India exim: Cut the hype. India is bleeding

RN Bhaskar

Politicians love to focus on their achievements, but remain silent about their shortcomings. This is also true of India’s recently announced Foreign Trade Policy for 2023 (https://www.business-standard.com/economy/news/govt-releases-foreign-trade-policy-2023-eyes-2-trn-export-target-by-2030-123033100329_1.html). The policy itself is an echo of what Piyush Goyal, Union Commerce Minister announced in October 2022 (https://www.financialexpress.com/economy/india-will-meet-2-trn-export-target-by-2030-piyush-goyal/2713758/). Both talked about India achieving a target of exports worth $2 trillion by 2030. During fiscal 2023, India’s exports are likely to be in the region of $760-770 billion as against $676 billion in FY22,

Politicians love to focus on their achievements, but remain silent about their shortcomings. This is also true of India’s recently announced Foreign Trade Policy for 2023 (https://www.business-standard.com/economy/news/govt-releases-foreign-trade-policy-2023-eyes-2-trn-export-target-by-2030-123033100329_1.html). The policy itself is an echo of what Piyush Goyal, Union Commerce Minister announced in October 2022 (https://www.financialexpress.com/economy/india-will-meet-2-trn-export-target-by-2030-piyush-goyal/2713758/). Both talked about India achieving a target of exports worth $2 trillion by 2030. During fiscal 2023, India’s exports are likely to be in the region of $760-770 billion as against $676 billion in FY22,

Obviously, many would say that India deserves to be congratulated, both on its current achievements, as well as its targets. But, some caveats are required.

Many caveats

#1 – it is easy to predict big numbers 5-10 years hence. Anything could happen in between. Remember the grand statement about doubling farmer incomes?

#1 – it is easy to predict big numbers 5-10 years hence. Anything could happen in between. Remember the grand statement about doubling farmer incomes?

#2 – the export figures conceal a lot. First, they do not tell you that imports grew faster than exports and currently stand at $653 billion as of February 2023 (see tables).

#3 – much of the exports was on account of lavish subsidies (the government calls them incentives under the Performance Linked Incentive or PLI scheme). Consider the largest export growth items – electronic goods and petroleum products. Both grew by over 49% during the year. But electronic goods exports soared because of dollops of PLI incentives. Will they continue when the incentives peter out? The jury is out.

As for the surge in petroleum exports, this was primarily because India had a huge opportunity (it could be temporary) of subsidised low price oil imports from Russia, which was a consequence of the Ukraine skirmish. India could thus purchase oil at cheap prices convert them into value-added refined products and then export them at market prices. Without these twin benefits, India’s exports would have been lower. Subsidies will always allow you to export increasing amounts year after year. But when the subsidies are forced to stop – inflation is one reason — a recession, or a bust takes place.

#4 – India’s agricultural exports do not even consider the water footprint factor (https://www.waterfootprint.org/resources/interactive-tools/product-gallery/) . It exports  huge amounts of rice and wheat. Rice is a water guzzler, and cereals in general consume around 1,644 litres of water for every kg of grain. (https://asiaconverge.com/2019/07/how-india-forgot-its-water-footprint/), That explains why China, which has three times more land than India, prefers to import rice, rather than grow it. The cost of saving water is several times greater than the cost of importing rice, or soya or other grains.

huge amounts of rice and wheat. Rice is a water guzzler, and cereals in general consume around 1,644 litres of water for every kg of grain. (https://asiaconverge.com/2019/07/how-india-forgot-its-water-footprint/), That explains why China, which has three times more land than India, prefers to import rice, rather than grow it. The cost of saving water is several times greater than the cost of importing rice, or soya or other grains.

#5 – the price at which India exports its grains and sugar and other agricultural products is often higher than the domestic market price. When it comes to exports, there is a further subsidy. In other words, India is subsidising the world by giving it access to cheaper exports than it allows its own population. This cannot go in for ever. Sooner or later, as the pressure on water becomes acute, India will have to price water, or restrict its usage.

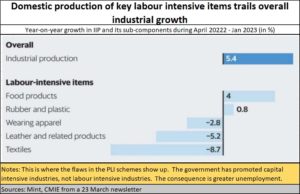

#6 – the government’s much touted PLI scheme is targeted at capital intensive industries (https://asiaconverge.com/2022/10/pli-and-the-indian-economy/). It is not for labour intensive industries. This is a charge that both Raghuram Rajan, former governor of the RBI and Arvind Subramanian, former chief economic adviser to the government have made (https://www.youtube.com/watch?v=XVXm57tD7tQ).

#7 – the sad truth is that India needs to promote labour intensive industries more aggressively, because of its terrible unemployment record (see table). As is now evident, and as explained later, labour intensive sectors have been ignored (https://www.business-standard.com/article/economy-policy/labour-intensive-manufacturing-segments-facing-external-headwinds-123022800254_1.html): “For instance, 11 manufacturing industries showed a decline in output in December. These constitute almost half of the total 23 industries.”

#8 – as a result, the traditional export industries – garments, leather and gems and jewellery – have been given a step-motherly treatment. True, there are schemes for garments that have been introduced (https://www.outlookindia.com/business/pm-mitra-mega-textile-parks-to-create-20-lakh-jobs-piyush-goyal-news-271018). Many of these are spelt out under the PM Netra scheme and envisage an export target for textiles (including garments) worth $100 bn by 2030. Once again, this is a long-term plan. If the money allocated for capital intensive industries were to be given to these labour intensive industries, the benefits for the country would have been huge. As cynics always say, in the long term all of us will be dead. The need is now, not in 2030.

