Loans will continue to rise if unemployment is not eased

RN Bhaskar

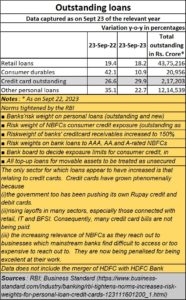

Last week India’s central bank, the RBI, revised and tightened norms for borrowings, raised risk weights for personal loans and credit cards. That will make the cost of borrowing more painful for common people, and choke the markets of further liquidity. The intent appears to be to clamp down on inflation.

But the RBI is possibly using the only weapon in its arsenal. It could possibly know that the causes for the loans becoming sticky lie elsewhere beyond its control. In fact, the RBI’s actions could be just like a band-aid over a gaping wound.

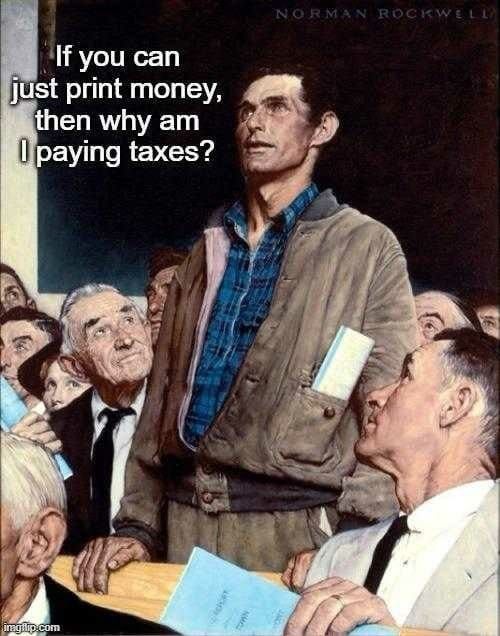

A WhatsApp image that was going viral at the time of writing this column, summed up the ire quite well. It seemed to ask that if the government could borrow, and overspend, why not consumers? Understandably, many consumers were left perplexed.

And the reasons for the average consumer’s ire was understandable. The major factor behind inflation, decline in the value of the rupee against the US $, and for credit card loans turning sour has been government policies.

The government encouraged financial irresponsibility

The government encouraged financial irresponsibility

When inflation is high, it makes more sense to borrow money and purchase things before the prices climb higher. And when jobs get lost, or are unavailable, the only recourse to hope and living is greater borrowing.

Observe the number of job reductions in BFSI (banking, financial, insurance sectors), IT (Information Technology) and retail sectors. When that happens, loans taken against credit cards or against EMIs are bound to go bad. People purchase items on credit when they have jobs, but are unable to pay back to banks when they lose their jobs suddenly.

Moreover, it is best not to forget that the purchasing spree was even encouraged by the government. It asked the banks to speed up the issue of Rupay debit cards and BHIM-UPI transactions (https://pib.gov.in/PressReleasePage.aspx?PRID=1890314). The government then began promoting Rupay credit cards (https://www.businesstoday.in/personal-finance/top-story/story/digital-payments-5-reasons-why-you-should-opt-for-a-rupay-credit-card-389691-2023-07-14). And NPCI itself began focussing on ways to get new customers to expand its Rupay credit card base (https://economictimes.indiatimes.com/industry/banking/finance/banking/npci-focusing-on-new-customers-to-expand-rupay-credit-card-base/articleshow/89867466.cms).

That is why, it is ironic to see the RBI belatedly trying to undo some of the moves of the government.

However, it will be wise not to penalise the consumers. The RBI’s moves will cause interest rates to soar, and loans to shrivel up. Both will hurt marginal consumers. It is better to focus on better policy planning and execution.

But even while the RBI tries to stanch individual borrowings, government borrowings are likely to continue. With an election round the corner, government spending continues unabated. As Jefferies pointed out in its November 9, 2023, newsletter (Heating up with the upcoming state elections), “The upcoming five state elections (15% of national seats) is driving rising freebie politics with Congress taking cues from its Karnataka victory. BJP is trying to match up, but without loan waivers and free electricity promise. Mr. Modi has also announced the extension of food subsidy by five years.”

It must be recalled, that notwithstanding the officials claiming that the culture of Freebies (often referred to as revaris) must stop, much of the freebie culture has been promoted by the government itself. It may also be recalled that it was the BJP government that opened the taps for freebies and loan waivers during the Uttar Pradesh elections, after coming to power on the promise of no loan waivers or freebies.

Capex expenditure misleading

Government capital expenditure has shown an increasing uptrend. But as these columns pointed out earlier, the government has not been wise about its increasing investments in power generation – especially rooftop solar (free subscription — https://bhaskarr.substack.com/p/india-has-been-terribly-shortsighted?sd=pf), Its policy on the dedicated freight corridors (DFCs, and industrial townships, is equally flawed (free subscription — https://open.substack.com/pub/bhaskarr/p/indias-two-dfcs-politics-trounces?r=ni0hb&utm_campaign=post&utm_medium=web). Its decision to prioritise the implementation of the bullet train over the DFCs is going to become a very expensive mistake. So don’t expect great returns from the soaring capex either.

