https://www.moneycontrol.com/news/trends/current-affairs-trends/opinion-why-modi-govts-push-for-ethanol-as-cheaper-fuel-is-not-good-for-india-2950791.html

Is the ethanol-for-vehicle-fuel concept a red herring for other interests?

RN Bhaskar — Sep 17, 2018

There are five reasons why the push for ethanol is not as good as it sounds.

All of a sudden, a very strong lobby appears to be emerging advocating the use of 20% ethanol in petrol for use by petrol driven cars. The argument favouring the use of ethanol is that it is (a) cheaper than petrol, (b) good for reducing the fuel related import bills, and (c) gives a higher price to sugarcane growers. In fact, all the three assumption are fallacious as shall be seen a bit later. Furthermore, there are dangers that trying to push through such a policy might actually hurt automobile manufacturers far more than they would like to state at the moment. Nobody likes to oppose an idea mooted by a very strong political lobby.

Take the facts first. The proposal for blending petrol with ethanol (another word for industrial alcohol) gains in decibel volume each time India faces a glut in sugar production.

One of the arguments is that the use of ethanol will allow for excess sugarcane to be used for producing ethanol. This way sugar prices will stabilise. It does not take into account the years when sugar production is low.

Another argument is that sugar production in India will continue to grow if it can benefit from the sale of ethanol as vehicle fuel. But should it be allowed to grow? This is because sugarcane is a water intensive crop. While it is okay for the crop to be grown in UP where  the state gets its waters from perennial rivers, it is not okay for Maharashtra which does not have enough water. The industry uses up groundwater resources as well, which harms the entire state, not just the sugarcane belt. As the Indian Sugar Mills Association (ISMA) pointed out in March this year, out of the 2017-18 production estimated at at 29..5 million tonnes, Uttar Pradesh is expected to produce 10.513 million tonnes, Maharashtra 10.13 million tonnes and Karnataka 3.545 million tonnes. The output of sugarcane in Maharashtra must be brought down, which is possible if water consumption is priced. Maharashtra’s politically powerful sugar producers have ensured that the rest of the state does not get the water. Hence only 20% of the state’s cultivable land is irrigated compared to 67% for neighbouring Madhya Pradesh. The sugar industry in this state has thus become a parasite which causes farm distress for other farmers. Diversification into ethanol is therefore risky. It is okay for countries like Brazil to promote ethanol use as a vehicle fuel. Itg has lots of land, huge amounts of water (thanks to the Amazon, and a second river flowing underground), and few people. India has less land, little water and lots of people. Comparing India and Brazil just does not make sense.

the state gets its waters from perennial rivers, it is not okay for Maharashtra which does not have enough water. The industry uses up groundwater resources as well, which harms the entire state, not just the sugarcane belt. As the Indian Sugar Mills Association (ISMA) pointed out in March this year, out of the 2017-18 production estimated at at 29..5 million tonnes, Uttar Pradesh is expected to produce 10.513 million tonnes, Maharashtra 10.13 million tonnes and Karnataka 3.545 million tonnes. The output of sugarcane in Maharashtra must be brought down, which is possible if water consumption is priced. Maharashtra’s politically powerful sugar producers have ensured that the rest of the state does not get the water. Hence only 20% of the state’s cultivable land is irrigated compared to 67% for neighbouring Madhya Pradesh. The sugar industry in this state has thus become a parasite which causes farm distress for other farmers. Diversification into ethanol is therefore risky. It is okay for countries like Brazil to promote ethanol use as a vehicle fuel. Itg has lots of land, huge amounts of water (thanks to the Amazon, and a second river flowing underground), and few people. India has less land, little water and lots of people. Comparing India and Brazil just does not make sense.

Third, sugar has not always been plentiful in India. . As the CARE chart shows, there have been years when India has been a net importer of sugar (see table 1). Building a fuel policy on an uncertain crop is foolhardy.

Third, sugar has not always been plentiful in India. . As the CARE chart shows, there have been years when India has been a net importer of sugar (see table 1). Building a fuel policy on an uncertain crop is foolhardy.

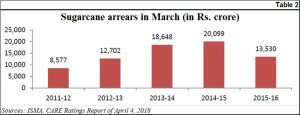

Fourth, sugar factories haven’t always been fair to the farmers. They have paid the farmers much later than they should be (see table 2). With the political and financial support they get from the government, they should be paying farmers upfront, especially since the farmers are bound to a specific sugar factory (each sugar factory is given a command area and the crop produced there must go to the sugar factory alone). There is thus no free pricing, or free movement of goods for sugarcane growers. In other words, the sugar producers always appear to have the winning hand, not the sugarcane growers.

