MARKET PERSPECTIVE

By J Mulraj

April 29 – May 5, 2023

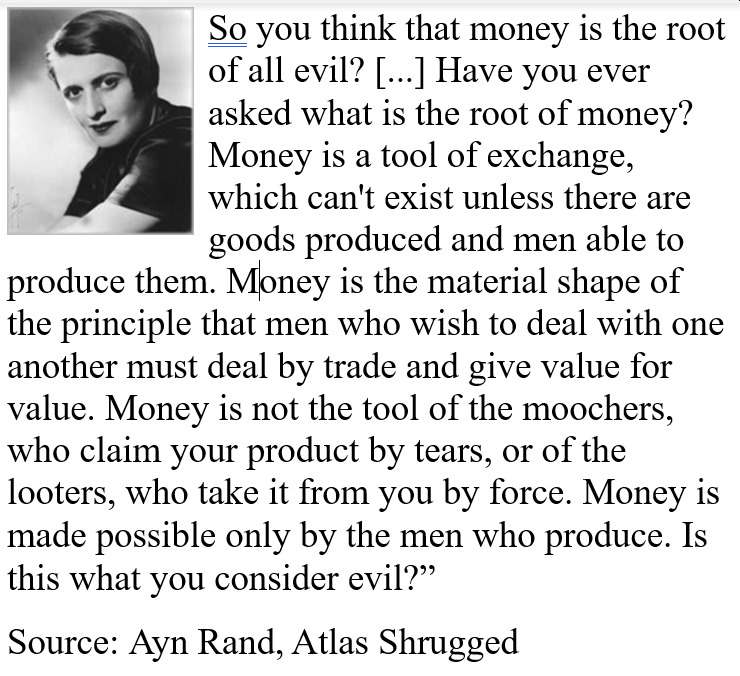

Saying that money is the root of all evil is just an excuse for poor governance

America, as also most countries, is beset with myriad problems, primarily because of poor governance. The global polity seeks to blame others, to hide its own failings.

It is time the polity read, or re-read, Ayn Rand. The reminder has been prompted by an asinine call by Senator Bernie Sanders to tax income over $1 billion fully, at 100%. He thinks that money is the root of all evil. Through her character, Francisco d’Aconia, in her book, ‘Atlas Shrugged’, Ayn Rand has provided the answer long before Bernie asked the question. All that Bernie’s inane suggestion would do is to drive those with the ability to create wealth out of the country. They will simply move to another, which they will then enrich.

In the same vein, the Biden administration has made a new federal rule, compelling people with a good credit score (680 or higher) to pay MORE to borrow, in order to subsidize borrowers with a poor credit score! In short, Biden seeks to reward irresponsibility and punish sobriety!

In the same vein, the Biden administration has made a new federal rule, compelling people with a good credit score (680 or higher) to pay MORE to borrow, in order to subsidize borrowers with a poor credit score! In short, Biden seeks to reward irresponsibility and punish sobriety!

Biden seems to have forgotten the lessons of the 2008 global financial crisis (GFC). Then, too, the federal Government encouraged bank lending to sub-prime borrowers, even going so far as to lend to NINJAs (people with No Income, No Jobs and no Assets). This caused the sub prime crisis and triggered the GFC.

Let us examine the myriad problems. The banking crisis is far from over, the latest victim being the First Republic Bank, taken over by JP Morgan, this past week. There will be more. Community banks like PacWest (stock down 60%), Western Alliance (30%), and others, are starting to buckle, weighed down by their lending to commercial real estate.

When banks fail, FDIC (Federal Deposit Insurance Corporation) insures customer deposits up to $ 250,000. The fund it has for this is now at $ 128 billion. Total deposits are at $ 9 trillion. So that’s an unexploded bomb.

The root of the banking problem was that, post the GFC, interest rates were lowered to zero (ZIRP, or zero interest rate policy), resulting in a misallocation of resources, and, simultaneously, there was a flood of liquidity injected to deal with the economic ravages of Covid. ZIRP, and excess liquidity created the next problem, inflation.

