MARKET PERSPECTIVE

By J Mulraj

MARCH 25- 31, 2023

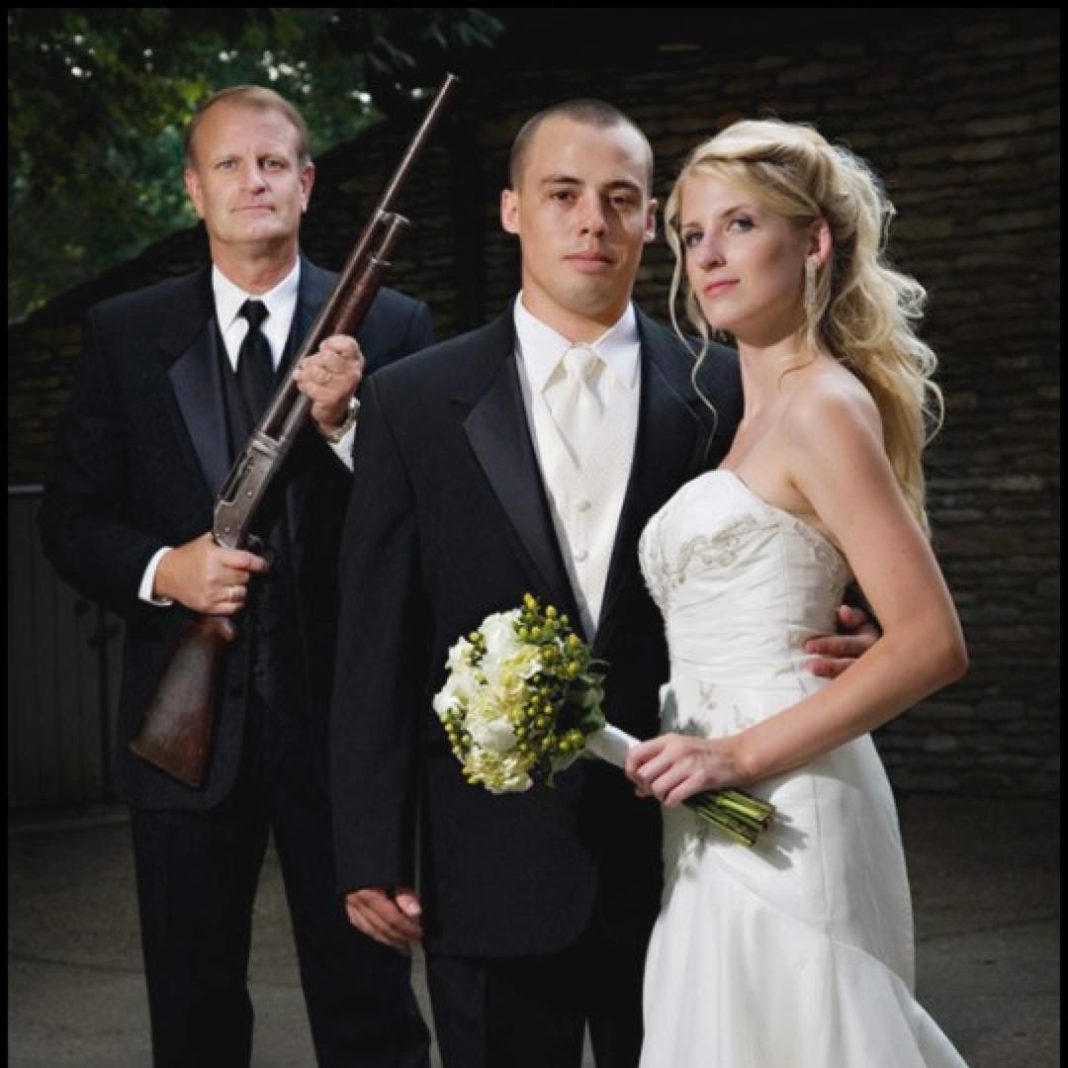

Or will there be more shotgun weddings?

In the wild west USA, there often used to be shotgun weddings where the groom, influenced by the exigency of a father in law holding a rifle, was compelled to marry the girl he made pregnant. Last week we saw Swiss financial regulator, FINMA, compel the largest bank, UBS, to marry a crisis ridden bank, Credit Swiss, CS, though it wasn’t responsible for it. FINMA was keen to avert a public lack of confidence in Swiss banks.

The CS crisis followed one in the US banking sector, with Silicon Valley Bank (SVB) and two others, failing. The SVB crisis was one of liquidity, caused by a lack of confidence, compounded by the fall in value of T-Bills it had invested in, whose market value dropped, as the Fed aggressively raised interest rates. In order to shore up depositor confidence, Janet Yellen, US Treasury Secretary, assured that all depositors would be safe. The FDIC protects deposits of up to $ 250,000.

As per its website the total funds available with it are $ 128 b., (under Performance Indicators). That’s 0.6% of total deposits of $ 17.6 trillion in US banks. So, Yellen saying that all deposits are secure is like taking solace from a band aid put over a wounded diabetic. The crisis is stanched, temporarily, until depositor confidence is shaken again. USA, and, indeed, the world, needs to tackle the root of the malaise, not simply cover it with a bandage.

