MARKET PERSPECTIVE

By J Mulraj

Dec 27, 2025- Jan 2, 2026

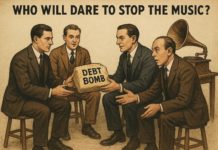

America plays checkers as China plays Go

Image created using Raphael.app

Checkers, a board game, popular in America, whose aim is to capture the opponent’s pieces or block them. The game is tactical and focused on immediate threats.

Go is a board game played in China, whose aim is to surround more territory than the opponent. The game is strategic complex and focused on influence, shape and long term territorial balance.

The approach of the two countries to defence seems similar. USA relies on large conglomerates like Lockheed Martin, RTX, Boeing, Northrop Gruman and General Dynamics, pouring billions of $s into them in cost plus contracts. The cost plus results in overspending, like $1500 for a coffee cup and overpayment of $150,000 for soap dispensers.

Social Security forms the largest item of expenditure in the US budget, with an outlay of $1.46 trillion in 2024. National Defence ($ 874 b.), together with Veteran’s benefits ($374 b) adding up to $1.2 trillion, would be #2, but the latter is shown separately. The wastage, due to lack of oversight and the cost plus model, is inexcusable for the world’s largest debtor, $38 trillion, and the country that seeks, with its military might, to secure peace. The large conglomerate model also discourages innovative startups such as Anduril. Anduril, a startup founded in 2017, develops advanced autonomous systems (drones, underwater drones) combined with AI and robotics. Unlike the cost plus system used for compensating the giant conglomerates, Anduril produces systems in anticipation of demand, and sells them at negotiated prices.

If America’s defence establishment were playing Go, it would encourage more Andurils. But it’s playing checkers.

In fact, the big companies have become so nonchalant that, despite significant cost overruns in Government projects, they continue to splurge on executive compensation, high dividends and share buybacks. Trump is considering passing an Execrative Order to stop this.

China has a long term vision. It has not, as USA has, egged on Ukraine to take NATO membership, and, when this led, inevitably, to a Russian pushback, it has not, as USA has, depleted it’s financial and military resources in helping Ukraine. America’s objective all along was trying to weaken Russia; the narrative of helping a democracy was a figleaf to hide its bad intention. In autumn, the figleaf dropped.

So, whilst the checkers player was capturing a few pieces on the opponent’s board, the Go player was waiting till the checkers player got financially and militarily depleted, before embarking on its true purpose.

The true purpose is the invasion, and the reunification of, Taiwan.

Whilst American (and European) money and arms were given to Ukraine, China was building up its military strength. Its navy is now larger than America’s, and it’s airforce is formidable.

So China could attempt a military takeover of Taiwan, which it has, for years, expressed its determination to takeover, by force, if necessary, considering it an integral part of China. That would shake global stock markets.

Countries like China have been accumulating physical stocks of silver in a big way; its holdings are estimated at over 70,000 tonnes. In USA the silver market is influenced more by futures contracts and other derivatives, which provide liquidity, rather than by physical availability. This is likely to lead to a crisis, if rumours about a major, systemically important bank, unable to meet margin calls on its silver trading, are true. Such a settlement crisis in a TBTF (too big to fail) bank would balsa shake global stock markets.

Another shake to global markets would come if Trump escalates US attacks on Venezuela, attempting to seize a piece (a ship ostensibly carrying narcotics) in his game of checkers. Russia may play Go, and live up to its promise to supply the hypersonic missile Oreshnik. This would create another crisis, like the Cuban missile crisis.

Last week the BSE Sensex ended at 85762, for a weekly gain of 721 points.

India sold 4.55 million cars in 2025, up 5.8% from the 4.3 million sold in the previous year. This was after a reduction in GST from 28% to 18% in September. For Indian bureaucrats the fact that lower taxes lead to higher tax collections is a difficult lesson to learn. The UAE, with a population of 11.5 million, collects 5% VAT on cars.

UAE’s per capita income is around $49000. India’s is $ 2500. UAE got independence from Britain in 1971. India in 1947.

Singapore’s per capita income was the same as India’s, in 1960. Today it is $94000. The first step taken by its PM Lee Kuan Yew after independence in 1971 was to root out corruption.

India has not. Perhaps its leadership is disinclined or disinterested. More likely the latter.

Though India has overtaken Germany in terms of GDP, its people are not rich, based on per capita income. The reasons are well known. Endemic corruption. A criminally slow judiciary. An ineffective investigative agency. An inadequate education system that focuses on quantity of students not quality of education. A food system which, 78 years after independence, requires Government to provide food assistance to 800 million people. And a bureaucracy that needs to re-learn that increase in tax rates does not mean higher revenue.

The reasons for low per capita income are known.

The political leadership should ask themselves what they are doing to correct it.

Presuming, of course, that they care.

———————————-

Comments may be sent to: jmulraj@asiaconverge.com

COMMENTS