Finally, there are good reasons to believe that the demand for ethanol is only to enhance the profits sugar barons already make, but off the sugar books (https://www.business-standard.com/article/markets/sugar-mills-divert-ethanol-raw-materials-to-alcohol-makers-115091800007_1.html); even the Government’s Tax & Duty Manual of September 2018 on Alcohol Products Tax and Reliefs Manual — https://www.revenue.ie/en/tax-professionals/tdm/excise/alcohol-products-tax/alcohol-products-tax-and-reliefs-manual.pdf — mentions the need to ensure that diversion of ethanol to alcohol does not take place). Moreover, with the government offer of Rs.43.70 yo Rs. Rs.59.10 per litre of ethanol compared to over Rs.750 a litre in the open markets (Amazon prices) is adequate cause for tempting diversion. Use of ethanol for making liquor pushes up profits by another 10-100 times.

Consider Table 3 Take into account the following:

- Ethanol is supposed to be cheaper than petrol. Not really. To compare ethanol with petrol, take the international cost of petrol and then compare it with ethanol costs. If the same duties and taxes are imposed on ethanol, chances are that ethanol will turn out to be almost as expensive as petrol. Then add back the cost of water that sugarcane growers get free, but the oil industry must pay for. Add taxes too (agricultural income applicable for sugarcane is tax-free). You will then get a better picture of the cost of ethanol vs petrol. Then take away the minimum price support mechanism that sugarcane enjoys. The petroleum industry enjoys no such support. Then see if ethanol remains cheaper than petrol.

- Remember, disruption in automobile technology is already underway. The government is already working towards phasing out vehicles powered by hydrocarbons and wants to usher in electric vehicles instead. It is not fair to ask the automobile industry to modify its technology at present to make use of ethanol. Moreover, modifying cars to use ethanol will be something that will last only a few years before electric cars become popular.

- To save of fuel import bills, the the sugarcane industry, as well as the rest of the agro industry, should be persuaded to convert all agro waste into methane. Methane is similar to CNG which is

already being used by vehicles and hotels. The technology is available. Moreover, even rough back-of-the-envelope calculations show that India’s potential for methane generation could be worth over Rs.18 lakh crore (Rs.18 trillion) a year. This is without including agro-waste, which could make the value swell three times more (http://www.asiaconverge.com/2018/04/shit-can-mean-big-money/). Now take the entire import bill for petroleum, oil and lubricants (POL). During 2017-18, India imported POL worth Rs5.89 lakh crore. Juxtapose this against Rs.18 lakh crore. It does not take a genius to know where the advantage lies. Promoting methane generation makes more sense than promoting ethanol as a vehicle fuel.

already being used by vehicles and hotels. The technology is available. Moreover, even rough back-of-the-envelope calculations show that India’s potential for methane generation could be worth over Rs.18 lakh crore (Rs.18 trillion) a year. This is without including agro-waste, which could make the value swell three times more (http://www.asiaconverge.com/2018/04/shit-can-mean-big-money/). Now take the entire import bill for petroleum, oil and lubricants (POL). During 2017-18, India imported POL worth Rs5.89 lakh crore. Juxtapose this against Rs.18 lakh crore. It does not take a genius to know where the advantage lies. Promoting methane generation makes more sense than promoting ethanol as a vehicle fuel. - The fortunes of ethanol are also linked with another interesting industry – alcohol. The price difference between industrial alcohol and that which is used in potable liquor is at least 1:10 and can go up to almost 1:100 if taxes and duties on alcohol are included. That is one reason why states do not want this to come under the central levy of GST. A bit of diversion of industrial alcohol into potable alcohol without informing the authorities means that much of slush money for both the sugar barons and their political friends. Creating another official outlet for alcohol-use (as vehicle fuel) could result in one more channel for generating slush funds. That is another reason why the creation of this mechanism is not good for either the industry or the country

- Watch the incomes accruing to the sugar industry in Table 3. It gets money from sale of molasses, bagasse and press-mud. Incomes from alcohol – either industrial or potable have been kept out. It is the classic example of privatisation of profit and socialization of losses. The government bails out the industry because its incomes from traditional sources are inadequate. But it does not account for incomes not registered on the sugar industry’s books. Bagasse could be used for methane generation. But the sugar industry shows the lowest return on this byproduct, by showing its use for burning. The lucrative parts of sugarcane derivatives are kept aside for private consumption.

Clearly, the sugar industry remains a bitter pill for the nation to swallow. By trying to mix it up with ethanol will therefore be detrimental to the interests of the sugar industry. It will also adversely affect the interests of Maharashtra’s farmers and the economic health of the country as well.

Ethanol is obviously a red herring for other interests and objectives.

COMMENTS