The root, of course, is spending far far in excess of its income. The last time USA balanced its budget was in the ‘90s, under President Bill Clinton. Besides expensive wars (Iraq, Afghanistan and others), USA went on a spending spree to help its populace during the Covid pandemic. Well intentioned, but not well thought out. The Government gave stymmies (stimulus) cheques to everyone without realizing that, other than groceries, which could be delivered, recipients couldn’t spend the money due to Covid lockdowns. Factories were locked down, so there was little to buy (stores were locked down too), and restaurants/cinemas were also shut. The stymmie cheques went into savings and, when lockdowns ceased, resulted in a spending spree. But supply chain bottlenecks created shortages, and, hence, inflation.

It didn’t help that authorities characterized inflation as transitory, delaying the interest rate hikes needed to fight it. So they had to be more aggressive, and raise interest faster and higher, to make up for lost time. The sharp rise in interest rates resulted in a sharp fall in prices of existing T-bills and mortgage backed bonds, the assets held by banks, and otherwise considered safe (the US Government is the world’s biggest borrower). Had the Fed not behaved, then, as a petrified ostrich sticking its head in the sand to avoid seeing inflation, the raising of rates would have been less aggressive and, perhaps, the crisis may have been avoided.

Is there likely to be another troubled bank? A probable candidate is Germany’s Deutsche bank, whose credit default swap rate rose sharply last week, indicating market nervousness. A lot of its German corporate clients would be facing margin pressure due to high energy prices, after they sanctioned cheap Russian oil and gas. It is the 11th largest bank in the world, by assets so, should it come under a crisis, it would be a bigger event than Lehman Bros.

As stated earlier, the root cause of repeated banking crisis is unbridled spending by Governments. Led, of course, by USA, as its currency is the internationally accepted one, allowing it to print $ when it likes. If India, or Indian companies, borrow overseas, they have to do that in USD (else pay a high premium to cover exchange rate risk). So, to repay the debt, they need to raise a $ reserve, by exporting goods and services. The US doesn’t! It can print $.

It has now hit the debt ceiling approved by the US Congress, and needs Congressional approval, to do so. The Congress, with Republican majority, is asking the Biden Government to reveal its plan to cut spending. An eminently sensible suggestion, indeed an unavoidable one. But Biden is refusing to show expenditure reduction plans, until after the Congress agrees to raise the ceiling.

So one possible forthcoming crisis would be if political ego triumphs over practicality, the debt limit is not raised, and USA defaults. In earlier times, someone blinked at the eleventh hour. This will probably happen again, but it remains a risk needing to be factored in. The likelihood of a no-deal on raising the debt ceiling has increased after the indictment of Donald Trump, for hush money payment.

Another risk is a likely collapse in the commercial real estate market. (The residential real estate market is in decline because mortgage loans are scarce, or too expensive). In commercial real estate, a lot of buildings are facing low occupancy rates after small businesses/startups closed down for the same reason, viz. scarcity of funds or cost of funds. Most of the buildings are financed by the smaller Community Banks, and are finding it tougher to get refinanced, more so due to low occupancy.

A scarier prospect is the Goldman Sachs report that as many as 300 m. jobs could be affected by AI! The loss of so many jobs would result in social unrest, which could be somewhat mitigated by a Minimum Basic Income. Which is questionable, because the current social safety net, i.e. the pension system, is underfunded. Watch Senator Bill Cassidy (R-Louisiana) point this out in a heated exchange with Janet Yellen at a Senate hearing. He says that, within 9 years, as per law, there would be a 24% cut in social security benefits, due to insufficient funds. Additional funds need to be raised. They cannot raise enough by additional taxes on those earning over $ 400,000, as Biden plans to. Nor can they be raised through debt, which would raise it to 200% of GDP.

French President Macron has seen this issue in France, and is seeking to correct it by raising the retirement age by 2 years. This has led to widespread protests. Is Paris Burning? Yes.

In contrast, thanks to favorable demographics in India (more young people contributing to pension fund, than older people withdrawing from it), state run EPFO has managed to increase dividend for its beneficiaries.

The missing link now is China. Premier Lee Qiang, recently appointed, inaugurated the China Development Forum, a 3 day event in Beijing. Judging by the participation of global CEOs, there seems to be a lot of continued interest in China. Present were CEOs of Apple, Tim Cook, Blackstone, Stephen Shwarzman, Samsung, Lee Jae-Yong, Bridgewater, Ray Dalio, Pfizer, Albert Bourla, and others. If China opens up with a bang, it will push up economic growth.

On the other hand, China has a lot of issues, including an extremely high level of debt! With a debt/gdp ratio of 273%. Its local Governments (State Governments) have also taken huge debts, both domestically and globally. According to a video, China’s local Governments have a debt burden of $5 trillion (@7:59). In addition, many of the 120 countries it has extended loans to, for BRI projects, are unable to repay.

Last week the BSE Sensex closed at 58991, up 1464 points.

Goldman Sachs is predicting for the US economy a soft landing (no recession, or a mild one) due to the strength of the US labour market. But, given the plethora of negative scenarios outlined above, a US recession is likely. The Russian offensive in Ukraine is now at a standstill, because of soft black soil over which tanks and heavy artillery can’t roll. Russia has gathered an overwhelming troop superiority, and the offensive would begin in May. It is soulless of global leaders not to attempt a peaceful resolution, to prevent further loss of lives.

In this crazy world, when did peace become a four letter word?

Picture source: Source: https://www.facebook.com/EMERGENCYWEDDINGS

Comments may be sent to jmulraj@asiaconverge.com

COMMENTS