Can India deal with China the way Vietnam has done?

By RN Bhaskar

India appears to be spooked by China. Its actions do not appear rational. To understand this, just look at what Vietnam has done. The world is waking up to new potential in Vietnam. And that could mean big things for the nation’s stock market.

The Vietnam example

As T Sean Michael Cummings, analyst, True Wealth, points out, on September 10, 2023, President Joe Biden travelled to Hanoi to meet with Vietnam’s General Secretary Nguyen Phu Trong. Both announced:

- an upgrade to Vietnamese and U.S. diplomacy… elevating Vietnam to America’s “Comprehensive Strategic Partner”. This means both countries will seek to grow their technological and economic cooperation. (For reference, some of the U.S.’s other Comprehensive Strategic Partners include Australia and India.)

Stansberry Research talks about Apple moving some of its iPad production from China to Vietnam (https://stansberryresearch.com/articles/apple-to-shift-ipad-production-to-vietnam-2). It also talks about Intel committing $1.5 billion to be invested in Vietnam (https://stansberryresearch.com/articles/the-u-s-government-just-secured-a-major-deal).

Interestingly, Vietnam has managed to get these investments without making the huge subsidies that India has been willing to make. It is worth bearing in mind the $2 billion subsidy that India has granted Micron for setting its semiconductor project in Gujarat. The project itself is worth just $2.7 billion (https://www.business-standard.com/companies/news/micron-set-to-break-ground-for-sanand-semiconductor-plant-on-saturday-123092000213_1.html).

But America isn’t the only country that’s courting Vietnam. Japan and China have also upgraded their diplomatic policies with Vietnam since November 2023. Its ties with China are interesting because after 1979, there were at least six clashes on the Sino-Vietnamese border in June and October 1980, May 1981, April 1983, April 1984, June 1985, and from October 1986 to January 1987.

Despite this, on 15 December 2023, Vietnam and China signed a 16-page joint declaration and 36 co-operation documents in areas such as infrastructure, trade, and security, during a visit to Hanoi by Chinese President Xi Jinping. Their contents were not made public. But Reuters (https://www.reuters.com/world/asia-pacific/pacts-signed-by-vietnam-china-during-xis-hanoi-trip-2023-12-15/) lists out some of the most important signings. They have been given in the chart alongside. They cover areas like defence (despite territorial disputes with each other), digital data and communications and trade and investments.

Unlike India which has banned Chinese investments in the telecom sector, Vietnam has embraced it. It is like what Singapore has done which uses technologies from Huawei, Nokia and Ericsson. The idea is not to be stuck to one technology or vendor. That way, Singapore expects them to compete with each other in terms of technology and pricing. A wise strategy.

Western media sources however, view these developments cynically (https://www.voanews.com/a/hanoi-embraces-future-with-china-to-reassure-beijing-experts-say-/7398721.html). Irrespective of eventual outcomes, it is indeed interesting to note that Vietnam has strengthened relations with Beijing, without jettisoning its ties with the US.

It must be underscored that like India, China has long been Vietnam’s top trade partner, with bilateral volume last year topping $175 billion. It is also the fourth-largest foreign investor in Vietnam.

As China sheds businesses, where labour costs have gone up, Chinese manufacturers have begun making a beeline to Vietnam (https://www.supplychaindive.com/news/vietnam-manufacturing-semiconductors-hub-growth-us-biden-china-amkor-intel-google/700461/). Vietnam is already home to a growing number of factories thanks to its increased use of free trade agreements, tax incentives and competitive labour costs.

Ask India’s textile industry barons. They will tell you that the best textile parks now exist in Vietnam, and that a lot of Chinese (and Indian) business is now being carried out from that country (https://asia.nikkei.com/Business/China-boosting-investment-in-Vietnamese-textile-industry). Even so, Vietnam continues to aggressively invite investments in textiles and apparels, even as it pursues its semiconductor plans (https://www.vietnam-briefing.com/news/seizing-investment-opportunities-vietnams-textile-garment-industry.html/).

FDI

Foreign direct investment in Vietnam rose 54% year-on-year in October 2023 (https://en.vietnamplus.vn/newly-registered-fdi-surges-54-in-10-months/270271.vnp), reaching $15.3 billion, according to data from the country’s Ministry of Planning and Investment. Investment in processing and manufacturing accounted for nearly 75% of the money.

In short, the political world is rushing to make inroads into Vietnam. And they are bullish about the country’s markets going forward. Even the corporate world is looking to Vietnam.

Jensen Huang, CEO of Nvidia (NVDA) – America’s fifth-largest company and the big winner of this year’s artificial-intelligence (AI) boom – is bullish on Vietnam. He called Vietnam “Nvidia’s second homeland” and spoke about plans to build a new Nvidia headquarters there. Speaks volumes about Vietnam’s investor-friendly policies.

