The ogre of debt dwarfs many countries

By RN Bhaskar

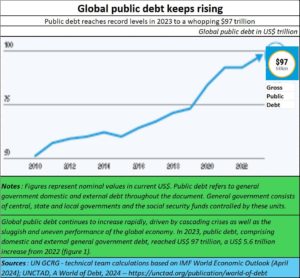

Last week UNCTAD brought out a brilliant document titled A World of debt – 2024 (https://unctad.org/publication/world-of-debt). It pointed out how “Global public debt continues to increase rapidly, driven by cascading crises as well as the sluggish and uneven performance of the global economy. In 2023, public debt, comprising domestic and external general government debt, reached US$ 97 trillion, a US$ 5.6 trillion increase from 2022.”

The helplessness of developing countries

The helplessness of developing countries

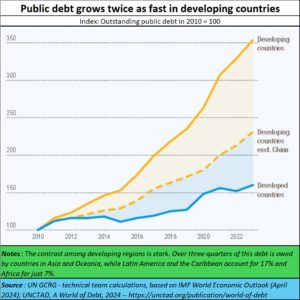

What the report however did not state that of the US$ 97 trillion, the US alone accounts for a total debt of US$ 34 trillion. Much of the US GDP surge is because of excess liquidity in the system. War funding has caused the debt to soar even further, and hence the GDP to climb. The big question is whether this is sustainable (free subscription — https://bhaskarr.substack.com/p/trade-and-currency-wars-move-centre?r=ni0hb&utm_campaign=post&utm_medium=web&triedRedirect=true). Nearly half the US national debt of $34 trillion was built up by the past three Presidents. Obama added $7.6 trillion, Trump $6.7 trillion, and Biden $2.5 trillion). Even if the US tries to trim its debt, the consequences of higher interest rates will be most savagely felt by developing and poor countries. This makes the entire global debt picture a precarious and scary one.

While internal governance issues do play a significant part in worsening the indebtedness of developing and less developed countries, the fact is that their costs of living have been pushed up by the developed countries’ penchant for war and bullying sanctions. Thus, the wars in Ukraine and Israel have seen the US being the principal provocateur and promoter.

In Israel, the US continues to send weapons despite the rulings of the International Criminal Court in The Hague accusing Israel of war crimes. In the case of Ukraine, the US planned the provocation against Russia as early as in February 2008 (free subscription — https://bhaskarr.substack.com/p/trade-and-currency-wars-move-centre?r=ni0hb&utm_campaign=post&utm_medium=web&triedRedirect=true) as outlined in the famous “NYET means NYET” cable of William Burns (then US ambassador to Russia and currently director, CIA).

Sanctions: expensive for developing countries

Sanctions: expensive for developing countries

Compounding this has been the US penchant for imposing unilateral sanctions against countries it does not like (see chart on ‘Global fragmentation in the midst of prosperity; — Free subscription — https://open.substack.com/pub/bhaskarr/p/global-fragmentation-new-alignments?r=ni0hb&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true) As the chart shows, the number of trade disruption escalated during the period when the world became unipolar and the US its hegemon.

The result is that prices of almost every item have climbed because people were denied access to the cheapest source for any item. Many of these items came from Iran, China, Russia or many countries in the Middle East. Smaller countries had to forget purchasing them. The risk of disobeying the sanctions was a fierce volley of reprisals from the US. Broken trade links are now being repaired, and smaller countries can heave a sigh of relief as their access to cheaper goods can soon get restored. This is because the US has stopped being the only global power. It has to share the stage with China and Russia. And its ability to cripple a nation with sanctions has been weakened considerably. The world is no longer unipolar. As things stand today, the total GDP of the BRICS countries is larger than that of the G-7.

But there is another danger lurking. The US has pushed the world closer towards extinction. The Doomsday clock is just 90 seconds from midnight (https://thebulletin.org/doomsday-clock/current-time/). A nuclear war is more probable now than ever before.

Thus, the potential of the US to destabilise the world — first through its debt, and then through its military provocations — remains undiminished.

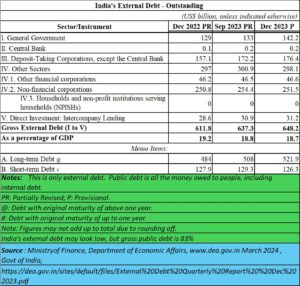

As for India, it has a very slippery path ahead. If one goes by numbers the government puts out, external debt accounted for just 18.7% of GDP. That does not look frightening. But it is only one-third of the picture.

In reality, government itself borrows money which in turn inflates its GDP. By the government’s own admission, its own debt accounted for 57% (Rs. 165.6 trillion) of total borrowing. Total public debt thus stands at a more alarming 83.1% of GDP.

In reality, government itself borrows money which in turn inflates its GDP. By the government’s own admission, its own debt accounted for 57% (Rs. 165.6 trillion) of total borrowing. Total public debt thus stands at a more alarming 83.1% of GDP.

But that figure is an understatement. This is because the government has been concealing its debt by getting interest-free money from the RBI (Rs.2.1 lakh crore) and from the listed PSUs (1.24 lakh crore) – more details can be found at (Free subscription) https://bhaskarr.substack.com/p/rbi-seeks-to-conceal-govt-deficit?sd=pf . You could add other figures like dividends from unlisted companies and the sale of other assets which the government has used to conceal debt.

Not surprisingly, in December 2023, the IMF warned that India’s general government debt may exceed 100% of gross domestic product (GDP) in the medium term (https://thewire.in/government/imf-warns-india-on-debt-concerns-says-it-may-exceed-100-of-gdp-centre-disagrees).

Government spokespersons protest and say that such statements are alarmist. But the way India has managed its finances does make one believe that there is a cause for panic.

India has already committed to extend freebies by another 5 years (https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1980689). That means it will continue spending on unproductive items. As explained in an earlier column, subsidies lull an entire population into complacence. When extended year after year, it makes people lose their ability to work. People then become a national liability.

Moreover, the government has frittered away precious money on building monuments, poorly planned and executed projects like Namami Gange (https://asiaconverge.com/2020/08/government-plunder-productive-states-in-india/), temples, and even the Eastern Dedicated Freight Corridor (DFC) at the expense of the more urgently needed Western DFC (Free subscription – https://open.substack.com/pub/bhaskarr/p/indias-two-dfcs-politics-trounces?r=ni0hb&utm_campaign=post&utm_medium=web). When money is borrowed and spent on unproductive projects, the danger of politics overriding economics becomes a nightmare.

Possible solutions

India will have to work its way through these promises on the one hand, and ensuring that FDI (foreign direct investment) is boosted.

This may also require reviving international arbitration and dispute resolution for foreign investors (https://asiaconverge.com/2020/01/arbitration-and-investment-protection/). It will certainly mean giving assurances that there will be no retrospective taxation or legislation, and that there must be a cooling off period before any new law that changes business prospects get introduced. Finally, it will require the government to rein in its law enforcement authorities and its list of compliances (https://bhaskarr.substack.com/p/fantasies-about-indias-economy-might?r=ni0hb&utm_campaign=post&utm_medium=web&triedRedirect=true).

In addition to all this, India must create more jobs and more wealth for its people.

Will it be able to do all this?

That is a question many analysts are asking.

==========

Postscript: Do watch my podcast on the RBI at https://www.youtube.com/watch?v=giY7I71VIJM&t=212s

COMMENTS