fall. We are now finding a very convenient set of reasons to explain why the markets have fallen.

But the thing to focus here is at which point in the cycle of the economy and the markets do these problems become serious problems and at which point they become really one of the many other problems. The world will never be short of problems and that’s the way life is. The issue here is that we are making a correlation between these problems and what has caused the markets to get into this turmoil situation. The markets are assuming that stocks are tanking due to Russia’s invasion of Ukraine, rising oil prices, inflationary trends and expectations of tightening of everything. But is that really the case? Or were the markets anyway primed to fall. We are now finding a very convenient set of reasons to explain why the markets have fallen.

The markets just needed a trigger. They just need excuses to get into a kind of a funk. We have had three back to back, very solid years of gains in the stock market. Statistically, if we will go back 100 years or wherever data is available, you will find that if markets have given three years of solid gains, the fourth year will not be an up year. Here 2019 was a very strong year for the global markets, 2020 too was a strong year and 2021 was also a very strong year. So statistically 2022 was not expected to perform well.

There is an almost zero probability that we would have a back-to-back the fourth year of gains. This year had to be a tepid or an outright bad year. It was very clear that 2022 is going to be a tough year; however, the reasons have come later. There was no oil price boom, there was no Russia and Ukraine crisis, and they was not even a hint of a Fed tightening at that point in time.

Things were looking brilliant in 2021, but if markets were going to have a bad year, the reasons will come out of the woodwork to support that point of view.

Let’s flip the situation around and go back to 2004-2005 when we had very sharply rising crude oil and commodity prices. At that point what did equity markets do? They kept going up. They did not even pause to take a breather. Why? Because the context of the market was that it had witnessed three bad deals in the preceding three years. So 2001, 2002 and 2003 in the aftermath of the Dotcom bust, markets had been down for those three years. Then the markets started to rally and so did gold, commodity and crude oil, as it was a young bull market. In a young bull market rising oil prices or whatever else you want to call a problem are ignored as the markets are strong enough to withstand it and they will shrug it off. However, in an ageing bull market, the same problem will bring this bull down to its knees.

Let’s flip the situation around and go back to 2004-2005 when we had very sharply rising crude oil and commodity prices. At that point what did equity markets do? They kept going up. They did not even pause to take a breather. Why? Because the context of the market was that it had witnessed three bad deals in the preceding three years. So 2001, 2002 and 2003 in the aftermath of the Dotcom bust, markets had been down for those three years. Then the markets started to rally and so did gold, commodity and crude oil, as it was a young bull market. In a young bull market rising oil prices or whatever else you want to call a problem are ignored as the markets are strong enough to withstand it and they will shrug it off. However, in an ageing bull market, the same problem will bring this bull down to its knees.

When do you expect the dump slide to get over?

I think the markets have just begun the downslide. I don’t think it’s over by any stretch. This whole year is ahead of us. It’s not behind us. If we for a minute assume this is going to be a tough year and a treacherous year in which we are going to see commodity prices trend higher then I don’t think we have seen much of the damage just yet. I think there is probably more in the markets when they come down, but they do not come down all at once. So, the typical pattern in a fall is — markets are here then they fall then they rally a bit.

This is where the phase where we are in right now. So we are going to be rallying for the next few months, maybe three months we rally because we had a brutal couple of months already. That’s the time when it is the most dangerous because we will say that the worst is over.

So the worst isn’t behind us?

You will repeatedly start to hear that the worst is over. But the worst is not over yet. If you assume for a minute that oil prices are not going to come down for a while, inflation is definitely sticky. It’s a problem for global central banks and it is a problem for RBI as well, which is, in my view very reticent to raise rates, but its hand is going to be forced if you put all that together. And the other problem for a country like India is that the currency itself is highly overvalued. If you look at competing currencies, like the Turkish lira or even the rouble and other currency like the Brazilian real — compared to them the rupee has been resilient and which is actually a problem in an export-driven country. We need a weaker currency as the rupee is overvalued. So if the rupee goes to 80 or 85 it will add further fuel to the fire of inflation. So, I don’t think, right now’s the time to start saying when things will become better. I think right now it’s time to become conservative in your portfolio strategy rather than become aggressive. I don’t say this as a piece of investment advice; I am saying that strategically, this pitch is a little trickier than what we have seen in the last two years or three years.  On this pitch, we still need to get runs, but we will get runs only when we are out there on the pitch, not by sitting in the pavilion and being very careful. Be very choosy in what you are going to invest in.

On this pitch, we still need to get runs, but we will get runs only when we are out there on the pitch, not by sitting in the pavilion and being very careful. Be very choosy in what you are going to invest in.

Over the last 21 years, the share of the dollar in reserve currencies in the world has been going down little by little. It is still a very large and dominant exchange, but currently, the dollar is not the most favourable currency for many countries right now. Recently the Wall Street Journal talked about Saudi Arabia wanting to sell its oil in yuan. When the dollar gets weak, there is panic because the most stable currency is getting weaker. What kind of implications will we see if that happens?

