MARKET PERSPECTIVE

By J Mulraj

Oct 14-20, 2023

If USA wants to continue to be numero uno

In the ‘80s the economic hegemony of USA was being challenged by Japan and Germany, the two foes it had vanquished in WW II, but had remarkably bounced back, with some assistance from America. Both challengers had adopted the ‘stakeholder capitalism’ model, in which corporate management treated equally the interests of financiers (equity and debt holders), customers, suppliers and employees. The Japanese Nikkei index peaked in December 1989, at 38195. Its telecom company, NTT DeCoMo stock price was the highest in the world, and its large companies were buying symbols of American might such as Universal Studios and Rockefeller Centre.

Germany’s auto and engineering industries were world famous and its disciplined and productive workforce made it the leading European economy.

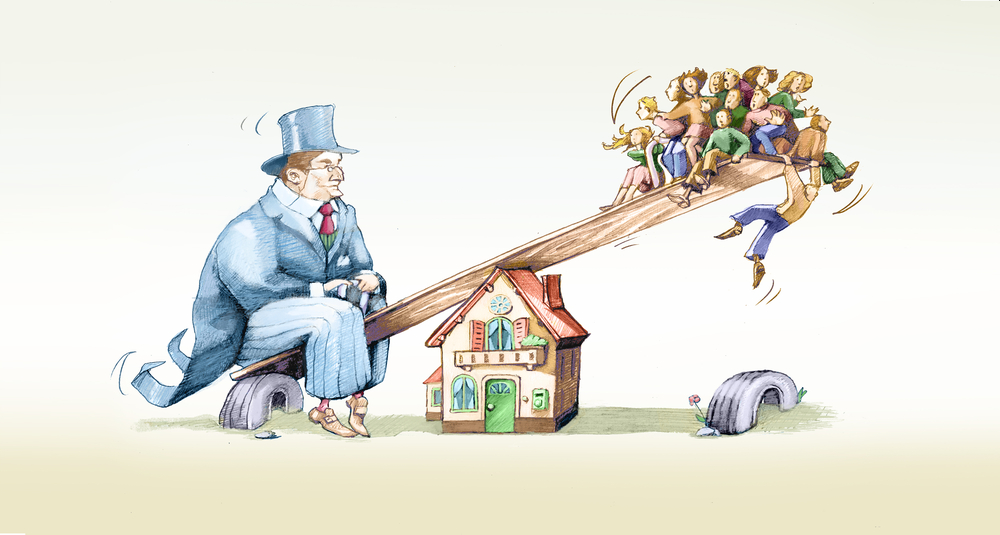

USA countered by promoting an alternate form of capitalism, viz shareholder capitalism. Propounded by economist Milton Friedman, in the 70s, shareholder capitalism enjoins corporate management to focus on returns for shareholders to ensure the survival of their companies.

It worked!

America regained economic preponderance even as the challengers fell behind. Japan’s stock markets have not been able to reach their Dec 1989 peak, in 34 years since.

But the US was then competing with countries that basically followed the tenets and practices of free markets. Today, however, it is facing a challenge from China, which is a one party system, hence can act more swiftly than a democratic one, and not always following the tenets and practices of free markets (eg it demanded, and got, exemption from financial audits for years).

Shareholder capitalism, which, by definition, enjoined companies to focus on shareholder returns, encouraged American companies to outsource a lot of their manufacturing, and supply chains, to other countries, especially China. Their vulnerabilities were exposed after Covid hit, and China enforced a zero tolerance policy, shutting down its manufacture. And then the post covid supply chain shocks due to lack of containers, port congestion, and then the blocking of the Suez Canal by the container ship, Ever Given.

The generous stock options, given largely to top management, created income and wealth inequalities, as measured by the Gini coefficient. It is hard to put the Gini back in the bottle.

Low interest rates, encouraged by the asinine ‘modern monetary theory, led to malinvestment, or undeserving projects being funded because money was so cheap and printed copiously.