To combat inflation the Fed aggressively raised interest rates by 5% at a fast rate. This has raised the probability of a recession, at an alarmingly fast rate. The probability of recession has risen from 0%, on May 10, 2022, to 67% now! Stanley Adams may need to reword his song to ‘What a difference a year makes’!

Inflation is harder for regulators to tackle than recession is, reminding one of the joke about the doctor, who advises a patient with a common cold, to take a chilled shower, then stand, wet, in front of an AC! Asked if that would help cure the cold, the doctor admitted that he couldn’t cure a cold, but that his advice would lead to pneumonia, which he knew how to cure! Fed Chair Jerome Powell has just increased interest rates by another 0.25%, and is determined to bring inflation down to his target of 2%. Inflation has thus far behaved like a roly-poly toy, bouncing back after each hit.

Which brings us to the next major problem the US is facing, high level of national debt. On Jan 1, 2000 US National debt was $ 5.7 trillion. Ten years later it was $ 12.3 t. A decade later $ 23.2 t. It is more than doubling every decade, while GDP growth is not. And on May 1, ‘23, it was $ 31.4 trillion. Consider that interest rates have risen 5%, which adds $ 1.57 trillion to the interest burden. That’s more than last year’s fiscal deficit of $ 1.4 trillion.

In order to borrow more, the US Government needs to get approval from the US Congress. It is controlled by the Republicans. The house has passed a bill, increasing the debt ceiling by $ 1.5 trillion, provided the Government agrees to certain cuts in expenditure. An eminently sensible provision; no Government can keep on over spending.

Yet Biden is likely to veto the bill, should the Senate clear it (unlikely). Fortunately, Biden has agreed to meet Republican speaker on May 9. Treasury Secretary Janet Yellen has warned that, unless the ceiling is raised before end May, the US may default on debt obligations.

It would be wise not to play Russian roulette with a debt bullet. It’s a bomb waiting to explode.

India’s polity, too, is erring in some respects. To its huge credit, Bloomberg assesses risk of recession in India at 0%, but at 65% for USA and at 70% for Germany. GST tax collections in April were ₹1.87 trillion, a record high. Yet, in some areas, tax authorities behave arbitrarily, with bad consequences. Like in Mumbai, where property transactions are to be based on a ‘ready reckoner’ rate decided by them. Yet, in practical terms, transactions are done at significantly different rates, depending on a plethora of factors, including age/condition/location of the property, the exigency of the sale and differing viewpoints on the asset. This runs the risk of being slapped, without any proof, of undervaluation. A fair solution would be to give the right to tax authorities to take over as buyer, if it suspected undervaluation. This was the case, earlier. The Government should, in all fairness, consider reverting to it.

The alternative, judicial redress, doesn’t work, as the system works slower than a pregnant snail with gout! This is another huge weakness of the India story.

China, too, is dealing with issues arising out of poor governance. It had allowed its realty sector to overbuild. This was because real estate developers were buying/leasing parcels of land from provincial (state) Governments, their major source of revenue. In a recent report the Ministry of Housing has revealed that there are 65 million residential buildings (not apartments, buildings!) which can house 5 b. people! So, unused buildings are being torn down! Just think about this. When being built, the cost would be added to China’s GDP. When pulled down, the cost of demolition would also be added. But net net, there is nothing to show for it except the same, vacant, plot of land.

But China just got lucky. CNOOC, its oil exploration company, has recently discovered reserves of 100 m tonnes of oil/equivalents, in the Bohai Sea, a discovery which significantly reduces not only its dependence on imported oil but also its vulnerability while transporting it through the Strait of Malacca.

Last week the BSE sensex was flat, closing at 61054.

A Russian attack on Ukraine is expected to commence soon, after the soft soil is hard enough to allow tanks to roll over it. It is expected that this may cause enough damage to Ukraine to allow peace negotiations to commence. Should this occur, end May, the ensuing rally may provide an exit opportunity. Take it.

A senseless polity, bent on provoking conflicts, could well provoke the next, even though no country can afford it. As Bob Dylan lamented ‘how many seas must a white dove sail, before she sleeps in the sand? The answer, my friend, is blowing in the wind.’

Please send your comments to jmulraj@gmail.com

COMMENTS