Adani Transmission Limited sustained growth

Consolidated Results for Q2FY23

Operational EBITDA in Q2FY23 grew 7% YoY to Rs 1,241 Cr

Cash Profit of Rs 748 Cr in Q2FY23, up 8% YoY

Synopsis

Operational Highlights Q2FY23:

Transmission Business

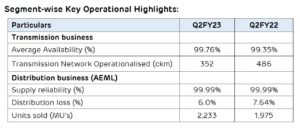

Operationalised 352 ckm; total transmission network at 18,795 ckm

Lakadia Banaskantha (LBTL) project is fully commissioned

Transmission system availability was 99.76%

Distribution Business (AEML)

Maintained supply reliability at 99.9% (ASAI)

Energy demand up 13% YoY to 2,233 million units

Distribution losses remain low at 6.0%

Consumer-centric initiatives continue with digital payment at 74.9%

Financial Highlights Q2FY23 (YoY):

Consolidated Revenue at Rs 3,032 Cr, increased by 22%

Consolidated Operational EBITDA at Rs 1,241 Cr, increased by 7%

Consolidated PAT at Rs 194 Cr is not comparable YoY on account of adverse forex movement (MTM) of Rs 138 Cr (Mark-to-market adjustment on foreign currency loans) vs Rs 6 Cr gain in the corresponding quarter in the AEML business

Consolidated Cash Profit (excluding one-time) of Rs 748 Cr surged 8%

Financial Highlights 1HFY23 (YoY):

Consolidated Revenue(1) increased by 22% to Rs 6,081 Cr

Consolidated Operational EBITDA(1) ended 8% higher to Rs 2,454 Cr

Consolidated Cash Profit (excluding one-time) of Rs 1,478 Cr up 12%

Net debt to EBITDA(3) as of 1HFY23 stands at 4.4x

Notes:Lakadia Banaskantha (LBTL) Transmission Line; MEGPTCL: Maharashtra Eastern Grid Power Transmission Limited; MERC: Maharashtra Electricity Regulatory Commission; ASAI: Average Service Availability Index; Cash profit calculated as PAT + Depreciation + Deferred Tax + MTM option loss; MTM: Mark-to-Market

Ahmedabad, 2 November 2022: Adani Transmission Limited (“ATL”), the largest private transmission and distribution company in India and part of the globally diversified Adani portfolio, today announced its financial and operational performance for the quarter ended September 30, 2022.

Financial Highlights – Consolidated (Transmission and Distribution(2)):

#In Q2FY23, consolidated PAT of Rs 194 Cr was lower YoY. It is not comparable on account of adverse forex movement (MTM) of Rs 138 Cr (Mark-to-market adjustment on foreign currency loans) vs Rs 6 Cr gain in the corresponding quarter in the AEML business

#In Q2FY23, consolidated PAT of Rs 194 Cr was lower YoY. It is not comparable on account of adverse forex movement (MTM) of Rs 138 Cr (Mark-to-market adjustment on foreign currency loans) vs Rs 6 Cr gain in the corresponding quarter in the AEML business

Consolidated revenue in Q2FY23 witnessed double-digit growth of 22% YoY on account of new transmission lines coming into operation and higher energy demand

In the second quarter, consolidated operational EBITDA increased 7% to Rs 1,241 Cr

Consolidated cash profit of Rs 748 Cr in Q2FY23 increased by 8% YoY

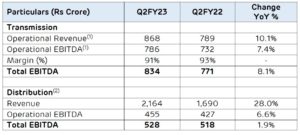

Segment-wise Financial Highlights

Transmission business revenue growth was driven by newly commissioned lines over the period

Transmission business revenue growth was driven by newly commissioned lines over the period

Distribution business revenue increased on account of a significant jump in energy demand

Operational EBITDA in both segments grew by higher single digits during the quarter

Notes: 1) Q1FY22 Operational Revenue and Operational EBITDA doesn’t include arrears of Rs 304 Cr (excluding arrears adjustments of Rs 16 Cr) approved in MERC order in June’21 determining and allowing MEGPTCL to claim incremental Aggregate Revenue Requirement (ARR) based on Appellate Tribunal for Electricity order (APTEL); 2) Distribution segment includes AEML Mumbai and Mundra Utilities Ltd. (MUL). MUL was acquired in December 2021 and included in Distribution segment from Q4FY22 onwards; 3) Considered long term debt at hedge rate excluding sub-debt of Rs. 2,294 Cr

Operationalized 352 ckm in Q2FY23 and maintained system availability at 99.76%

Operationalized 352 ckm in Q2FY23 and maintained system availability at 99.76%

Energy demand (units sold) improved by 13% YoY in Q2FY23, driven by a rise in commercial and industrial segment demand

Distribution losses remain low on account of high collection efficiency and loss reduction measures

Recent Developments, Achievements and Awards:

Adani Transmission has pledged to become Net Zero by 2050; limiting global warming to 1.5 °C above pre-industrial levels through measurable actions

S&P Global rated Adani Transmission for being aligned with the Task Force on Climate-related Financial Disclosures (TCFD) with 6 elements fully aligned

ATL received a Platinum Award in Restorative Category and a Silver Award in Innovative Category at the 43rd CII National Kai-Zen Competition amongst 70 companies

Won the Greentech Quality and Innovation Summit 2022’s Product Innovation and Quality Improvement Award

Recevied Platinum Award from CII under Innovation in Office Category for presenting a case study at National Office innovation Competition

ATL won the prestigious PeopleFirst HR Excellence Awards 2022 for leading practises in employee engagement and talent management

Received a Sustainable Performance Award from World CSR for best-in-class sustainability performance monitoring and disclosures

Anil Sardana, MD & CEO, Adani Transmission Ltd., said, “ATL is constantly evolving and is already a significant player in the T&D sector. ATL’s growth trajectory remains firm despite the challenging macro environment. Our pipeline of projects and recently operationalised assets will further strengthen our pan-India presence and consolidate our position as the largest private sector transmission and distribution company in India. ATL is consistently benchmarking to be the best-in-class and is pursuing disciplined growth with strategic and operational de-risking, capital conservation, ensuring high credit quality and business excellence with high governance standards. The journey towards a robust ESG framework and practising a culture of safety is integral to our pursuit of enhanced long-term value creation for all our stakeholders.”

About Adani Transmission Limited: Adani Transmission Limited (ATL) is the transmission and distribution business arm of the Adani Portfolio. ATL is the country’s largest private transmission company with a cumulative transmission network of ~18,795 ckm, out of which ~15,003 ckm is operational and ~3,792 ckm is at various stages of construction. ATL also operates a distribution business serving 12 million+ consumers of Mumbai and Mundra SEZ. With India’s energy requirement set to quadruple in coming years, ATL is fully geared to create a strong and reliable power transmission network and work actively towards serving retail customers and achieving ‘Power for All’ by 2022.

COMMENTS