The chickens are now coming home to roost.

America’s biggest competitor is China, which works on a command system. Their leadership determines what’s necessary, they allocate resources, financial and manpower, and achieve their aim. So, in order to compete, the shareholder capitalism system would need to be tweaked.

For example, though profit maximization is the foundation of shareholder capitalism, the Covid lockdown, followed by severe supply chain blockages, make it necessary to tweak the system to factor in these risks.

ESOP’s (Employee Stock Option Plans) would need to be tweaked too. A front page story in Economic Times, October 19, says that almost 80% of options in India are granted to top management. This, too, would need to be tweaked to ensure wider inclusion.

In a capitalist economy, money is the basic foundation. It is the cost of money that determines the viability of projects. It has been a monumental error for the authorities to try and control the cost of money, by lowering interest rates. It’s best left to the market, under proper supervision. The artificially low interest rates misdirected capital to undeserving projects, and the ongoing sharp increase, in order to fight inflation, is causing bigger problems. For example, an entrepreneur who borrowed at 1% to build an office building, collected enough rent to service the loan and then some. But not at 6%. Many commercial real estate projects will bot be able to refinance bank loans, and will simply walk away, leaving banks, mainly community banks, to be owning an unviable building. There will be many more Silicon Valley Banks.

The UAW auto strike at the big three, Ford, GM, Stellantis, has come at the worst time for the car companies, in the middle of a transition to clean energy electric vehicles, for which, sadly, their managements have not prepared the companies. The chief grouse of the union, UAW, is that the top management enriched themselves using ESOPs, so it is demanding a matching, 40% hike in wages for labor. It’s quite possible that some, even all, the auto companies, would fold, if they agree to a big pay hike.

Creative workers in Hollywood film industry are striking, seeking assurances that their jobs be secure from the threat of AI. This, in America, which has been the beacon of innovation! And creative destruction.

China is innovating faster! An EV manufacturer, Dong Feng, has produced a solid state sodium battery, to replace the lithium ion battery. Lithium ion battery is constrained by the supply of lithium, a rare earth element in short supply, generally found in unreliable countries. Sodium is cheaper, and longer lasting.

So the big three automakers, already lagging behind EV companies such as Tesla, will be hard pressed, after the settlement with UAW, to spend more money on innovating for the future.

The third largest item of export from USA is commercial aircraft and parts, including engines. Thus far Boeing, USA and European Airbus, were the two contenders. Now China has entered the field with its C919, and has procured a big order from Brunei.

America will have to get its act together to ward off the challenge from China. In the political realm, it is failing to do so. The schism between its two parties, the Democrats and the Republicans, runs deep, with the population almost equally divided between them. The Republicans, who have a majority in the House, find themselves unable to muster enough votes to elect their Speaker, to replace ousted Kevin McCarthy. A handful of Republicans vote against their nominee, Jim Jordan.

The bone of contention is over the long needed sending cuts, desperately needed to curb debt, already past the ceiling. Republicans like Jim Jordan want to have a path laid out now, to cut expenditure; the Democrats, who are fiscally incontinent, would like to leave it vague.

Hitting the debt ceiling and unable to raise it means that funding for Ukraine and now, for Israel, will be a challenge. Should the Israel-Hamas conflict spread regionally, as can happen, it would strain USA fiscally, militarily and geopolitically. With its divided polity behaving immaturely, the prospect of USA being able to ward of the Chinese challenge don’t lend much hope.

Last week the BSE Sensex closed at 65397, down 885 points over the week.

Geopolitical tensions have pushed up Brent crude to over $ 93/b. America is ill prepared to ward off a serious challenge from China, especially under Biden leadership. China, too, has its own set of serious problems.

One would need to have a powerful telescope to spot the silver lining.

Picture Source: https://www.econlib.org/stakeholder-capitalism-and-the-great-reset/

comments may be mailed to jmulraj@asiaconverge.com

COMMENTS