One of the most interesting take-aways from this whole Russia crisis is that it is a big anti-globalization moment. I mean that we have seen the world become more and more insular. Countries are watching out for their own interests rather than opening up their doors to the free flow of trade and commerce over the last few years after the global financial crisis that happened in 2008. Countries have decided to become more inward-looking and create barriers for imports. In that scenario, this current situation adds one of the last few nails into that coffin of globalization.

All countries which are non-friendly or at least neutral to the US feel that they need to watch out for themselves. Because one fine day they will switch off the SWIFT and cut off the payment system and impose sanctions. And these countries from being decent economies can turn into rubble. So, we need to create our own backbones and our own infrastructures, which also means creating a robust mechanism to trade a non-dollar format. One is the payment system and the other is in what form do you do this payment because if you do dollars you will do you will have to use only SWIFT as there is no other method. Every SWIFT transaction is done in dollars and that’s the way the banking system works.

But if you want to bypass that, it means you will have to do a non-dollar transaction I think the proportion of non-dollar transactions will rise exponentially after this. The Saudi move is just one of the earliest. India too will have to do a deal with Russia in some form but I don’t how that will pan out. We will have to bypass the dollar and go again to the old rupee rubble transaction. The world, especially countries that are developing like China or India will say that we cannot be held to ransom by a single country.

Has the United States weaponized currency?

Yes, absolutely. It has weaponized currency by weaponizing the payment mechanisms. It has weaponized the economy and the economic tools, which are more potent than arms and armaments. That’s the way they have looked at their dominance of world trade and world commerce.

Will gold gets stronger?

Gold may or may not get stronger, but alternate methods of storing value such as cryptocurrencies can get stronger as money is expected to flow into them. Like art crypto too has no underlying but they surely have value.

So alternate method of investment will gain…

Yes. Things will bypass the dollar system and many countries are thinking long and hard about this situation. It is a very critical point in world history. I think we will look back on this like the Bretton Woods moment or the Plaza Accord of the 80s. It’s that kind of moment.

With countries becoming more inward-looking, with global trade breaking up, there are commodities like copper, lithium and oil that witness global trade. How does that pan out with countries becoming insular?

I don’t have any idea, it is way above my pay grade to think of all these even as global leaders are grappling with the situation — that how on earth will the movement of gold or commodities take place and how do we pay if containers themselves are not available? Because some of the shipping lines will say I will not trade with this country as it is happening in the case of Russia. These issues raise logistical complexities, from payments to the currency in which you will make those transactions to actual physical movements. These are way out of our depth to even go near about answering this question

So, this effectively means that commodity prices will keep increasing…

There are going to be shortages. Whenever there are shortages irrespective of demand the fact that supply will be a problem to just go from point A to point B, can mean stronger commodity prices and not just hard commodities like oil and copper and lithium, but even soft commodities like Agri produce. We have seen what wheat and sugar have been doing. I mean all this will have a more damaging effect than just a stock market fall because the stock market fall or collapse doesn’t really affect a broad country like India. Just 5% or 10% rise in the stock market doesn’t really affect day to day life, but rises in wheat, sugar and oil will have a downstream ripple effect that is far more damaging. Yes, commodity prices can be elevated because of the logistical challenges of payments and transport.

What would you recommend investors to do? Sleep on cash?

No, not at all. What I’m saying is basically that Indian investors have to narrow down their choices to one area of the market which looks the most attractive. There’s no hard and fast rule in investing. My view is that the major companies in India, excluding the IT, other sectors like banks, financials, FMCG and autos are unlikely to give you a 15- 20% compounded return for the next few years. I think they are already of the size when just growth will become a struggle. So I don’t expect great performance on those stocks. But the market is always a giant wheel if something doesn’t perform something else will. In the giant wheel, the top cars are moving down. The top cars are the Nifty heavyweights and the bottom cars are the small caps and that area is buzzing. There are several good companies which are very inexpensive. In my view, those are the areas if you choose 20 – 25 good stocks in that zone then I think in two years you will easily double your money. So it is a perfect market to go out there and do a bit of hard work. This market will require harder work than the previous couple of years because it’s not a broad bull market. But that’s the fun of investing. If markets change, you change your game to suit the market. This market will require you to really understand companies at a deeper level. And if you get by 20 – 25 of them, I think two years from now, you will really be laughing all the way to the bank.

Now a question that is not market-related but Shankar Sharma related. Why do you prefer to be outside India?

I have lived abroad now for about 10 to 11 years. The primary reason was that I was stagnating when I lived in Mumbai for the preceding 30 odd years. It’s the same set of people you’re hanging out with. There’s no new thought, or no incremental new knowledge coming into me. I thought to myself let’s go abroad and spend a year.

I never thought I was going to stay on for 10 years. I said let’s try it for a couple of years and see how it goes. It’s a change of scene.

But I find that living abroad gives me a far wider perspective because I meet people from all over the world in a global city like Dubai. I hang out with a bunch of Russians and understand their perspective. I meet Ukrainians and understand their perspective. I understand other Commonwealth of Independent States (CIS) countries and their perspective.

It is a very global city as there is a 100% ex-pat population and I find myself growing in my knowledge. I am a knowledge hunter permanently and for that reason, I choose to spend more time abroad.

COMMENTS