MARKET PERSPECTIVE

By J Mulraj

FEB 22-28, 2025

DOGE calls for an audit of US gold in Fort Knox.

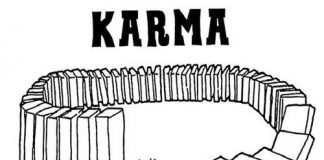

Image created by Bing.

Knock, knock

Who’s there?

Fort

Fort who?

Fort Knocks.

It was the comment by Elon Musk, who heads DOGE (Department of Government Agency), that there should be an audit of Fort Knox, that spurred the joke. Fort Knox stores 149 million ounces (4176 metric tonnes out of US total reserves of 8133 tonnes; the rest is stored elsewhere) of US gold reserves. Shockingly, no one has fully audited it since 1953! A few Congressmen visited Fort Knox in 1974, did a visual inspection, and confirmed that the gold was there! But a cursory visual inspection is not an audit! A full audit requires verifying that the bars are, indeed, present. And that they are gold, and not tungsten covered with a thin layer of gold (both weigh the same). An audit also requires a matching of serial numbers, not done for decades.

In July 2020, in Wuhan, just 8 months after the outbreak of the Wuhan corona virus, a Chinese jeweler, Wuhan Kingold Jewelry, revealed that 83 tonnes of gold, pledged by it against loans taken, were actually gold coated tungsten!. This represented 4.2% of China’s gold reserves then. So, the fear that the Fort Knox gold may be partly, or significantly, fake, is not unfounded. And it is surprising that, even after the Kingold fraud was publicly disclosed, the US did not think of getting a full audit of its gold reserves done.

The price of gold has gone up by around 45% in the past 12 months. This has been building up over the past few years, for various reasons. After Covid Governments printed a lot of money to help their citizens cope; they had no income due to the Covid lockdown. They continued spending even after Covid ended. This debased Fiat currencies, making investors turn towards gold as a hedge. Then, after Russia invaded Ukraine, leading to severe sanctions, Governments of other countries started buying gold, lest they get sanctioned for displeasing America.

Perhaps another reason for the spurt may be ETFs, or gold exchange traded funds. ETFs are supposed to own the underlying asset, in this case gold, to the extent of the units issued. however, some of them loan out the gold to an investor who loans it to another, and so on. As a result the paper gold, represented by ETFs is more than the actual physical gold, which is a classic bear squeeze situation.

The US gold reserves are valued at the rate of $42/ounce. The current market price of gold is $2939/ounce. If the gold reserves are valued at the current market price, the value would be $760 b. The revaluation can be done by an executive order, not requiring Congressional approval. If, hypothetically, the US decides to value the gold at $120,000/ounce, its gold would be equal to its debt, of $36 trillion!

To rewind a bit, after the Allies won WW II, there was a conference at Bretton Woods, USA, attended by all nations, at which it was decided that all countries would peg their currencies to the US $, which, in turn, would be begged to gold. The US$ accumulated by other countries, would be convertible into gold at a price of $35/ ounce, guaranteed by USA. This decision gave the USD the status of a globally accepted currency, allowing the US to print it at will, without worrying about inflation. Several other countries, including France, sent their gold, 12000 tonnes, to for safekeeping, fearful of seizure by Hitler or Stalin.

And print the dollar the US did, in order to fund the Korean War and the Vietnam war fought in the 50s, 60s and 70s. In mid 60s, President Charles De Gaulle of France had the gall to ask for France’s gold. England followed. In 1971 US President Nixon felt that his promise to convert USD into gold at $35/ounce would bankrupt USA, as the market price of gold was much higher. So, in August ‘71, he ended the fixed rate conversion. The USD became a Fiat currency, not backed by gold, but by the reputation of America as the world’s largest economy.

So, what’s happening?

It is likely that the US is buying gold to issue gold backed Treasury bonds, demand for which has fallen after the ballooning of its debt. If the US acquires a large enough quantity of gold, it may consider putting the USD onto a blockchain. That would allow all expenditure to be monitored. DOGE has found an egregious amount of wasteful expenditure in several Government departments, including USAID. A blockchain link to its currency would allow for real time tracking to prevent illegal or senseless waste of taxpayer resources.

But, together with that, the global polity must listen to Bob Dylan’s some lyrics in his song ‘Blowin’ in the Wind’.

‘how many times must the cannonballs fly, before they are forever banned?

How many years must some people exist, before they’re allowed to be free?

Yes and how many deaths will it take ‘til he knows, that too many people have died?

The answer, my friend, is blowing in the wind…’

Far too many people have died in the senseless Russian-Ukraine war. The immense tragedy lies in the fact that just weeks after it began, a negotiated settlement was reached between both sides, the agreed terms of which were a complete withdrawal by Russian troops and an agreement that Ukraine wouldn’t seek NATO membership. That’s all that Putin ever wanted. But the then British Prime Minister, Boris Johnson, egged in by Biden, scuttled the ceasefire, (agreed upon by the warring sides and one that would have let Ukraine retain its territory and its people who later died in the fighting). What was Boris Johnson’s locus standi? Nothing. Why did Zelensky agree? Ask him.

Having agreed to let the ceasefire get scuttled, the responsibility for the consequences rests entirely on the shoulders of Zelensky, Boris Johnson and Biden. Zelensky’s demand to retain its full territory, having lost the war, and insistence on a security guarantee, which the ceasefire would have provided, appear futile.

Zelensky has agreed with Trump to give up a part of the revenue from extraction of rare earth minerals, which the US desperately wants, the terms of which are being discussed now in Washington.

Under pressure from Trump that EU increase its defence spending and reduce dependence on USA to continually bail it out, Britain’s PM, Keir Starmer, has agreed to hike its defence spending by 1% to 3.5% of its GDP Where will the money come from? It will come from reducing British aid to poorer countries.

What rot! An inversion of deals. How many years must people exist, before they’ve a right to be free?’ It was the spending on two world wars, followed by wars in Korea and in Vietnam, and Afghanistan and Iraq, and many others, that have led to debasement of Fiat currencies, thence to global inflation, thence to the allure of gold and, in 2008, a global financial crisis as too much fiat money chased assets, driving up stock and commodity markets unsustainably high, ultimately to crash and bring the world to a disaster. Why can leaders not sit in a warm room in Davos, leaving their coats and other hang ups outside, and discuss how to live in harmony? Less war-war and more jaw-jaw!

Last week the BSE Sensex closed at 73198, down 113 points over the week.

Last week a CBI Court judge decided to hold continuous hearings and deliver a judgement. In a week, with no adjournments. Though the Supreme Court (SC) and the High Courts have often asserted their desire not to allow adjournments, they cave in to pressures to grant them. This is because MPs and MLAs can continue to hold office until they are convicted by the SC (46% of them have criminal convictions against them). This is an inbuilt incentive to grant adjournments. It was refreshing to see the SC deciding to impose a lifetime ban on MPs or MLAs convicted of a criminal offense. Of course, the polity has objected, insisting that a ban of 6 months is enough.

The stockmarket will be affected by a trade war or another conflict. But good seems to got its lustre back, and will benefit from both,

Comments may be sent to jmulraj@asiaconverge.com

COMMENTS