More worrisome is the fact that Generative AI (artificial intelligence) is now set to affect over 300 million jobs in the US and Europe (https://www.ft.com/content/7dec4483-ad34-4007-bb3a-7ac925643999). A similar warning has also been sounded by Goldman Sachs (https://edition.cnn.com/2023/03/29/tech/chatgpt-ai-automation-jobs-impact-intl-hnk/index.html). Many of these losses, which will inevitably spread to India, will be in the high-tech, capital-intensive sectors, where money is being pumped in. They are not likely to affect India’s labour intensive sectors like leather, agriculture and garments.

More worrisome is the fact that Generative AI (artificial intelligence) is now set to affect over 300 million jobs in the US and Europe (https://www.ft.com/content/7dec4483-ad34-4007-bb3a-7ac925643999). A similar warning has also been sounded by Goldman Sachs (https://edition.cnn.com/2023/03/29/tech/chatgpt-ai-automation-jobs-impact-intl-hnk/index.html). Many of these losses, which will inevitably spread to India, will be in the high-tech, capital-intensive sectors, where money is being pumped in. They are not likely to affect India’s labour intensive sectors like leather, agriculture and garments.

As CMIE points out, domestic production of key labour intensive industries continue to lag behind industrial growth (see table).

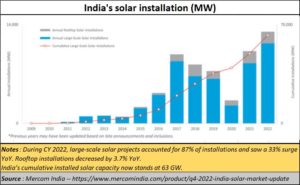

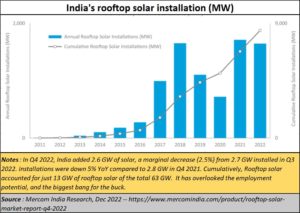

#9 – another big policy failure on the part of the government is its inability to aggressively harness rooftop solar. These columns had written about the need for solar rooftops as early as in 2017 (https://asiaconverge.com/2017/12/sabotaging-rooftop-solar-and-employment-generation/). It had cited the German experience which saw solar energy creating more jobs than even the engineering sector (https://asiaconverge.com/2016/04/india-not-learn-germanys-hermann-scheer-solar-power-model/).

Even the accidental successes in Tripura with rooftop solar in 2018 did not saw India’s policy makers. Tripura was where 50,000 houses were given roof top solar facilities (https://asiaconverge.com/2019/03/biplab-kumar-deb-has-big-plans-for-tripura/).

Even NRDC pointed out in January 2022, that the employment potential with rooftop solar was immense (https://www.nrdc.org/bio/charlotte-steiner/india-could-create-millions-jobs-through-renewable-energy). It points out that just the India’s renewable energy sector could potentially employ around one million people by 2030, which would be ten times more than the existing workforce.

But the government’s adherence to solar farms remains undiminished (https://www.mercomindia.com/product/q4-2022-india-solar-market-update). It is then that you realise that the potential for handing out subsidised power connections, free power and even power theft (did someone say “revadi”?) is possible only with grid power. Not so with rooftop solar, where a rural household has abundant ‘free’ electricity for almost 300 days a year. Rooftop solar is just a one-time bonanza that politicians can gift away. Grid power has the ‘gift’ potential year after year. Moreover, solar farms also offer the opportunity of land grab. No wonder then that rooftop solar continues to languish (https://www.mercomindia.com/product/rooftop-solar-market-report-q4-2022).

But the government’s adherence to solar farms remains undiminished (https://www.mercomindia.com/product/q4-2022-india-solar-market-update). It is then that you realise that the potential for handing out subsidised power connections, free power and even power theft (did someone say “revadi”?) is possible only with grid power. Not so with rooftop solar, where a rural household has abundant ‘free’ electricity for almost 300 days a year. Rooftop solar is just a one-time bonanza that politicians can gift away. Grid power has the ‘gift’ potential year after year. Moreover, solar farms also offer the opportunity of land grab. No wonder then that rooftop solar continues to languish (https://www.mercomindia.com/product/rooftop-solar-market-report-q4-2022).

The numbers are there for anyone to see. The government has also brought solar farms under the PLI scheme (https://www.livemint.com/news/india/ril-renew-9-others-secure-solar-pli-sops-11680025610284.html). Effectively, the government perpetuates the agony of India remaining a high-cost producer of goods, because energy costs are crucial for any industry. This cost becomes even higher, as the government subsidises the rural  sector, and even consumers, and makes industry the highest cost for energy.

sector, and even consumers, and makes industry the highest cost for energy.

What is worse, India’s policymakers have gone about announcing policies that appear to be wonderful, till someone asks “Hey! But can this work?”

A good example is the recent government announcement of working on prepaid cards for solar power. Great idea. But how do you have prepaid cards for solar pumps? They are a disaster because they encourage endless groundwater extraction (https://asiaconverge.com/2020/02/solar-pumps-s-a-bad-idea/). These columns wrote about this in 2020. The government persists with its myopic plans. So, India will spend money in creating smart prepaid cards for some people, while the rest guffaw at the suckers that did not opt for solar pumps (again with government subsidies).

That is why, the commerce ministry’s announcements need to be taken with a barrel-full of salt. They sound nice. But the underpinnings are weak. The picture looks great. But the vision is missing. There are other bottlenecks as well – notably education and skilling. But more on that later.

COMMENTS