Splurge even if you are going bankrupt

RN Bhaskar

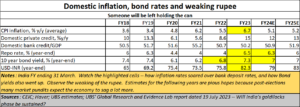

Most economists agree that governments can either control interest rates, or exchange rates. They cannot do both. If the government controls interest rates to tamp down inflation, then the repercussions will be felt on forex rates. As the domestic currency weakens, because of devaluation, the result is more expensive imports, and a corresponding fall in foreign exchange for the same volumes.

India is trying to do both, and is falling between the two stools. As a result, interest rates have begun to go up. Watch the rates at which the government sells its T bills. And the rupee is weakening. Watch it weaken further.

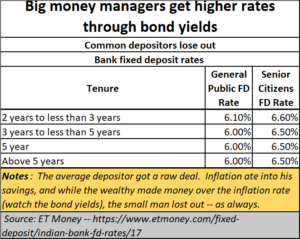

On the other hand watch common people fry in high inflation rates. The interest they get on their deposits has caused their savings to shrink. This is a huge and crippling tax rate that is being imposed on people.

The rich get by. In any case, they get higher rates by subscribing to Treasury Bonds. They can even escape the sharp fangs of inflation. But not the common man.

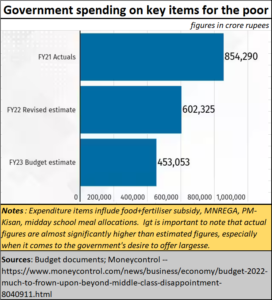

The culprit is not difficult to find. It is the government’s ever-increasing urge to splurge. It wants to impress voters, in much the same way as a trapeze artiste wants to engage his audience. It wants to win votes, so it offers free food, subsidised housing, almost-free medicare, and subsidised LPG cylinders. The list keeps growing. Since free food for India’s teeming poor millions will mean a softening of food prices in the markets, the government is compelled to offer higher minimum support prices (MSP) for rice, wheat and five other crops (https://pib.gov.in/PressReleasePage.aspx?PRID=1754566). Obviously, the government cannot afford to lose farm votes, as they account for almost 50% of the population.

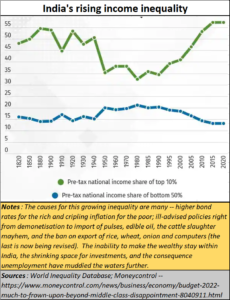

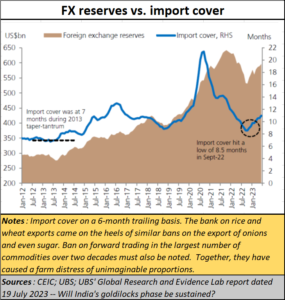

As a consequence, India has been witness to a growing income inequality. But that is inevible, if the government embarks on ill-thought-out policies like those relating to cattle slaughter, demonetisation, the import of pulses and edible oils, the subsidies for the milk industry, the bans on futures in commodity trading, the bans on the export of rice, wheat, sugar and even onions. The manner in which inflation has decimated the ranks of the middle class, and impoverished many, and the higher bond yields for the rich, have – cumulatively — added to the inequality. The conseuqences are inescable. The middle class is being edged out, almost brutally (Free subscription — https://open.substack.com/pub/bhaskarr/p/the-shrinking-growth-of-the-middle?r=ni0hb&utm_campaign=post&utm_medium=web).

As a consequence, India has been witness to a growing income inequality. But that is inevible, if the government embarks on ill-thought-out policies like those relating to cattle slaughter, demonetisation, the import of pulses and edible oils, the subsidies for the milk industry, the bans on futures in commodity trading, the bans on the export of rice, wheat, sugar and even onions. The manner in which inflation has decimated the ranks of the middle class, and impoverished many, and the higher bond yields for the rich, have – cumulatively — added to the inequality. The conseuqences are inescable. The middle class is being edged out, almost brutally (Free subscription — https://open.substack.com/pub/bhaskarr/p/the-shrinking-growth-of-the-middle?r=ni0hb&utm_campaign=post&utm_medium=web).

It is such developments, especially the urge to splurge, that make the article on India by Mihir Sharma immensely relevant and meaningful (“India’s Growth Story May not have a happy ending”, Bloomberg, https://www.bloomberg.com/opinion/articles/2023-10-02/india-s-economy-will-stumble-because-of-low-savings).

This is not to say that the government is doing nothing at all. On the contrary, it has been doing a lot, but not in the way that would have allowed the country’s economy to grow stronger.

This is not to say that the government is doing nothing at all. On the contrary, it has been doing a lot, but not in the way that would have allowed the country’s economy to grow stronger.

Consider the expected inauguration on 1 November, of the 1,337-km Eastern Dedicated Freight Corridor (EDFC), from Punjab to Bihar (https://www.business-standard.com/opinion/editorial/a-new-beginning-123101600910_1.html). Everyone is focussed on that.

But what about the Western Dedicated Freight Corridor from Rewari in Haryana to JMPT near Mumbai (some wanted it to be extended to Dighi)? It was conceived in 2006 and was supposed to be ready by 2018. That would have given the business belt on the Western part of India a bigger boost, by reducing logistics costs. It would have been a boon for exporters as well (https://asiaconverge.com/2011/02/dmic-delhi-mumbai-corridor-will-create-new-best-class-cities/). That was why the Japanese had agreed to fund the Western corridor, not the Eastern one. Yet, politics, not economic development, pushed the government to focus on the Eastern corridor. The rest of India can wait. The Western corridor was an export enhancer.

Ironically, even as the completion of the Western DFC was forgotten, more emphasis was given to the Bullet Train. Both the Western DFC and the Bullet Train were to be funded by Japan. So why has the Bullet Train been fast-tracked? The Western DFC promised faster deliveries and reduced logistics costs for industry and exporters.

And what about Dholera which was to become the largest SEZ in the world, even larger than Shenzhen in China. Why have these projects been forgotten?

Take two more instances. India has shown its ’s inability to galvanise exports, Instead, it has opted to focus on backdoor licensing – the PLI is a very good example (https://asiaconverge.com/2023/05/indias-economy-is-being-hollowed-out/).

The ban on computers was introduced, revised, and shelved, not withdrawn. The government wanted a case-by-case approach to such imports. A perfect recipe for stunting India. Good that better sense has prevailed. Such moves, and the ban on export of agricultural goods, have as resulted in India’s import cover dipping alarmingly. Yes, forex reserves look healthy. But import cover is a crucial indicator of how vibrant the Indian economy is.

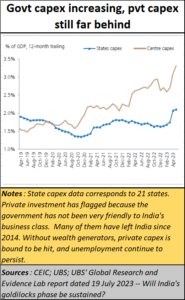

Take another indicator. The country has seen capex growing, but only in terms of government expenditure. Even in the power sector, where private investments are welcome, the government has taken the larger share (https://bhaskarr.substack.com/p/india-has-been-terribly-shortsighted?sd=pf). And unwisely. It has taken money (not borrowed) from the country’s central Bank – the RBI – and from public sector units to finance its growing appetite for funds. The loser is the economy.

Next year, after elections are over, the government will have no money left. Expect capex to fall then. This is because the government has made the wealthy run away from India, and even Indians are increasingly surrendering their passports (Free subscription — https://open.substack.com/pub/bhaskarr/p/the-shrinking-growth-of-the-middle?r=ni0hb&utm_campaign=post&utm_medium=web). This needs to be reversed.

The conclude: there is big financial turmoil ahead. Investors had better tighten their seatbelts for what is going to be quite a rough ride ahead, especially post-elections.

COMMENTS