The Vietnamese government put out a statement highlighting Nvidia’s proposal. It is likely to attract talent from around the world to contribute to the development of Vietnam’s semiconductor ecosystem and digitalization.

Nvidia has already invested $250 million in Vietnam so far… but that’s a drop in the bucket compared with what’s expected to come.

Vietnam is also rapidly becoming a key player in geopolitics. And it will soon become a key player in AI and semiconductors.

Two exchange-traded funds provide broad-based exposure to Vietnam: the VanEck Vietnam Fund (VNM) and the Global X MSCI Vietnam Fund (VNAM). Both funds track Vietnamese stocks. And both promise a great way to own the market.

Like Vietnam, India too has disputes with China. But unlike Vietnam, it began shutting itself out for trade and commerce. Yet, it is aware that its pharmaceutical exports would suffer grievously without import of critical raw material and intermediates from China. Ditto with the need for export of phones and other electronic items. Hence, trade between the two countries continues to grow.

But do recall that India banned Tik-Tok. But it also banned WeChat – a discussion platform used by businessmen and students from both countries.

It then banned telecommunications – which, incidentally, Vietnam has allowed — and thus cut itself off from many cost-effective solutions in 5G. Airtel, it may be remembered, wanted to use technology from China, till the government banned all investments from China in this sector.

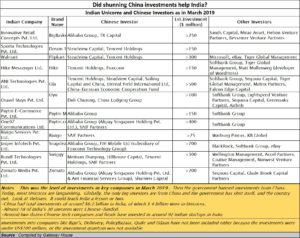

But the biggest blow was felt by the startup-sector. Prior to 2020, India was an attractive destination for China. It had begun investing in Indian startups, and part of the reason for the initial spurt in startup growth was the easy availability of Chinese investments. And this author too thought that investments from China would continue to grow (http://www.asiaconverge.com/2020/03/china-investments-in-india-are-strategic-and-profitable/)

Today, as the famed Unicorns of India are gasping for funds, and investments from China would be most welcome.

Like Vietnam, India ought to look at business with China as an economic desirable, even as it continues to grapple with China on border issues.

This is because of several reasons.

First, China has more investible funds than much of the Western world. Even Germany and Israel are looking at investments from China.

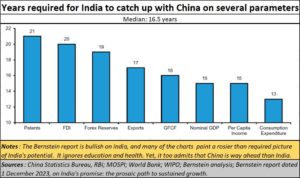

Secondly, it will take India several years to catch up with China, notwithstanding the chest thumping proclamations political leaders love to make on this subject.

Third, if Vietnam, despite its overtures to China can continue getting substantial investments in the US semiconductor industry, there is no reason why India cannot.

In some ways, India recognises this. When it comes to building tunnels or excavating huge quantities of earth and rocks from its mountainous agencies, India still consults the Chinese makers of excavators and tunnelling equipment. It must also be remembered that all major metro lines in India are being built by L&T in partnership with STEC (Shanghai Tunnel Engineering Co., Ltd).

Lastly, the world is no longer unipolar, though the US would like it to be that way. As John Mearsheimer, noted expert on geo-politics often explains, the US has succeeded in wrecking the plans of others who wanted to be the top hegemon in the world. It unseated the UK, ensured that neither Germany nor Japan would rise again, and it tripped the erstwhile USSR and is keen to see Russia broken. Earlier, it did this with both Egypt and Iraq.

But now, the world is changing, and there are at least two other superpowers that the US has to contend with – Russia and China. India could become a superpower if it gets its human resources and its investment climate right. But even then, it will take at least two decades.

In the meantime, it makes sense for India to be friendly – with excellent trade relations – with all the three superpowers. Trade has a way of warming relations, and even working out ways to smoothen other edges. And trade allows India to choose the most cost-effective partner, on commercial, not ideological, terms.

In any case, the few Chinese enterprises that have succeeded in in India are already major players, all angling to be the best in their respective fields. Consider just a sampling — Xiaomi, TCL, Oppo, MG, Sany, Haier, TP Link and Huawei. Each of them is a major market player. Some of the best strides in telecommunications have been made by Huawei, which is now competing head on with Apple.

Clearly, India may have to revise some of its views about China. While the latter can continue exploiting markets elsewhere – Africa is perhaps the most promising of them from the medium term – India may have to look for technology and finance from China. And when India, China and Russia work together, big changes are possible (https://asiaconverge.com/2022/06/russia-india-china-should-work-together/). Isolated, India will remain more vulnerable than it is currently.

In a multi-polar world, it is best to keep all options open. Vietnam has shown that this is possible.

COMMENTS