Behind India’s hoopla about GST and GDP is a grim reality

By RN Bhaskar

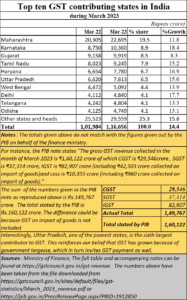

Lately, there has been a great deal of excitement over India’s GST (Goods and Services Tax) collections climbing by another 13% on a year-on-year basis. And people have been exulting over India soon becoming the third largest in the world in terms of GDP.

As the government website put it (https://pib.gov.in/PressReleasePage.aspx?PRID=1912850), “It is for the fourth time, in the current financial year that the gross GST collection has crossed ₹1.5 lakh crore mark registering second highest collection since implementation of GST.” Many analysts – possibly to please the government – have been saying that this increase points to India’s economic resurgence. Really?

As the government website put it (https://pib.gov.in/PressReleasePage.aspx?PRID=1912850), “It is for the fourth time, in the current financial year that the gross GST collection has crossed ₹1.5 lakh crore mark registering second highest collection since implementation of GST.” Many analysts – possibly to please the government – have been saying that this increase points to India’s economic resurgence. Really?

Government spokespersons seem to concur with the analysts. But the truth could be quite different. To understand this, it is first important to know a bit about GST.

Unfair tax

GST is a tax which demands that the party which bills or invoices another party for the supply of goods and services must promptly pay to the government the applicable percentage of the invoiced amount. The billing party must pay the tax even if the amount has not yet been received.

This is okay for large companies which have the staying power till the funds arrive. But small businessmen, who often have a hand-to-mouth existence, find that paying a tax even before the money arrives is a huge penalty, often unbearable. Many businesses have to borrow money to pay the tax, thus inflicting a double burden on them. They have to borrow to provide the goods and services. Then they have to borrow again to pay the taxes. They heave a sigh of relief when the invoiced amount finally arrives. But this is one reason why the small businessperson is not enamoured by the GST structure. Intuitively, he is aware that this has caused India to build for itself a cost plus economy. Businesses must now add the cost of finances twice over. It can be painful.

But there is another factor that many people overlook. GST goes up when government spending on social welfare and subsidies and incentives to industry increase. So, the more the government spends on subsidies for the poor, or for agriculture, or by way of incentives or subsidies for the PLI (production linked incentive) scheme, the more will the GST soar (https://asiaconverge.com/2022/11/gst-growth-does-not-mean-that-the-economy-is-growing/).

In a way, it is similar to any Ponzi scheme, where more money is poured in to make the pool look larger and robust.

The acid test will come when such government spending stops. Expect GST collections to fall then.

The table appears to confirm this. Look at the GST contribution share of non-manufacturing poor states. While Maharashtra, Gujarat, Karnataka and Tamil Nadu have already proven their credentials of being commercially vibrant states – by becoming the biggest revenue generators for the government by way of direct taxes in addition to GST – the remaining states cannot command such respect. Haryana is already seeing a flight of investment, thanks to its reservation in jobs for locals policy (https://www.thehindu.com/business/Industry/happening-haryana-slips-as-investmentaddress/article66797708.ece).

Another interesting example is that of Uttar Pradesh, It has been the biggest beneficiary of government grants and subsidies (Gujarat is rapidly moving in that direction). These funds must be spent; they then invite a GST levy of at least 12.5% — if not more, given the increase in levies on several items.

Another interesting example is that of Uttar Pradesh, It has been the biggest beneficiary of government grants and subsidies (Gujarat is rapidly moving in that direction). These funds must be spent; they then invite a GST levy of at least 12.5% — if not more, given the increase in levies on several items.

GDP myths

Another apparition is GDP.

You can grow GDP through borrowed funds. But the day of reckoning will arrive when the loans must be squared off. Moreover, annual servicing of the debt must also take place.

Of course, the government need not repay its debts, by merely printing more currency. But that would stoke inflation, isn’t it? Nobody talks about this much, but one of the causes of the current inflation is the way central and state governments have resorted to borrowing to finance public largesse.

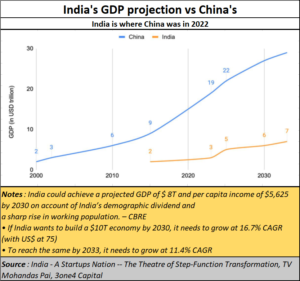

This could also explain why China’s GDP growth will continue to be more robust than India’s – percentages can be terribly deceptive. The big difference is focussing on productive investments, not spending merely to satiate consumption. The latter brings in the  possibility of votes. The former requires nurturing businesses for at least three to five years. The latter also requires a business-friendly environment. Just look at the way over 35,000 high networth individuals have left India in the past decade. And do bear in mind that the number of Indians renouncing their citizenship keeps rising each year (https://asiaconverge.com/2022/07/major-financial-turbulence-ahead-inr-may-weaken-further/). Without such people, garnering investments in India’s projects will become increasingly difficult.

possibility of votes. The former requires nurturing businesses for at least three to five years. The latter also requires a business-friendly environment. Just look at the way over 35,000 high networth individuals have left India in the past decade. And do bear in mind that the number of Indians renouncing their citizenship keeps rising each year (https://asiaconverge.com/2022/07/major-financial-turbulence-ahead-inr-may-weaken-further/). Without such people, garnering investments in India’s projects will become increasingly difficult.

