http://www.freepressjournal.in/npa-albatross-around-banks-neck-rn-bhaskar/857767

The scourge of NPAs

The markets are still reeling. They are trying to cope with the NPA burden. Estimated at Rs.4 lakh crore, NPAs threaten to become almost 1.5 times the cumulative market capitalization of these banks. Some of these issues have already been dealt with in these columns, Recounting the great Indian bank robbery and When banking becomes a nightmare.

The FPJ-IMC Forum recently took the initiative of hosting a discussion on ‘NPAs: Who took the money?’ In his keynote address at the forum, RBI Deputy Governor S S Mundra talked about the urgent need to address issues related to governance, deficit, skill gaps (more evident now since there is a focus on making stressed assets productive again), leadership vacuum and misplaced incentives.

With the new data that is now available it is clear that what hurt India’s public sector banks (PSBs) most was their willingness to take on more risky lending, even when they were not geared to generate big profits.

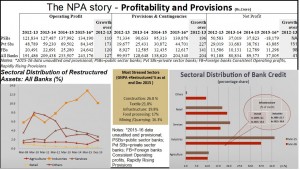

Look at the figures carefully. Private sector banks lent more riskily than public sector banks. The loans and provisions and contingencies of private sector banks shot up more sharply than those of PSBs. Provisioning went up by 227%, during the period 2012-13 and 2015-16, as against 196% for PSBs. But private sector banks fared better because they could generate more profits.

Operating profits (before interest, depreciation and taxes) climbed faster for private sector banks – at 173% — compared to PSBs (110%) during this period. In fact, private sector banks were more aggressive in making profits than even foreign banks. This could become a worrisome aspect in these years of economic turbulence.

How much of these NPAs could be attributed to a worsening business environment, and how much is because of collusion, is yet to be determined. One only hopes that the RBI will soon come out with these figures as well. True, some loans went bad because of an economic downturn. Steel and other commodity prices crashed. But within the steel sector, why did the banks give loans to steel mills using electric arc furnaces (EAFs)? Surely every banker knows that EAFs are not viable. They knew that these units were stealing electricity. Even the loans against brand names were deplorable .

Ditto for loans to groups that were known to have borrowed overseas. One corporate group owes a foreign bank $3 billion, and the bank is now proceeding to use all means to recover this money. The group’s exposure to Indian PSBs is also quite large. It is only now that PSBs, under directions from the RBI and courts, have begun to demand that the group sell off some of its assets to repay Indian loans. Obviously, some of their global assets will also be vetted by the foreign banks.

But the answer does not lie in driving the banking business aground. It lies in sweating existing assets, and generating profits from them. As RBI Governor Raghuram Rajan said on February 11 to a CII gathering, “There are two polar approaches to loan stress. One is to apply band aids to keep the loan current, and hope that time and growth will set the project back on track. Sometimes this works. But, most of the time, the low growth that precipitated the stress persists. The fresh lending intended to keep the original loan current grows. Facing large and potentially unpayable debt, the promoter loses interest, does little to fix existing problems, and the project goes into further losses.

“An alternative approach is to try to put the stressed project back on track rather than simply applying band aids. This may require deep surgery. Existing loans may have to be written down somewhat because of the changed circumstances since they were sanctioned. If loans are written down, the promoter brings in more equity, and other stakeholders like the tariff authorities or the local government chip in, the project may have a strong chance of revival, and the promoter will be incentivised to try his utmost to put it back on track.”

Another chart depicted alongside shows that the impact of restructured assets is already declining in most sectors. Hopefully, with the newly introduced Bankruptcy Code, some of the unproductive assets will get hocked and the painful process of restructuring will soon begin.

To quote Rajan once again, “The market turmoil will pass. The clean-up will get done, and Indian banks will be restored to health. While we should not underplay the dimensions of the task, we should be confident that it is manageable and that the government and the RBI will do what it takes to make sure that banks are able to support the tremendous growth that lies ahead.”

COMMENTS