INVESTMENT PERSPECTIVE

By J Mulraj

Feb 18-24, 2023

The World is Dangerously Poised

The US has hit the national debt ceiling imposed by its Congress, and needs its permission to raise it. A failure to raise the debt ceiling will result in a debt default, which would have disastrous consequences not only for USA but for the whole world. The Republicans, who have a majority of members in the US Congress, are demanding that the Government (ie the White House) agree to a road map of expenditure control, so that the need to again raise the debt ceiling in future, is obviated. The White House is not agreeable to such a negotiation, resulting in a stalemate. The debt bomb is ticking, and will explode, catastrophically, if there is no agreement reached, to raise the ceiling.

This situation has arisen because previous Governments have been profligate in spending, living beyond its means, a luxury afforded to it by virtue of the US$ being the world’s international currency. It outspends every other country in military expenditure, which expenditure is simultaneously necessary, but also often wasteful. It expended $ 2 trillion over 20 years fighting a war in, and later occupying, Afghanistan, for which it achieved nothing. Except embarrassment over a blotched and messy withdrawal, earning its military an undeserved disdain.

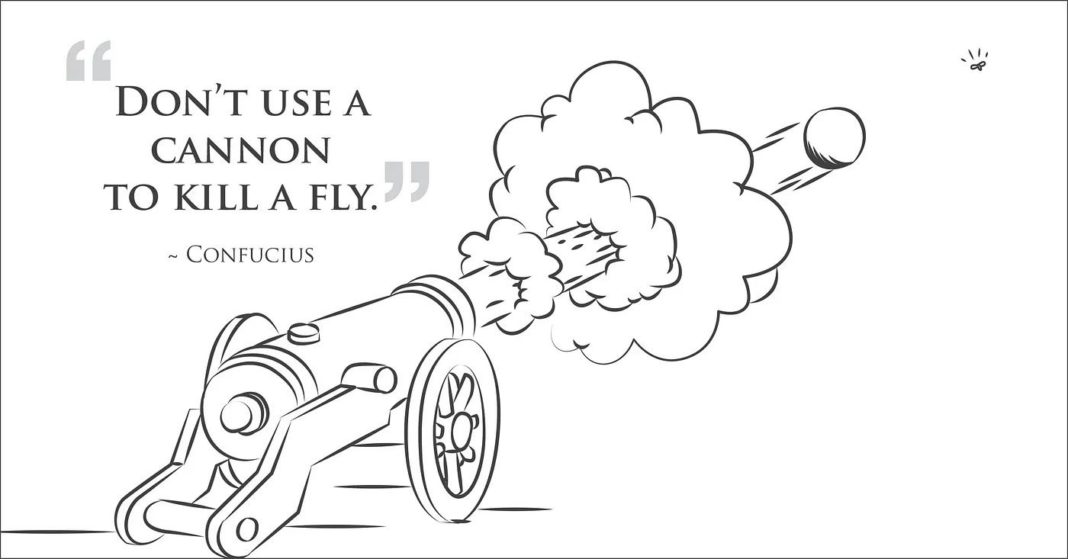

More recently, after shooting down a Chinese weather/spy (whichever narrative you believe) balloon, it went on to shoot down 3 more unidentified flying objects (UFOs). One such UFO, shot down by a $ 400,000 sidewinder missile, was probably a hobby balloon costing between $ 12 – 180. That is a foolish waste of money, indicative of a knee jerk reaction than a well investigated and thought out plan. Is it any wonder why the US has hit the debt ceiling?

Consider this. US GDP, at $ 23 trillion, is nearly 13 times Russia’s GDP of $ 1.8 t. The US military budget is $ 800 b. which is nearly 10 times that of Russia’s, which is $ 84 b? Yet Russian manages to give NATO, and USA, the jitters about what Russia’s next target would be. Having said that, many of the weapons announced with a lot of fanfare, such as the Kinzhal hypersonic missile, announced in 2018, capable of flying at Mach 5, and of carrying conventional or nuclear payloads, or, eg, the Armata tank, or the Sukhoi Su-57 , intended to take on the F-22 Raptor, have not been proven in combat.

Defense spending of $ 800b. by USA exceeds the combined spend of the next 9 countries, indicating that the Military-Industrial-Complex dictates US Government policy and spending.