Politicians love giving freebies and claiming credit for it. They don’t seem to have an appetite for issues like education and creating a business-friendly environment.

Borrowing for votes

Borrowing for investing in productive capacities is good, but when money is borrowed to aid consumption, without much regard for production, you can be sure that the country is heading for troubled days ahead. Consider how lack of investment in productive capacities has resulted in surging unemployment.

Listen to Mahesh Vyas, ceo, CMIE (https://www.business-standard.com/opinion/columns/unemployment-rate-rises-in-april-123050100899_1.html) when he points out, “India’s unemployment rate increased in April to 8.11 per cent from 7.8 per cent in March 2023. The unemployment rate has been on an upward trend since the start of the year, recording an increase for the fourth consecutive month.”

In some ways, schemes like free food, do help reduce extreme poverty. This is confirmed even by critics of government policies, like Arvind Subramanian, currently senior fellow at Brown University, and a distinguished non-resident fellow at the Center for Global Development (https://www.project-syndicate.org/commentary/welfare-policy-explains-why-india-primeminister-modi-still-popular-by-arvind-subramanian-and-josh-felman-2023-04). He admits that there is a possibility that one factor could be “Prime Minister Narendra Modi’s unique approach to redistribution, which one of us dubbed “New Welfarism,” [which] emphasizes funding for items such as toilets that are essential but normally provisioned privately, as opposed to public goods such as primary education and basic health care.” Vyas adds, “The number of unemployed persons in the country rose from 34.5 million in March to 37.9 million in April. Around 3.4 million additional people became unemployed.”

Subramanian explains that – in addition to the government under Modi — very few Indian governments have paid much attention to providing public goods. “After all, educational and health reforms take years to deliver measurable results and often produce meagre political returns, giving policymakers little incentive to pursue them.”

Rich government, poor people

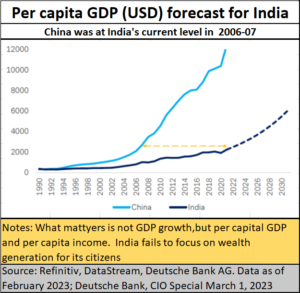

But without education and healthcare, India is not likely to go very far, notwithstanding cheerleaders like the ministers for Commerce and Finance. The key indices are per capita income and longevity. Compare India’s longevity with the top five GDP nations, and you will discover that it lags behind .

Another indicator is per capita income. And even while India cheers itself on becoming the most populated country in the world, there are warning signals ahead (https://asiaconverge.com/2022/12/gdp-per-capita-gdp-debt-and-growth-in-india/). Overtaking China’s population means little unless India can improve the per capita income of its people. And there lies the rub.

Without per capita incomes growing, India will enjoy the distinction of being a rich country with very poor people (free subscription – https://bhaskarr.substack.com/p/india-population-and-economic-growth). It is possible for a country to be rich given a large population and an over-dependence on indirect taxation (GST is an indirect tax). Even a rupee from each person (through purchase of food, oil, match boxes etc) will fetch the government 1.4 billion rupees.

Flagging exports

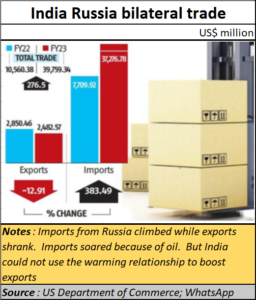

Look at flagging exports as well. As pointed out in an earlier column (https://asiaconverge.com/2023/04/indias-confused-exim-strategy/), last year’s exports were rosy because they were buttressed by an arbitrage opportunity created by discounted oil from a beleaguered Russia buffeted by sanctions. That advantage is becoming slimmer. Ironically, even when India’s import of oil from Russia surged, India’s exports to that country declined. That itself points to the lack of competitiveness plaguing Indian exports.

Look at flagging exports as well. As pointed out in an earlier column (https://asiaconverge.com/2023/04/indias-confused-exim-strategy/), last year’s exports were rosy because they were buttressed by an arbitrage opportunity created by discounted oil from a beleaguered Russia buffeted by sanctions. That advantage is becoming slimmer. Ironically, even when India’s import of oil from Russia surged, India’s exports to that country declined. That itself points to the lack of competitiveness plaguing Indian exports.

Sectors where India could have done well – leather and meat exports — have been discouraged by the government. Rural distress is acute (https://asiaconverge.com/2023/02/budget-2023-and-agriculture/), but softened by the handouts of free food and subsidies. Without rural prosperity, the purchasing power of 50% of India’s population will remain stunted, which in turn will stunt industry as well. Pushing policies to boost rural productivity is crucially important. This also means easing policies that have hurt the cattle, leather, and meat industries (https://asiaconverge.com/2023/01/sodhis-resignation-has-dire-warnings-for-agriculture-and-milk/).

But, most importantly, India must focus on boosting education which is in dire straits (free subscription – https://bhaskarr.substack.com/p/the-state-of-education-in-india). Unless that and healthcare, are remedied, India can brag as much as it wants, but it will remain close to becoming a failed state.

COMMENTS