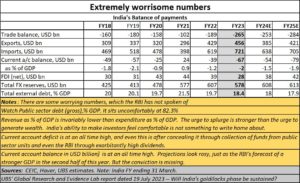

The rupee falls

Fiscal deficit appears to be under control. But that’s because it has been disguised by the government. It has taken money from public sector units and even the RBI as dividends (free subscription — https://bhaskarr.substack.com/p/the-shrinking-growth-of-the-middle?r=ni0hb&utm_campaign=post&utm_medium=web). Expect them to have little money to plan expansions or move in aggressively to protect the value of the Indian rupee. It is not a surprise therefore that the Indian rupee has been slipping against the US$ (https://www.business-standard.com/economy/news/rupee-closes-at-a-fresh-low-of-83-38-most-asian-currencies-weaken-123112400848_1.html).

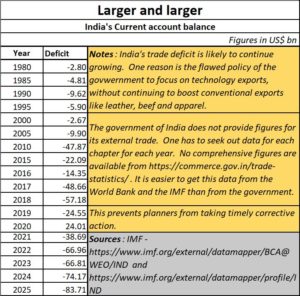

The best indicator of India’s weakening domestic export base can be seen in the soaring current account deficit numbers. The worsening numbers can be found in the weakening of exports and strengthening of imports leading to a worsening trade balance (free subscription — https://bhaskarr.substack.com/p/india-trade-slips-deeper-into-the?utm_campaign=post&utm_medium=web).

The borrowing climate could get worse because of poor job creation. India has one of the worse unemployment rates in this region (https://asiaconverge.com/2023/01/what-budget-2023-should-focus-on/).

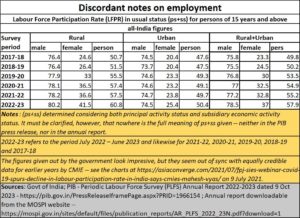

Government data suggests that this is not really the case. In its latest annual report on Periodic Labour Force Survey (PLFS) for 2022-23, (https://mospi.gov.in/sites/default/files/publication_reports/AR_PLFS_2022_23N.pdf?download=1) the government suggests that employment generation has been good.

But these numbers are at variance with almost every other labour survey – including numbers brought out periodically by the CMIE (https://asiaconverge.com/2021/07/fpj-sies-webinar-covid-19-spurs-decline-in-labour-participation-rate-in-india-says-cmies-mahesh-vyas/). Compare the numbers given out by the government with those by the CMIE for 2017 to 2021, and you will then notice the discrepancy. In fact, job creation continues to fall (https://retirement.outlookindia.com/plan/news/formal-job-creation-dips-14-5-in-first-4-months-of-fy23-24-epfo-payroll-data-shows).

When people are without jobs, they have no alternative but to borrow.

And since banks have not been able to service the needs of small earners well enough, it is the NBFCs which stepped into the groove. They meet the requirements of small borrowers, though at higher rates of interest to adjust for the risk involved. Clearly, NBFCs are becoming more relevant to India than banks – especially when it comes to meeting the financial needs of small and marginal income people (https://asiaconverge.com/2023/07/the-rbi-should-be-encouraging-more-nbfcs/). Naturally, the surge in loans given by NBFCs was higher than for the banking sector.

But when it came to defaults, it is the banking sector that has continued to register more defaults. In fact, NBFCs have shown that they are better managers of money than government owned banks (https://bhaskarrn.substack.com/p/nbfcs-become-more-relevant-to-india?sd=pf). Unfortunately, the current stipulations of the RBI to control the risk of small loan defaults will hit NBFCs harder than the banks.

Bad numbers mean a worsening headaches

Bad numbers mean a worsening headaches

The moves of the RBI thus do not address the gaping wounds. These wounds have been caused by worsening numbers on the country’s balance sheet.

FDI has been slipping. Exports dwindling. Imports surging. The zooming demand for gold indicates that it remains the best hedge against inflation. India’s gold imports zoomed 677% in May, highest year-on-year surge (https://www.hindustantimes.com/business/indias-gold-imports-zoomed-677-in-may-highest-year-on-year-surge-report-101654533119334.html). True, the rush to buy gold is evident across the world because of the uncertain fate of currencies, In India the fear is greater because of inflation, concealed deficit spending, and the worsening balance of trade.

Solutions exist, but not the will

The answer appears to lie in giving a boost to traditional export sectors like leather, beef, and apparels, instead of pouting big money over capital-intensive industries which do not promise much employment. But this is a job for the government, not the RBI.

Similarly, large numbers of jobs can be created. Promoting rooftop solar is one way, which can create around 80 million jobs. Employment in the IT sector can be boosted by accelerating more outsourcing of government data collection. It could hire reputed organisations like CMIE or TCS to do such jobs. For instance, the former has shown that it can collect information on employment and rural distress far more effectively than many of the government agencies. The latter has streamlined the issue and renewal of passports.

The government can outsource the work relating to digitisation of land records, the workings of the offices of tehsildars, and even creating the infrastructure required for mapping agricultural areas for interpreting drone images. These can allow faster and more accurate assessment of crop acreage, yields, and even losses.

There are ways to improve employment. But it needs vision and political will. Without employment, no matter what the RBI says, loans will continue to rise – either officially or off the books. Middle class distress will also continue to increase and ravage huge numbers of this country’s population (https://open.substack.coeximm/pub/bhaskarr/p/the-shrinking-growth-of-the-middle?r=ni0hb&utm_campaign=post&utm_medium=web).

COMMENTS