Stanchart tries to break Indian banking ranks

Stanchart, apparently, gets six of the smaller lenders to join ranks with Grant Thornton (UK), the audit and accounting firm.

Curiously, none of the Indian banks, nor Grant Thornton, is willing to confirm any of this.

RBI turns a deaf ear, and refuses to comment.

By  RN Bhaskar

RN Bhaskar

Increasingly it appears that someone from the government has been pressuring Indian banks to allow Standard Chartered Bank (Stanchart or SCB) to take away over Rs.3,000 crore of Indian banks, many of them government-owned. Strangely enough, even the Reserve Bank of India(RBI) seems content to look the other way, unwilling to haul up the foreign bank, or to assist the Indian government-owned banks to counter such moves.

Backgrounder

In order to under the full sequence of events, it is advisable for readers to refer to https://asiaconverge.com/2022/07/jatin-mehta-sues-debeers-stanchart-kroll-for-5-bn/. In that article, one learns that Jatin Mehta – often portrayed as a renegade, an absconder from Indian law, had filed a damages suit before the Surat Civil Court (Special Civil Suit No. 120-2022). Mehta sued De Beers, Standard Chartered Bank (SCB) and Kroll. The claim prepared on 27 May 2022, outlines how the three conspired over a number of years to destroy Mehta’s business and his and his family’s reputations. How they had scuttled every attempt to work out repayment plans.

Media lapped up this news, especially those in regional languages (a more complete list of media coverage can be downloaded from Jatin-Mehta-case_media-coverage).

Instead of responding to the charges outlined in the Surat court submissions, GT on behalf of Stanchart, opted to approach the UK courts. The court documents make reference to a GT-SCB scheme, details of which have been shrouded in secrecy. We asked Stanchart for a copy of the appeal filed before the UK courts, and were sent a two-line reply stating “As the matter is sub-judice, we prefer to refrain from making any comments. The Bank will suitably respond before the Court.” GT and Stanchart even managed to get an ex-parte ruling in its favour to freeze all the global assets of Jatin Mehta, his relatives and the groups controlled by them. This was challenged in the High Court of England where the judge pronounced his interim verdict on 22 November 2022. Excerpts of the judgement can be found at https://asiaconverge.com/wp-content/uploads/2023/01/2023-01-26_Excerpts-from-the-UK-judgment-dated-22-November-2022.pdf.

We wanted to write about the issues raised by the court, and contacted Stanchart once again by email citing specific questions arising from the contents of the court judgement. Once again, on 16 January 2023, Stanchart stated: “We decline to comment.” Thereafter, we wrote to Indian banks, and to the RBI, and then when no reply was forthcoming, wrote about these developments in an article on 21 January 2023 (https://asiaconverge.com/2023/01/stanchart-and-indian-banking-laws/).

Interestingly, on the evening when this news-report got published, at least one senior manager from the banks spoke with this author, thanking him for bringing out the article, so that people might know what is happening. He declined to elaborate more. What this could mean was that Indian banks were under a lot of pressure from someone powerful in the government.

The very next day, Stanchart’s officials sought a meeting with the author to explain the situation. But on 27 January 2023, the scheduled meeting was cancelled by Stanchart. The discussion did not take place.

In the meantime, three developments too place.

- We gained access to the crucial parts of the UK court’s findings.

- We got a strange reply from the Reserve Bank of India

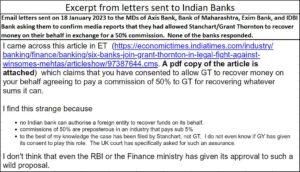

- A large media house came out with a report stating that six of the 15 banks which had lent money to Winsome and Forever, had given their consent to Grant Thornton (UK) for recovering money on behalf of all the 15 banks (see table) for a very handsome fee. The media report did not disclose that Grant Thornton (UK) would get 50% of the proceeds from the recovery, and only the balance could be shared by Indian banks. The report also did not mention Stanchart anywhere. It was about Grant Thornton (UK) getting permission from six Indian Banks.

On seeing the news report, we immediately — on 28 January – contacted the four Indian banks via email/Whatsapp and phone. We pointed to the article that had been published (https://economictimes.indiatimes.com/industry/banking/finance/banking/six-banks-join-grant-thornton-in-legal-fight-against-winsomes-mehtas/articleshow/97387644.cms) which claimed that the bank had consented to allow GT to recover money on its behalf agreeing to pay a commission of 50% to GT. We said that we found it “strange because

On seeing the news report, we immediately — on 28 January – contacted the four Indian banks via email/Whatsapp and phone. We pointed to the article that had been published (https://economictimes.indiatimes.com/industry/banking/finance/banking/six-banks-join-grant-thornton-in-legal-fight-against-winsomes-mehtas/articleshow/97387644.cms) which claimed that the bank had consented to allow GT to recover money on its behalf agreeing to pay a commission of 50% to GT. We said that we found it “strange because

- no Indian bank can authorise a foreign entity to recover funds on its behalf.

- commissions of 50% are preposterous in an industry that pays sub 5%

- to the best of my knowledge the case has been filed by Stanchart, not GT [we later came to learn that it was filed by GT on behalf of Stanchart]. I do not even know if GT has given its consent to play this role. The UK court has specifically asked for such an assurance.

I don’t think that even the RBI or the Finance ministry has given its approval to such a wild proposal.”

We asked the four banks to clarify whether (a) the contents of the news item were true, and (b) if yes, whether such a consent from the RBI or the Ministry of Finance had been taken.

We asked the four banks to clarify whether (a) the contents of the news item were true, and (b) if yes, whether such a consent from the RBI or the Ministry of Finance had been taken.

As expected, none of the banks came back with a confirmation or an explanation for the issues raised above.

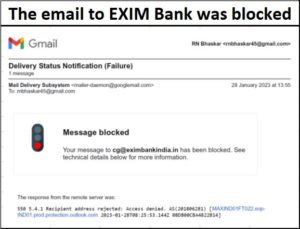

The email to EXIM Bank was “blocked”.

The email to EXIM Bank was “blocked”.

Crucial questions demand answers

This leaves us with more questions than answers which India’s policy makers must immediately address:

- Can an Indian bank agree to let a foreign entity take away 50% of recoveries as its fees as this is preposterously high compared to the global norm of under 5%?

- Shouldn’t Stanchart and GT (UK) be reprimanded for allowing such a preposterous proposal to be submitted before a UK court before first getting it approved by Indian authorities? Has someone allowed Stanchart to stomp merrily over Indian laws and processes?

- Won’t such a practice lead to more forex outgo at a time when even the Economic Survey 2023 bemoans a widening CAD? Don’t such practices dis-empower Indian banks which are sought to be strengthened.

We are waiting to an appropriate response from the RBI and the Ministry of Finance.

COMMENTS