This just became more alarming, after the announcement by Putin, that Russia would suspend its participation in the new START Treaty, the last remaining major military agreement with USA. With political rhetoric becoming increasingly vituperative, an open line of communication, plus an agreed set of protocols, is imperative to avoid a nuclear catastrophe.

The chances of one are increasing by the day. The economic collapse of Pakistan is a matter of alarming concern, for fear that nuclear arms land into the hands of terrorists, rather than something to gloat over, as media is won’t to do. Stories about increased levels of uranium enrichment by Iran, inching it closer to obtaining atomic weapons, bring forward the specter of a preemptive strike by Israel, engulfing the Middle East into a war. North Korea has started shooting off missiles over Japan, a blackmail tactic it has adopted whenever it is running out of money. Any of these, or similar, incidents, can create a stock market panic.

It’s not only USA, the world’s largest economy, that is facing economic woes. China, the #2 economy, has its own set of seemingly insurmountable problems. It’s debt/GDP ratio, at 295% is far worse than USA’s. It’s realty sector, which contributes 30% of its GDP, is in trouble, and, with low demand for housing, reduces the revenue for provincial (State) Governments. Covid is spreading thanks to an absence of herd immunity after severe lockdowns prevented its earlier spread, and also to an ineffective, locally developed vaccine. Several senior leaders of the CCP have recently died. More importantly, China’s demographic profile is poor; insistence on a one child policy (introduced by Mao for fear China wouldn’t have enough food to feed a growing population) has led to a situation where it’s population is now in irreversible decline.

The #3 economy, Japan, has a worse demographic profile with an aging population, evidenced by a higher demand for adult diapers than for infant ones. It’s central bank has done yield curve management to control inflation, by buying enough of its Government issued 10 year bonds to prevent bond prices falling, and so raising bond yields. A new Governor is to take charge shortly, and May reverse the yield curve control policy. Japan is the world’s most indebted country.

This begs the question that if the three leading economies of the world approach debt capital markets, who, exactly, are the buyers? There is a huge pool of money sloshing around in private funds, including pension funds, endowment funds, SWFs, hedge funds, family offices and others. Will Governments not be tempted to expropriate a part of those? Remember, Cypriot banks had seized some 40% of large bank deposits, overnight, when it faced a banking crisis.

Amidst this gloomy scenario, India paints an optimistic picture, eloquently presented in this must see video by Deepak Bagla, the MD & CEO of Invest India, the nodal body of GOI to attract and facilitate foreign direct investment. He points out that in 2022, in the middle of an unprecedented global lockdown due to Covid, India received $ 83 b. in FDI, across 61 sectors. Both global records. Importantly, this FDI has come in 31 States/Union Territories, not just in the more industrialized States, indicative of inclusive growth.

One of the drivers of FDI is the fact that 2/3rds of India’s GDP is driven by domestic demand. A demand which, given India’s young demographic profile (average age is 29) and rising economic growth, will continue to increase. This presents an investment opportunity for FDI that is appealing.

Bagla points out to the stability of India’s democracy. In the last elections 600 million voters cast their votes, in over a million polling booths. In digitization, India leads the world in data consumption, consuming more data than US and China combined! India leads the world in digital transactions, doing 41 b. transactions last year, to China’s 18 b. In the case of start up ecosystem, India is #3 in the number of unicorns (companies valued at $1 b. +), #2 in the number of startup’s, and #1 in the number of startups launched every day.

A fascinating point made by Bagla was the scale of the rural to urban migration. Every minute 30 people migrate from a village to a city. This will create demand for everything, such as housing, education, electricity, healthcare and products and services. That would propel sustainable economic growth.

To achieve all this, some weaknesses must be tackled, chief amongst which are income disparities, a woefully slow judicial system, an uncaring investigative system and poor regulatory oversight.

Last week, the BSE Sensex dropped 1539 points to close at 59463. What now?

Geopolitics would play a huge part in the direction of stock markets. If attempts by some sane world leaders succeeds in hammering out a peaceful resolution to the Ukraine crisis, markets would rally. Next would come the hurdle of refinancing debt, and containing inflation. It is unlikely that Central Banks would reverse the rising interest rate cycle. Rates can be expected to be higher for longer. So it may be prudent to be a bit more patient, keeping an eye open for investment opportunities in Indian equity, whose growth story is encouraging.

Picture Source: https://medium.com/optimumoutput/dont-use-a-cannon-to-kill-a-fly-a752469262e8

Comments may be sent to jmulraj@asiaconverge.com

COMMENTS