Adani Portfolio – Response to recent news reports

Contents

- Adani Portfolio presence and business expansion

- Portfolio credit highlights

- Equity Injection in the Adani Portfolio

- Banking Relationships

- ESG Highlights

Annexure 1: Page references for Table 1 from Annual Reports of the listed businesses .

The Adani group has reviewed the Credit Sights report dated August 23, 2022 and have presented below our key observations, clarifications on the issues highlighted in the report.

-

Adani Portfolio presence and business expansion

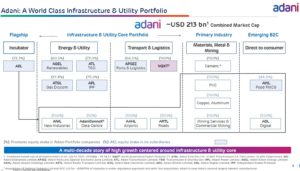

Adani Portfolio operates in four broad verticals

– The first two verticals are Energy and Utility Vertical, Transport and Logistics vertical, which together form the infrastructure sector businesses of Adani portfolio. The businesses are fully integrated in their respective sectors and present across the entire value chain.

– The third vertical is Primary Industries vertical, which feeds off the strengths of the portfolio across Energy and utility vertical and transport and logistics vertical. For example, the Cement manufacturing business has significant adjacencies to power, energy, resource and logistics businesses of the portfolio.

– The fourth vertical is direct to consumer (Emerging B2C), which includes consumer businesses such as Adani Digital Labs and Adani Wilmar Limited.

It may be further noted that all businesses which require shareholder support are housed under the incubator arm – Adani Enterprises Limited (AEL). These businesses continue under AEL till the time the business is self-sustaining post which they are listed separately creating value for AEL’s shareholders. Further, all the listed businesses operate on a strict “no financial accommodation” policy and have independent boards and management.

It may be further noted that all businesses which require shareholder support are housed under the incubator arm – Adani Enterprises Limited (AEL). These businesses continue under AEL till the time the business is self-sustaining post which they are listed separately creating value for AEL’s shareholders. Further, all the listed businesses operate on a strict “no financial accommodation” policy and have independent boards and management.

The businesses operate on a simple yet robust and repeatable business model focused on development and origination, operations and management and capital management plan.

The full pdf document can be downloaded from here

The full pdf document can be downloaded from here

COMMENTS